Air Canada 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2011

Voted #1

Best International Airline

in North America.

Table of contents

-

Page 1

ANNUAL REPORT 2011 Voted #1 Best International Airline in North America. -

Page 2

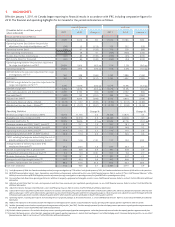

... quarters of 2010. (7) Operating expense, excluding fuel expense and excluding the cost of ground packages at Air Canada Vacations, is a non-GAAP ï¬nancial measure. Refer to section 20 of the MD&A for additional information. (8) Reï¬,ects FTE employees at Air Canada. Excludes FTE employees at third... -

Page 3

...-GAAP Financial Measures ...72 21. Glossary ...74 Management's Report ...75 Independent Auditor's Report ...76 Consolidated Financial Statements and Notes ...77 Officers and Directors ...148 Investor and Shareholder Information ...149 Official Languages at Air Canada ...149 Corporate Profile... -

Page 4

2011 Air Canada Annual Report MESSAGE FROM THE PRESIDENT AND CHIEF EXECUTIVE OFFICER tracked by the NYSE Arca Global Airline Index, which fell 31.5 per cent. However, looking past the headlines reveals some encouraging trends as the company performed well on several key operating metrics. In ... -

Page 5

... which Air Canada is a founding member. In addition, Air Canada belongs to a transatlantic revenue sharing joint venture with United Airlines, Lufthansa and several other leading Star Alliance carriers. On the ground in Toronto, progress has been made on improved customer flow and baggage management... -

Page 6

...-looking statements due to a number of factors, including without limitation, industry, market, credit and economic conditions, the ability to reduce operating costs and secure financing, pension issues, energy prices, employee and labour relations, currency exchange and interest rates, competition... -

Page 7

...), and are subject to change after such date. However, Air Canada disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities regulations. Assumptions were... -

Page 8

... Trudeau Airport. In 2011, such other third party regional carriers under capacity purchase agreements with Air Canada operated 21 aircraft on behalf of Air Canada. Air Canada is a founding member of the Star Allianceâ„¢ network. The Star Alliance network includes 28 member airlines. Through... -

Page 9

... brand and its strong position in the market for transatlantic and transpacific travel to and from Canada and the Canada-South America market; Its extensive global network, which is enhanced by Air Canada's membership in Star Alliance and by its participation in a transatlantic revenue sharing... -

Page 10

... with United Airlines and Deutsche Lufthansa AG, referred to as A++. By coordinating pricing, scheduling and sales, Air Canada is better able to serve customers by offering more travel options, while reducing travel times. Leveraging New Opportunities for Revenue Growth and Cost Transformation... -

Page 11

2011 Management's Discussion and Analysis Air Canada was also recognized with the following awards, reflecting both the skill and professionalism of its employees and the quality of its product offerings: ï,· "Best In-Flight Services in North America" and "Best North American Airline for ... -

Page 12

...the airline's cost transformation program. Partially offsetting these decreases was an increase in employee benefits expense. A key element of Air Canada's business strategy is to consistently improve unit revenue and cost productivity. To this end, in early 2009, Air Canada launched a major company... -

Page 13

..., except per share figures) Operating revenues Passenger Cargo Other Operating expenses Aircraft fuel Wages, salaries, and benefits Airport and navigation fees Capacity purchase agreements Depreciation, amortization and impairment Aircraft maintenance Sales and distribution costs Food, beverages and... -

Page 14

2011 Air Canada Annual Report System passenger revenues increased 8.3% from 2010 Compared to 2010, system passenger revenues increased $781 million or 8.3% to $10,208 million in 2011 due to traffic and yield growth. The table below provides passenger revenue by geographic region for the full year ... -

Page 15

... million or 5.9% from 2010 due to yield and traffic growth. The capacity growth in 2011 was mainly due to Air Canada's new service from Toronto Island's Billy Bishop Airport to Montreal Trudeau Airport. Components of the year-over-year change in domestic passenger revenues included: ï,· The traffic... -

Page 16

2011 Air Canada Annual Report Pacific passenger revenues increased 8.3% from 2010 Pacific passenger revenues of $1,177 million in 2011 increased $90 million or 8.3% from 2010 due to traffic and yield growth. The capacity growth in 2011 mainly reflected a capacity increase on routes to China partly ... -

Page 17

... 3% from 2010 Other revenues consist primarily of revenues from the sale of the ground portion of vacation packages, ground handling services, and other airline-related services, as well as revenues related to the lease or sublease of aircraft to third parties. Other revenues of $923 million in 2011... -

Page 18

... Capacity purchase agreements Ownership (DAR)(1) Aircraft maintenance Sales and distribution costs Food, beverages and supplies Communications and information technology Other Total operating expense Remove: Cost of fuel expense and cost of ground packages at Air Canada Vacations Operating expense... -

Page 19

... terminated hedging contracts of $5 million in the second quarter of 2010 covering 2010 consumption. The economic cost of fuel is a non-GAAP measure used by Air Canada and may not be comparable to measures presented by other public companies. Air Canada uses this measure to calculate its cash cost... -

