Aetna 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013

Aetna Annual Report,

Financial Report to Shareholders

Table of contents

-

Page 1

2013 Aetna Annual Report, Financial Report to Shareholders -

Page 2

-

Page 3

-

Page 4

... CT 06156 Mark T. Bertolini Chairman, Chief Executive Officer and President To our shareholders: 2013 was a historic year for Aetna. We produced record results and successfully closed on our acquisition of Coventry Health Care. The acquisition has significantly improved our market... -

Page 5

... enabling providers to deliver on this new model of care through technology that seamlessly connects the health care community here and abroad. One of our core values at Aetna is caring. Our more than 48,000 employees demonstrate this value every day by meeting the needs of our customers and... -

Page 6

-

Page 7

...sheets at December 31, 2013 and 2012 and the related consolidated statements of income, comprehensive income, shareholders' equity and cash flows for each of the years 2011 through 2013. Notes to Consolidated Financial Statements Reports of Management and our Independent Registered Public Accounting... -

Page 8

...insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, medical management capabilities, Medicaid health care management services, Medicare Advantage and Medicare supplement plans, workers' compensation administrative services... -

Page 9

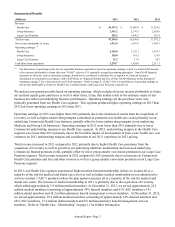

...increase in Commercial Health Care premium and fees and other revenue as well as a group annuity conversion premium in our Large Case Pensions segment. In 2013, our Health Care segment experienced higher medical Insured membership (where we assume all or a majority of the risk for medical and dental... -

Page 10

... new financial and regulatory challenges. Since its enactment in 2010, key components of Health Care Reform have been phased in, including required minimum medical loss ratios ("MLRs") in Commercial products, enhanced premium rate review and disclosure processes, reduced Medicare Advantage payment... -

Page 11

... goals for 2014 are to continue to integrate the Coventry acquisition, solve for the financial impacts of the significant fees, taxes and assessments imposed on us by Health Care Reform as well as for the rate pressures in our Medicare Advantage business, change the provider business model through... -

Page 12

... us. Management Update Lonny Reisman, M.D., Aetna's Chief Medical Officer, is expected to leave the Company in April 2014. 2011 Acquisitions During 2011, we completed the acquisitions of Medicity Inc. ("Medicity"), Prodigy Health Group ("Prodigy"), Genworth Financial, Inc.'s ("Genworth's") Medicare... -

Page 13

...health plans that combine traditional POS or PPO and/or dental coverage, subject to a deductible, with an accumulating benefit account (which may be funded by the plan sponsor and/or the member in the case of HSAs). We also offer Medicare and Medicaid products and services and other medical products... -

Page 14

... class action litigation regarding Aetna's payment practices related to out-of-network health care providers. • In 2012, we recorded a severance charge of $24.1 million ($37.0 million pretax) related to actions taken in 2012 and 2013. • In 2011, we announced a voluntary early retirement program... -

Page 15

... Accounting Estimates - Health Care Costs Payable" beginning on page 23 for additional information). Medicare operating results for 2013 reflected an increase in membership, primarily from the Coventry acquisition, offset by lower underwriting margins in our underlying business. Medicare premiums... -

Page 16

... as well as the termination of a contract in 2011 that carried a relatively lower MBR. Fees and Other Revenue Health Care fees and other revenue for 2013 increased $689 million compared to 2012 due primarily to the inclusion of Coventry's service businesses. Health Care fees and other revenue for... -

Page 17

... absence management services offered to employers, which include short-term and long-term disability administration and leave management. Group Insurance also includes long-term care products that were offered primarily on an Insured basis, which provide benefits covering the cost of care in private... -

Page 18

... paid-up group whole life insurance business. In 2013, we sold our claim against Lehman Re to an unrelated third party (including the reinsurance recoverable) and terminated the reinsurance arrangement. Upon the sale of the claim and termination of the arrangement, we released the related allowance... -

Page 19

...tax-qualified pension plans. These products provide a variety of funding and benefit payment distribution options and other services. The Large Case Pensions segment includes certain discontinued products. Operating Summary (Millions) Premiums Group annuity contract conversion premium Net investment... -

Page 20

... single-premium annuities ("SPAs") and guaranteed investment contracts ("GICs"), primarily to employer sponsored pension plans. In 1993, we discontinued selling these products to Large Case Pensions customers, and now we refer to these products as discontinued products. We discontinued selling these... -

Page 21

... 31, 2013, 2012 and 2011, respectively, of experience-rated pension contracts supported by our general account assets could be withdrawn or transferred to other plan investment options at the direction of plan participants, without market value adjustment, subject to plan, contractual and income tax... -

Page 22

... as Level 3 inputs in accordance with GAAP). Refer to Note 10 of Notes to Consolidated Financial Statements beginning on page 107 for additional information on the methodologies and key assumptions we use to determine the fair value of investments. At December 31, 2013 and 2012, our debt and equity... -

Page 23

... invested assets at both December 31, 2013 and 2012. There were no material impairment reserves on these loans at December 31, 2013 or 2012. Refer to Note 8 of Notes to Consolidated Financial Statements on page 100 for additional information on our mortgage loan portfolio. Risk Management and Market... -

