Aetna 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report- Page 4

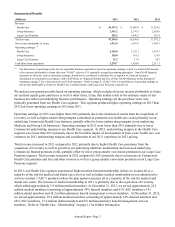

During the past three years our cash flows supported both new and ongoing initiatives.

We generated substantial cash flows in the past three years, which we used to support our growth strategies,

including partially funding the Coventry acquisition, funding other acquisitions, and investing in ACS businesses;

repurchasing our common stock; repurchasing our long-term debt; and increasing our shareholder dividend.

With respect to capital management, in 2013, 2012 and 2011, we repurchased approximately 23 million, 32 million,

and 45 million shares of our common stock, respectively, at a cost of approximately $1.4 billion in both 2013 and

2012 and $1.8 billion in 2011 under share repurchase programs authorized by Aetna's Board of Directors (our

“Board”). In addition, on February 7, 2014, we issued a notice of redemption for $750 million aggregate principal

amount of our 6.0% Senior Notes due 2016, which we expect to refinance with additional indebtedness.

We have contributed to our tax-qualified noncontributory defined benefit pension plan (the “Aetna Pension Plan”)

in each of the past three years. During each of 2013, 2012 and 2011, we made voluntary cash contributions of $60

million to the Aetna Pension Plan.

Health Care Reform

The Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010

(collectively, “Health Care Reform”) has changed and will continue to make broad-based changes to the U.S. health

care system which could significantly affect the U.S. economy and we expect will continue to significantly impact

our business operations and financial results, including our pricing, our medical benefit ratios (“MBRs”) and the

geographies in which our products are available. Health Care Reform presents us with new business opportunities,

but also with new financial and regulatory challenges. Since its enactment in 2010, key components of Health Care

Reform have been phased in, including required minimum medical loss ratios (“MLRs”) in Commercial products,

enhanced premium rate review and disclosure processes, reduced Medicare Advantage payment rates to insurers,

and linking Medicare Advantage payments to a plan's Centers for Medicare & Medicaid Services (“CMS”) quality

performance ratings or “star ratings.” The effects of these changes are reflected in our financial results.

While key components of Health Care Reform will continue to be phased in through 2018, the most significant

changes during that time will occur in 2014, making 2014 a uniquely challenging year. The components of Health

Care Reform that take effect in 2014 include: public health insurance exchanges (also known as health insurance

marketplaces) (“Public Exchanges”), Medicare minimum MLRs, the individual coverage mandate, guaranteed

issue, rating limits in the individual and small group markets, and significant new industry-wide fees, assessments

and taxes. We are dedicating and will continue to be required to dedicate material resources and incur material

expenses during 2014 to implement and comply with Health Care Reform as well as state level health care

reform. While the federal government has issued a number of regulations implementing Health Care Reform, many

significant parts of the legislation, including aspects of Public Exchanges, Medicaid expansion, enforcement related

reporting for the individual and employer mandates, assessments, taxes and fees, reinsurance, risk corridor, risk

adjustment and the implementation of Medicare Advantage and Part D minimum MLRs, have not been finally

implemented and may require further guidance and clarification at the federal level and/or in the form of regulations

and actions by state legislatures to implement the law. The federal government also has announced significant

changes to and/or delays in effective dates of various aspects of Health Care Reform, and it is likely that further

changes will be made at the federal and/or state level based on implementation experience. As a result, key aspects

and impacts of Health Care Reform will not be known for several years, and given the inherent difficulty of

foreseeing how individuals and businesses will respond to the choices afforded them by Health Care Reform, we

cannot predict the full effect Health Care Reform will have on us. It is reasonably possible that Health Care Reform,

in the aggregate, could have a material adverse effect on our business operations and financial results.

On October 1, 2013, Public Exchanges became available for consumers to access and begin the enrollment process

for coverage beginning January 1, 2014. For 2014, Aetna currently has chosen to participate in 10 statewide

individual Public Exchanges and, on a limited basis, an additional seven states' individual Public Exchanges.

Additionally, in 2014, Aetna currently has chosen to participate in three statewide small group Public Exchanges

and, on a limited basis, one additional state's small group Public Exchange.