Page 20

... of changes in schedule and aircraft types operated to certain destinations and to an increase in terminal user fees, effective April 1, 2011, at London Heathrow Airport. Costs associated with Air Canada's new services operated by Sky Regional between Billy Bishop Toronto City Airport and Montreal... -

Page 21

... included in other expenses: Full Year (Canadian dollars in millions) Air Canada Vacations' land costs Terminal handling Building rent and maintenance Crew cycle Miscellaneous fees and services Remaining other expenses $ $ Change 2010 $ $ 35 8 1 (2) (2) (4) $ 36 2011 307 193 127 115 108 380 1,230... -

Page 22

2011 Air Canada Annual Report ï,· A decrease in interest expense of $77 million which was mainly due to Air Canada having recorded a charge of $54 million related to the repayment of its secured term credit facility in 2010 while no such charge was recorded in 2011, as well as higher debt ... -

Page 23

..., except per share figures) Operating revenues Passenger Cargo Other Operating expenses Aircraft fuel Wages, salaries, and benefits Airport and navigation fees Capacity purchase agreements Depreciation, amortization and impairment Aircraft maintenance Sales and distribution costs Food, beverages and... -

Page 24

... year-over-year percentage changes in passenger revenues and operating statistics for the fourth quarter of 2011 versus the fourth quarter of 2010. Fourth Quarter 2011 Versus Fourth Quarter 2010 Canada U.S. transborder Atlantic Pacific Other System Passenger Revenue % Change 3.2 11.6 (1.0) 6.9 11... -

Page 25

..., Sky Regional, on behalf of Air Canada, began operating 15 daily flights from Toronto Island's Billy Bishop Airport to Montreal's Pierre Elliott Trudeau International Airport ("Montreal Trudeau Airport"). The domestic capacity growth in the fourth quarter of 2011 was mainly due to this new service... -

Page 26

2011 Air Canada Annual Report U.S. transborder passenger revenues increased 11.6% from the fourth quarter of 2010 U.S. transborder passenger revenues of $500 million in the fourth quarter of 2011 increased $52 million or 11.6% from the fourth quarter of 2010 due to yield and traffic growth. The ... -

Page 27

...the fourth quarter of 2010, mainly due to yield and traffic growth. The table below provides year-over-year percentage changes in Pacific passenger revenues and operating statistics for the fourth quarter 2011 and each of the previous four quarters. Pacific Passenger Revenues Capacity (ASMs) Traffic... -

Page 28

2011 Air Canada Annual Report Other passenger revenues increased 11.1% from the fourth quarter of 2010 Other passenger revenues (comprised of routes to Australia, the Caribbean, Mexico, Central and South America) of $214 million in the fourth quarter of 2011 increased $21 million or 11.1% from the ... -

Page 29

... of 2011 increased $4 million or 2% from the fourth quarter of 2010. The growth in other revenues was due to a $6 million increase in third party ground package revenues at Air Canada Vacations. This increase in third party revenues at Air Canada Vacations was due to a higher selling price of ground... -

Page 30

... Capacity purchase agreements Ownership (DAR)(1) Aircraft maintenance Sales and distribution costs Food, beverages and supplies Communications and information technology Other Total operating expense Remove: Cost of fuel expense and cost of ground packages at Air Canada Vacations Operating expense... -

Page 31

... changes in schedule and aircraft types operated to certain destinations, as well as an increase in terminal user fees, effective April 1, 2011, at London Heathrow Airport. Costs associated with Air Canada's new services operated by Sky Regional between Billy Bishop Toronto City Airport and Montreal... -

Page 32

... of lease maintenance return provision, resulting from changes in cost and discount rate assumptions. A higher volume of engine maintenance events, which was largely related to Air Canada's narrowbody fleet, and an increase in maintenance cost obligations related to aircraft lease terminations were... -

Page 33

... relating to employee benefit liabilities Loss on financial instruments recorded at fair value Other $ $ Change $ $ (22) 1 10 14 (13) 20 $ 10 9 (86) (18) 8 (21) 136 2011 114 10 (76) (4) (5) (1) 38 $ $ 2010 28 Factors contributing to the year-over-year change in fourth quarter non-operating... -

Page 34

...2011 and 2010, as well as planned changes to its operating fleet (excluding aircraft which are leased or subleased to third parties and excluding aircraft operated by Jazz under the Jazz CPA and by other regional airlines operating flights on behalf of Air Canada under commercial agreements with Air... -

Page 35

... are leased to Jazz, five Dash 8-400 aircraft are subleased to Sky Regional and five Beech aircraft are subleased to other Tier III carriers. In 2011, Air Canada exercised purchase rights for two Boeing 777 aircraft with scheduled deliveries in mid-2013. Air Canada is currently reviewing operating... -

Page 36

...annual operating revenues. 9.2. Financial Position The following table provides a condensed statement of financial position of Air Canada as at December 31, 2011 and as at December 31, 2010. (Canadian dollars in millions) Assets Cash, cash equivalents and short-term investments Other current assets... -

Page 37

... information on Air Canada's pension funding obligations. 9.3. Adjusted Net Debt The following table reflects Air Canada's adjusted net debt balances as at December 31, 2011 and as at December 31, 2010. (Canadian dollars in millions) Total long-term debt and finance leases Current portion of long... -

Page 38

... information on Air Canada's working capital balances at December 31, 2011 and at December 31, 2010. (Canadian dollars in millions) Cash and short-term investments Accounts receivable Other current assets Accounts payable and accrued liabilities Advance ticket sales Current portion of long-term debt... -

Page 39

... cash from operations, a reduction in cash provided by working capital and an increase in past service pension funding obligations. Starting in 2011, Air Canada resumed making past service contributions to its domestic registered plans pursuant to the terms of the Air Canada 2009 Pension Regulations... -

Page 40

... position), and purchase rights for 10 Boeing 787 aircraft (entitling Air Canada to purchase aircraft based on Boeing's current pricing). In 2011, Air Canada exercised purchase rights for two Boeing 777 aircraft with scheduled deliveries in mid-2013. Air Canada is currently reviewing operating... -

Page 41

..., both a fixed charge coverage ratio for Air Canada and the unrestricted cash of Air Canada. Air Canada also has agreements with this processor for the provision of certain credit card processing services requirements for markets other than North America and for its cargo operations worldwide and... -

Page 42

... reports for current service (including the applicable discount rate used or assumed in the actuarial valuation), the plan demographics at the valuation date, the existing plan provisions, existing pension legislation and changes in economic conditions (mainly the return on fund assets and changes... -

Page 43

... 4,000 call centre and airport check-in and gate agents employed by Air Canada and the Canadian Union of Public Employees ("CUPE"), the union representing the airline's 6,800 flight attendants. The agreements include amendments to the defined benefit pension plans of CAW and CUPE members, which are... -

Page 44

2011 Air Canada Annual Report Issuer Bid In December 2011, Air Canada announced that it received approval from the Toronto Stock Exchange ("TSX") to implement a normal course issuer bid to purchase, for cancellation, up to 24,737,753 Class A Variable Voting Shares and/or Class B Voting Shares (the ... -

Page 45

2011 Management's Discussion and Analysis 10. QUARTERLY FINANCIAL DATA The following tables summarize quarterly financial results and major operating statistics for Air Canada for the last eight quarters. (Canadian dollars in millions, except where indicated) Operating revenues Aircraft fuel ... -

Page 46

... in the fourth quarter of 2010. Operating expense, excluding fuel expense and excluding the cost of ground packages at Air Canada Vacations, is a non-GAAP financial measure. Refer to section 20 of this MD&A for additional information. Includes fuel handling and is net of fuel hedging results. In the... -

Page 47

...adjustment for cargo investigations to operating income (loss) and EBITDAR to operating income (loss). Total long-term liabilities include long-term debt (including current portion) and capital leases, pension and other benefit liabilities, maintenance provisions and other long-term liabilities. 47 -

Page 48

... cash flows of a financial instrument will fluctuate because of changes in market interest rates. Air Canada enters into both fixed and floating rate debt and leases certain assets where the rental amount fluctuates based on changes in short term interest rates. Air Canada manages interest rate risk... -

Page 49

... point in time is dependent upon a number of factors, which include the amount of foreign revenue conversion available, U.S. dollar net cash flows, as well as the amount attributed to aircraft and debt payments. The following are the current derivatives employed in foreign exchange risk management... -

Page 50

2011 Air Canada Annual Report Fuel Price Risk Fuel price risk is the risk that future cash flows relating to jet fuel purchases will fluctuate because of changes in jet fuel prices. In order to manage its exposure to jet fuel prices and to help mitigate volatility in operating cash flows, Air ... -

Page 51

2011 Management's Discussion and Analysis The following information summarizes the impact of fuel derivatives on Air Canada's consolidated statement of operations and consolidated statement of comprehensive income. Fourth Quarter (Canadian dollars in millions) Consolidated Statement of Operations ... -

Page 52

... strategy adopted by Air Canada, including the longer duration in its bond portfolio in comparison to other pension plans. These factors are used to determine the average rate of expected return on the funds invested to provide for the pension plan benefits. The determination of the long-term rate... -

Page 53

... the asset allocation strategy adopted by Air Canada, including the longer duration in its bond portfolio in comparison to other pension plans. These factors are used to determine the average rate of expected return on the funds invested to provide for the pension plan benefits. While the review... -

Page 54

... impairment at the individual asset level. Value in use is calculated based upon a discounted cash flow analysis, which requires management to make a number of significant assumptions including assumptions relating to future operating plans, discount rates and future growth rates. An impairment loss... -

Page 55

2011 Management's Discussion and Analysis Maintenance Provisions The recording of maintenance provisions related to return conditions on aircraft leases requires management to make estimates of the future costs associated with the maintenance events required under the lease return condition and ... -

Page 56

... to be subsequently measured at amortized cost or fair value. Specifically, financial assets that are held within a business model whose objective is to collect the contractual cash flows, and that have contractual cash flows that are solely payments of principal and interest on the principal... -

Page 57

...statement of financial position. Based on current trading prices of European Union CO2 allowances (EUAs), Air Canada expects to incur operating costs of no more than $4 million in 2012. This amount is subject to change based on the change in the market price of EUAs. Based on current operating plans... -

Page 58

...Guarantees in Fuel Facilities Arrangements Air Canada participates in fuel facility arrangements operated through Fuel Facility Corporations, along with other airlines that contract for fuel services at various major airports in Canada. The Fuel Facility Corporations operate on a cost recovery basis... -

Page 59

2011 Management's Discussion and Analysis When Air Canada, as a customer, enters into technical service agreements with service providers, primarily service providers who operate an airline as their main business, Air Canada has from time to time agreed to indemnify the service provider against ... -

Page 60

2011 Air Canada Annual Report 16. RELATED PARTY TRANSACTIONS At December 31, 2011, Air Canada had no transactions with related parties as defined in the CICA Handbook - Part 1, except those pertaining to transactions with key management personnel in the ordinary course of their employment or ... -

Page 61

... following table describes, on an indicative basis, the financial impact that changes in certain assumptions would generally have had on Air Canada's operating results. These guidelines were derived from 2011 levels of activity and make use of management estimates. The impacts are not additive, do... -

Page 62

... Liquidity Air Canada faces a number of challenges in its business, including in relation to economic conditions, pension plan funding, labour issues, volatile fuel prices, contractual covenants which could require Air Canada to deposit cash collateral with third parties, foreign exchange rates and... -

Page 63

...current levels, fuel costs could have a material adverse effect on Air Canada, its business, results from operations and financial condition. Due to the competitive nature of the airline industry, Air Canada may not be able to pass on increases in fuel prices to its customers by increasing its fares... -

Page 64

... workforce were renewed or extended in 2009 and expired in 2011. In 2011, collective agreements with the unions representing Air Canada's customer service employees at airports and call centres, as well as with the union representing its flight attendants were, respectively, concluded and imposed... -

Page 65

... Fixed Costs The airline industry is characterized by low gross profit margins and high fixed costs. The costs of operating any particular flight do not vary significantly with the number of passengers carried and, therefore, a relatively small change in the number of passengers or in fare pricing... -

Page 66

... terms and costs, sufficient quantities of goods and services in a timely manner, including those available at airports or from airport authorities or otherwise required for Air Canada's operations such as fuel, aircraft and related parts and aircraft maintenance services (including maintenance... -

Page 67

... of flying done on its behalf by Jazz. Star Allianceâ„¢ The strategic and commercial arrangements with Star Alliance members provide Air Canada with important benefits, including codesharing, efficient connections and transfers, reciprocal participation in frequent flyer programs and use of airport... -

Page 68

... 12, 2011, the Federal Court of Appeal dismissed Air Canada's appeal, adversely impacting Air Canada's ability to secure new slots at the Billy Bishop Toronto City Airport ("BBTCA") on a fair and equitable basis to effectively compete with Porter. Pay Equity The Canadian Union of Public Employees... -

Page 69

... industry knowledge of its executive officers and other key employees to execute its business plan. If Air Canada were to experience a substantial turnover in its leadership or other key employees, Air Canada's business, results from operations and financial condition could be materially adversely... -

Page 70

... higher passenger fares and cargo rates. Refer to section 14.1 of this MD&A for additional information. The availability of international routes to Canadian air carriers is regulated by agreements between Canada and foreign governments. Changes in Canadian or foreign government aviation policy could... -

Page 71

...financial reporting in the following process areas: Accounting policy selection (including controls over changes in accounting policies); Property and equipment; Provisions (lease return conditions); Impairment of long-lived assets; Employee benefits. Management has considered the control risks... -

Page 72

... Excluding the Cost of Ground Packages at Air Canada Vacations Air Canada uses operating expense, excluding fuel expense and excluding the cost of ground packages at Air Canada Vacations, to assess the operating performance of its ongoing airline business as such expenses may distort the analysis of... -

Page 73

...Aircraft fuel Operating expense, excluding fuel expense and excluding the cost of ground packages at Air Canada Vacations (808) (640) (168) (3,375) (2,652) (723) $ (57) 2,740 $ (49) 2,552 $ (8) 188 $ (307) 11,126 (272) $ 10,282 $ (35) 844 $ Full Year Change $ $ 196 $ 2011 2,797 $ 2010 2,601 2011... -

Page 74

2011 Air Canada Annual Report 21. GLOSSARY Atlantic passenger and cargo revenues - Refers to revenues from flights that cross the Atlantic Ocean with origins and destinations principally in Europe. Available Seat Miles or ASMs - A measure of passenger capacity calculated by multiplying the total ... -

Page 75

... financial statements and other financial information. The Audit, Finance and Risk Committee reviews the quality and integrity of the Corporation's financial reporting and recommends approval to the Board of Directors; oversees management's responsibilities as to the adequacy of the supporting... -

Page 76

...), statement of changes in equity, and statement of cash flow for the years ended December 31, 2011 and December 31, 2010, and the related notes, which comprise a summary of significant accounting policies and other explanatory information. Management's responsibility for the consolidated financial... -

Page 77

... liabilities Advance ticket sales Current portion of long-term debt and finance leases Total current liabilities Long-term debt and finance leases Pension and other benefit liabilities Maintenance provisions Other long-term liabilities Total liabilities EQUITY Shareholders' equity Share capital... -

Page 78

2011 Air Canada Annual Report CONSOLIDATED STATEMENT OF OPERATIONS For the year ended December 31 (Canadian dollars in millions except per share figures) Operating revenues Passenger Cargo Other Total revenues Operating expenses Aircraft fuel Wages, salaries and benefits Airport and navigation fees... -

Page 79

...) $ (24) 2011 2010 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Share capital January 1, 2010 Net income (loss) Net gain on employee benefit liabilities Other comprehensive income Total comprehensive income Share-based compensation Ordinary shares issued Distributions December 31, 2010 Net income... -

Page 80

...-cash working capital balances Other Financing Proceeds from borrowings Shares issued Reduction of long-term debt and finance lease obligations Distributions related to aircraft special purpose leasing entities Investing Short-term investments Additions to property, equipment and intangible assets... -

Page 81

... cargo services on routes between Canada and major markets in Europe, Asia, South America and Australia using cargo capacity on Boeing 777 and other wide body aircraft operated by Air Canada. Air Canada Vacations is one of Canada' s leading tour operators. Based in Montreal and Toronto, Air Canada... -

Page 82

... on the Corporation's reported statement of financial position, statement of operations and cash flows, including the nature and effects of significant changes in accounting policies from those used in the Corporation's consolidated financial statements for the year ended December 31, 2010 prepared... -

Page 83

... on a straight-line basis over the period during which the travel pass is valid. The Corporation has formed alliances with other airlines encompassing loyalty program participation, code sharing and coordination of services including reservations, baggage handling and flight schedules. Revenues are... -

Page 84

2011 Air Canada Annual Report E) AEROPLAN LOYALTY PROGRAM Air Canada purchases Aeroplan Miles® from Aeroplan, an unrelated party. Air Canada is an Aeroplan partner providing certain of Air Canada's customers with Aeroplan Miles®, which can be redeemed by customers for air travel or other rewards ... -

Page 85

... costs related to return conditions on aircraft leases are recorded over the term of the lease for the end of lease maintenance return condition obligations within the Corporation's operating leases, offset by a prepaid maintenance asset to the extent of any related power-by-the-hour maintenance... -

Page 86

2011 Air Canada Annual Report L) FINANCIAL INSTRUMENTS Under the Corporation's risk management policy, derivative financial instruments are used only for risk management purposes and not for generating trading profits. Financial assets and financial liabilities, including derivatives, are ... -

Page 87

... and other assets; available-for-sale financial assets are measured at fair value with gains or losses recorded in Other comprehensive income ("OCI"). ï,· Fuel Derivatives After considering the costs and benefits specific to the application of cash flow hedge accounting, the Corporation no longer... -

Page 88

2011 Air Canada Annual Report number of shares included with respect to time vesting options and warrants is computed using the treasury stock method unless they are anti-dilutive. Under this method, the proceeds from the exercise of such instruments are assumed to be used to purchase Class B ... -

Page 89

... at cost. Indefinite life intangible assets are not amortized while assets with finite lives are amortized on a straight line basis over their estimated useful lives. Estimated Useful Life International route rights and slots Marketing based trade names Contract and customer based Technology based... -

Page 90

... route and slot rights which enable the Corporation to provide services internationally. The value of the recorded intangible assets relates to the cost of route and slot rights at Tokyo's Narita International Airport, Washington's Reagan National Airport and London's Heathrow Airport. Air Canada... -

Page 91

... and the related asset. Refer to Note 11 for a continuity schedule of recorded provisions. BB) AIRCRAFT LEASE PAYMENTS IN EXCESS OF OR LESS THAN RENT EXPENSE Total aircraft operating lease rentals over the lease term are amortized to operating expense (aircraft rent) on a straight-line basis... -

Page 92

... those re-defining short-term and other long-term benefits guidance on the treatment of taxes related to benefit plans, guidance on risk/cost sharing factors and expanded disclosures. The Corporation's current accounting policy for employee benefits for the presentation of pension expense and the... -

Page 93

... Employee future benefits - The cost and related liabilities of the Corporation's pensions, other post-retirement and post-employment benefit programs are determined using actuarial valuations. The actuarial valuations involve assumptions including discount rates, expected rates of return on assets... -

Page 94

2011 Air Canada Annual Report 5. PROPERTY AND EQUIPMENT Aircraft and flight equipment Buildings, and leasehold improvements Ground and other equipment Purchase deposits, including capitalized interest $ $ $ 38 - 38 38 48 (51) - - - $ 35 $ $ $ $ Total At January 1, 2010 Cost Accumulated ... -

Page 95

2011 Consolidated Financial Statements and Notes As at December 31, 2011, flight equipment included 21 aircraft (2010 - 17) that are retired from active service with a net carrying value of $12 (2010 - $4). In 2010, the Corporation recorded an impairment charge of $49 in Depreciation, amortization ... -

Page 96

2011 Air Canada Annual Report 6. INTANGIBLE ASSETS International route rights and slots Marketing based trade names Contract and customer based Technology based (internally developed) $ $ $ 245 (115) 130 130 23 (36) $ 117 $ $ $ $ Total At January 1, 2010 Cost Accumulated amortization Net book ... -

Page 97

... Financial Statements and Notes The recoverable amount of the cash-generating units has been measured based on its value in use, using a discounted cash flow model. Cash flow projections are based on the annual business plan approved by the Board of Directors of Air Canada. In addition, management... -

Page 98

... level. Air Canada is managed as one operating segment based on how financial information is produced internally for the purposes of operating decisions. In assessing the goodwill for impairment, the Corporation compares the aggregate recoverable amount, based on the fair value less cost to sell... -

Page 99

... under maintenance agreements Investment in Aveos Other deposits Aircraft lease payments in excess of rent expense Deposit related to the Pension and Benefits Agreement Asset backed commercial paper Other (a) Represents the amount of deposits with lessors for the lease of aircraft and flight... -

Page 100

... time with the payment of applicable fees. US$347 and JPY15,073 of the financing is supported by a loan guarantee by the Export-Import Bank of the United States ("EXIM"). In 2010, the Corporation concluded a credit agreement to refinance amounts related to sixteen aircraft. In 2011, the Corporation... -

Page 101

... residual value support. Total collateral provided under the test for these aircraft as at December 31, 2011 is $55 (US$54) (2010 - $53 (US$54)), in the form of cash deposits included in Deposits and other assets. Cash interest paid on Long-term debt and finance leases in 2011 by the Corporation was... -

Page 102

... current service costs for pensions and a portion of post-employment and post-retirement benefits based on actuarial calculation for their specific employee group. This cost recovery amounted to $21 for the year ended December 31, 2011 (2010 - $27). Pension and Benefits Agreement with Aveos Air... -

Page 103

... 4,000 call centre and airport check-in and gate agents employed by Air Canada and the Canadian Union of Public Employees ("CUPE"), the union representing the airline's 6,800 flight attendants. The agreements include amendments to the defined benefit pension plans of CAW and CUPE members which are... -

Page 104

2011 Air Canada Annual Report Benefit Obligation and Plan Assets The net benefit obligation is recorded in the statement of financial position as follows: 2011 Accrued benefit liabilities for Pension benefits obligation Other employee future benefits Net benefit obligation Current portion Pension ... -

Page 105

... in plan assets is 17,647,059 Class B Voting Shares of Air Canada with a fair value of $17 (2010 - $61) which were issued in 2009 in co-ordination with pension funding agreements reached with all of the Corporation's Canadian-based unions. All future net proceeds of sale of such shares are to... -

Page 106

... conform to the Statement of Investment Policy and Objectives of the Air Canada Pension Funds, as amended during 2011. The investment return objective is to achieve a total annualized rate of return that exceeds by a minimum of 1.0% before investment fees on average over the long term (i.e. 10 years... -

Page 107

... 97 599 696 Labour (b) Asset retirement (c) Litigation Total provisions (a) Maintenance provisions relate to the provision for the costs to meet the contractual return conditions on aircraft under operating leases. The provision relates to leases with expiry dates ranging from 2012 to 2024 with... -

Page 108

2011 Air Canada Annual Report 12. OTHER LONG-TERM LIABILITIES 2011 Proceeds from contractual commitments (a) Deferred income tax Collateral held in leasing arrangements and other deposits Aircraft rent in excess of lease payments Long-term employee liabilities Other Note 3BB Note 11(b) Note 11(c) $... -

Page 109

... 29.96% in 2010. The Corporation's applicable tax rate is the Canadian combined rates applicable in the jurisdictions in which the Corporation operates. The decrease is mainly due to the reduction of the Federal income tax rate in 2011 from 18% to 16.5%. The income tax expense (recovery) relating to... -

Page 110

2011 Air Canada Annual Report The balances of loss carryforwards vary amongst different taxing jurisdictions. The following are the Federal non-capital tax loss expiry dates: Tax Losses 2026 2027 2028 2029 2030 2031 $ $ 2 594 957 406 11 6 1,976 Cash income taxes paid in 2011 by the Corporation ... -

Page 111

2011 Consolidated Financial Statements and Notes 14. SHARE CAPITAL Number of shares At January 1, 2010 Shares issued on the exercise of stock options Shares issued on the exercise of warrants At December 31, 2010 Shares purchased in trust for employee recognition award Shares issued for employee ... -

Page 112

... Board with more time to pursue, if appropriate, other alternatives to maximize shareholder value. Under the terms of the Plan, one right (a "Right") has been issued with respect to each Class B Voting Share and each Class A Variable Voting Share (each a "Share") of Air Canada issued and outstanding... -

Page 113

... Canadians would receive Class A Variable Voting Shares. The Plan is scheduled to expire at the close of business on the date immediately following the date of Air Canada's annual meeting of shareholders to be held in 2014, unless terminated earlier in accordance with the terms of the Plan. 113 -

Page 114

... Annual Report 15. SHARE-BASED COMPENSATION Air Canada Long-Term Incentive Plan Certain of the Corporation's employees participate in the Air Canada Long-term Incentive Plan (the "Long-term Incentive Plan"). The Long-term Incentive Plan provides for the grant of options and performance share units... -

Page 115

... be redeemed for Air Canada shares purchased on the secondary market and/or equivalent cash at the discretion of the Board of Directors. The compensation expense (recovery) related to PSUs in 2011 was ($1) (2010 - $4). A summary of the Long-term Incentive Plan performance share unit activity is as... -

Page 116

2011 Air Canada Annual Report Employee Recognition Award In 2011, Air Canada's Board of Directors approved a special one-time Employee Recognition Award in the form of Air Canada shares granted to all eligible unionized and certain non-unionized employees worldwide, where permitted. Under the award... -

Page 117

... Numerator for basic and diluted earnings per share: Net loss attributable to shareholders of Air Canada Denominator: Weighted-average shares Effect of potential dilutive securities: Warrants Stock options Shares held in Trust for employee share-based compensation award Add back anti-dilutive impact... -

Page 118

... to purchase aircraft based on previously determined pricing and delivery position), and purchase rights for 10 Boeing 787 aircraft (entitling Air Canada to purchase aircraft based on Boeing's then current pricing). In 2011, the Corporation exercised purchase rights for two Boeing 777 with scheduled... -

Page 119

... using year end exchange rates. 2012 Subleases $ 88 $ 2013 49 $ 2014 25 $ 2015 15 $ 2016 4 Thereafter $ - $ Total 181 For accounting purposes, the Corporation acts as an agent and subleases certain aircraft to Jazz on a flow-through basis, which are reported net on the statement of operations... -

Page 120

... for 2012 is $222. The annual commitment is based on 85% of the average total Aeroplan Miles® actually issued in respect of Air Canada flights or Air Canada airline affiliate products and services in the three preceding calendar years. During 2011, the Corporation purchased $270 of Aeroplan Miles... -

Page 121

... cash Asset backed commercial paper Aircraft related and other deposits Investment in Aveos Derivative instruments Fuel derivatives Share forward contracts Foreign exchange derivatives Interest rate swaps $ Financial Liabilities Accounts payable Current portion of long-term debt and finance leases... -

Page 122

...a financial instrument will fluctuate because of changes in market interest rates. The Corporation enters into both fixed and floating rate debt and also leases certain assets where the rental amount fluctuates based on changes in short term interest rates. The Corporation manages interest rate risk... -

Page 123

... one point in time is dependent upon a number of factors, which include the amount of foreign revenue conversion available, US dollar net cash flows, as well as the amount attributed to aircraft and debt payments. The following are the current derivatives employed in foreign exchange risk management... -

Page 124

2011 Air Canada Annual Report Share-based Compensation Risk The Corporation issues share-based compensation to its employees in the form of stock options and PSUs as described in Note 15. Each PSU entitles the employees to receive a payment in the form of one Air Canada ordinary share, cash in the ... -

Page 125

... credit cards, through geographically dispersed travel agents, corporate outlets, or other airlines. Credit rating guidelines are used in determining counterparties for fuel hedging. In order to manage its exposure to credit risk and assess credit quality, the Corporation reviews counterparty credit... -

Page 126

2011 Air Canada Annual Report Fuel Price Risk Fuel price risk is the risk that future cash flows arising from jet fuel purchases will fluctuate because of changes in jet fuel prices. In order to manage its exposure to jet fuel prices and to help mitigate volatility in operating cash flows, the ... -

Page 127

...market rates. Management estimated the fair value of its long-term debt based on valuation techniques taking into account market rates of interest, the condition of any related collateral, the current conditions in credit markets and the current estimated credit margins applicable to the Corporation... -

Page 128

... Statement of Financial Position using a fair value hierarchy that reflects the significance of the inputs used in making the measurements. Fair value measurements at reporting date using: December 31, 2011 Financial Assets Held-for-trading securities Cash equivalents Short-term investments... -

Page 129

... alleged anti-competitive cargo pricing activities, including the levying of certain fuel surcharges, of a number of airlines and cargo operators, including Air Canada. Competition authorities have sought or requested information from Air Canada as part of their investigations. Air Canada has been... -

Page 130

... Annual Report Pay Equity The Canadian Union of Public Employees ("CUPE"), which represents Air Canada's flight attendants, filed a complaint before the Canadian Human Rights Commission where it alleges gender-based wage discrimination. CUPE claims the predominantly female flight attendant group... -

Page 131

..., changes of law and certain income, commodity and withholding tax consequences. When the Corporation, as a customer, enters into technical service agreements with service providers, primarily service providers who operate an airline as their main business, the Corporation has from time to time... -

Page 132

2011 Air Canada Annual Report 20. AVEOS CERTIFICATION ORDER Aveos Certification Order On January 31, 2011, the Canada Industrial Relations Board issued an order (the "Order") determining that the sale of Air Canada's former aircraft, engine and component maintenance and repair business had occurred... -

Page 133

... of the above agreements, Air Canada's equity investment in Aveos was recorded at $49, based upon its estimated fair value, and $2 for legal fees. The Term Note of $22 was recorded at its estimated fair value of $11, based on the present value of expected cash flows on a discounted basis. Other... -

Page 134

2011 Air Canada Annual Report 21. GEOGRAPHIC INFORMATION A reconciliation of the total amounts reported by geographic region for Passenger revenues and Cargo revenues on the Consolidated Statement of Operations is as follows: Passenger Revenues Canada US Transborder Atlantic Pacific Other $ $ 2011... -

Page 135

2011 Consolidated Financial Statements and Notes 22. CAPACITY PURCHASE AGREEMENTS Air Canada has capacity purchase agreements with Jazz Aviation LP and certain other regional carriers. The following table outlines the capacity purchase fees and pass-through expenses under these agreements for the ... -

Page 136

... contractual payments and the factor may not recognize discount rates implicit in the actual leases or current rates for similar obligations with similar terms and risks. Market capitalization is based on the closing price of Air Canada's shares multiplied by the number of outstanding shares. This... -

Page 137

... Chief Operating Officer, Executive Vice-President and Chief Financial Officer, and Executive Vice-President and Chief Commercial Officer. Compensation awarded to key management is summarized as follows: 2011 Salaries and other benefits Post-employment benefits Other long-term benefits Share-based... -

Page 138

2011 Air Canada Annual Report 25. RECONCILIATION OF PREVIOUS CANADIAN GAAP TO IFRS For all periods up to and including the year ended December 31, 2010, the Corporation previously prepared its consolidated financial statements in accordance with Canadian GAAP. Accordingly, the Corporation has ... -

Page 139

... gains on sale and leaseback transactions Pension and other employee future benefits Defined benefit plan gains Intangible assets and goodwill adjustment Recognition of additional provisions Reclassification of 2004 fresh start reporting adjustment to share capital Reclassification of related party... -

Page 140

... share figures) Operating revenues Passenger Cargo Other Total revenues Operating expenses Aircraft fuel Wages, salaries and benefits Airport and navigation fees Capacity purchase agreements Depreciation, amortization and impairment Aircraft maintenance Sales and distribution costs Food, beverages... -

Page 141

... on the continuing power to govern the financial and operating policies of an entity so as to obtain benefits from its activities and be exposed to related risks. Non-controlling interest is initially measured at the non-controlling shareholders' interest in the historical cost of the subsidiary... -

Page 142

...of 10% of the greater of the projected benefit obligation or market-related value of plan assets at the beginning of the year were amortized over the expected remaining service life of active employees. Under IFRS, the Corporation has elected an accounting policy to recognize net actuarial gains and... -

Page 143

... - long-term $ 120 1,098 1,937 $ $ 3,155 - 3,155 ï,· Consolidated Statement of Operations - Wages, salaries and benefits expense under Canadian GAAP for the year ended December 31, 2010 increased by $28. - Net financing expense on employee benefits related to the expected return on plan assets... -

Page 144

... relating to maintenance of fleet assets (including maintenance provided under power-by-the-hour contracts) are charged to operating expenses in the income statement on consumption or as incurred. Maintenance and repair costs related to return conditions on operating leases are accrued over the term... -

Page 145

... expense charged. Impact The impact arising from the change is summarized as follows: ï,· Consolidated Statement of Financial Position - At January 1, 2010, Goodwill, which was reported by Air Canada prior to the application of fresh start reporting under Canadian GAAP of $311, was reinstated with... -

Page 146

... the term of the lease for the end of lease maintenance return condition obligations within the Corporation's operating leases, offset by a prepaid maintenance asset to the extent of any related power by the hour maintenance service agreements or any recoveries under aircraft subleasing arrangements... -

Page 147

... the year ended December 31, 2010 increased by $21. vii) Long-term Debt Accounting policy differences on presentation In August 2010, the Corporation concluded a credit agreement for a secured term loan facility (the "Facility") to refinance amounts related to 16 aircraft. Under Canadian GAAP, as... -

Page 148

... President, Operations Senior Vice President, Customer Service Vice President, Air Canada Maintenance and Engineering Vice President, Airports Vice President, Alliances, International Operations and Regulatory Affairs Vice President, Network Planning President and Chief Executive Officer, Air Canada... -

Page 149

... Email: [email protected] Investor Relations Telephone: 514-422-7849 Facsimile: 514-422-7396 Head Office Air CanaTa Centre 7373 Côte-Vertu BlvT. West Saint-Laurent, Que)ec H4S 1Z3 Internet aircanaTa.com Air CanaTa complies with the guiTelines aTopteT )y the Toronto Stock... -

Page 150

... frequent in frequent flyer flyer programs programs and use andof use airport of airport lounges. lounges. Air Canada Air Canada also generates also generates revenue revenue from from its Air its Canada Air Canada Cargo Cargo division division and and from from tour tour operator operator services...