Page 24

... funded from the sale of investments (which are reported as cash provided by investing activities). Refer to the Consolidated Statements of Cash Flows on page 81 for additional information. (Millions) Cash flows from operating activities Health Care and Group Insurance Large Case Pensions Net cash... -

Page 25

... financing for the acquisition of Coventry as well as our May 2012 long-term debt financing, partially offset by share repurchases, repayments of long-term and short-term debt and dividend payments. Refer to Note 14 of Notes to Consolidated Financial Statements on page 126 for additional information... -

Page 26

... and disbursements. At December 31, 2013 and 2012, we did not have any commercial paper outstanding. The maximum amount of commercial paper borrowings outstanding during 2013 was $700 million issued to finance a portion of the cash purchase price for the Coventry acquisition. Annual Report- Page 20 -

Page 27

... to Consolidated Financial Statements on page 126 for additional information on our short-term and long-term debt. In connection with the Coventry acquisition, we expect to continue to incur material integration-related costs in 2014. Pretax integration-related costs incurred in 2013 and 2012 were... -

Page 28

... paid by the plans. At December 31, 2013, the funded status of the qualified pension plan was included in other long-term assets in our consolidated balance sheets. Refer to Note 11 of Notes to Consolidated Financial Statements beginning on page 114 for additional information. • Deferred gains of... -

Page 29

...as separate account assets, they are legally segregated and are not subject to claims that arise out of our business and only support Aetna's future policy benefits obligations under that group annuity contract. Refer to Notes 2 and 19 of Notes to Consolidated Financial Statements beginning on pages... -

Page 30

... care practices, inflation, new technologies, increases in the cost of prescription drugs (including specialty pharmacy drugs), direct-to-consumer marketing by pharmaceutical companies, clusters of highcost cases, claim intensity, changes in the regulatory environment, health care provider or member... -

Page 31

... other than health care costs payable for benefit claims primarily related to our Group Insurance segment. We refer to these liabilities as other insurance liabilities. These liabilities primarily relate to our life, disability and long-term care products. Life and Disability The liabilities for our... -

Page 32

...) than our actual future portfolio returns, our reserves may be higher (lower) than necessary. Our discount rates for life insurance waiver of premiums and long-term disability reserves at December 31, 2013 were consistent with the rates used at December 31, 2012 and 2011. Based on our historical... -

Page 33

... contracts. Any such reserves established would normally cover expected losses until the next policy renewal dates for the related policies. We did not have any premium deficiency reserves for our Health Care or Group Insurance business at December 31, 2013 or 2012. Large Case Pensions Discontinued... -

Page 34

... 2012, we made voluntary cash contributions of $60 million to the Aetna Pension Plan. Our non-qualified supplemental pension plan and OPEB plans do not have minimum funding requirements. Refer to Note 11 of Notes to Consolidated Financial Statements beginning on page 114 for additional information... -

Page 35

... Terminations and Uncollectible Accounts Our revenue is principally derived from premiums and fees billed to customers in the Health Care and Group Insurance businesses. In Health Care, revenue is recognized based on customer billings, which reflect contracted rates per employee and the number... -

Page 36

...The components of Health Care Reform that take effect in 2014 include: Public Exchanges, Medicare minimum MLRs, the individual coverage mandate, guaranteed issue, rating limits in the individual and small group markets, and significant new industry-wide fees, assessments and taxes. We are dedicating... -

Page 37

... minimum MLRs. Health Care Reform's minimum MLR requirements limit the level of margin we can earn in our Commercial Insured and Medicare Insured business while leaving us exposed to medical costs that are higher than those reflected in our pricing. Freezing 2011 Medicare Advantage payment rates for... -

Page 38

... of minimum MLR standards to both our limited benefit and student health products may have an adverse effect on our ability to sell these products in the future. In addition, certain provisions of Health Care Reform tie Medicare Advantage plans' premiums to the achievement of favorable CMS quality... -

Page 39

... demonstrate that pricing in rate filings; and imposing taxes on insurers and other health plans to finance Public Exchanges, Medicaid and other state programs. In addition, we requested significant increases in our premium rates in our individual and small group Health Care businesses for 2014 and... -

Page 40

... new business and renewal premium rates and limit the ability of a carrier to terminate coverage of an employer group. Health Care Reform expanded the premium rate review process by, among other things, requiring our rates to be reviewed for "reasonableness" at either the state or the federal level... -

Page 41

...in our individual and small group Health Care businesses for 2014 and expect to continue to request significant increases in those rates for 2015 and beyond in order to adequately price for projected medical cost trends, the expanded coverages and rating limits required by Health Care Reform and the... -

Page 42

... drug program ("PDP") premium rates for 2014 reflect a material reduction in 2014 premiums compared to 2013 for Medicare Advantage and PDP plans which is in addition to the challenge we face from the impact of the industry-wide health insurer fee that became effective January 1, 2014. CMS's 2014... -

Page 43

...health care provider medical malpractice insurance costs. Reducing federal and/or state government funding of government-sponsored health programs in which we participate, including Medicare and Medicaid programs. Restricting or mandating health plan or life insurer claim processing, review, payment... -

Page 44

... could increase our liability exposure and could result in greater state regulation of our operations. The Employee Retirement Income Security Act of 1974 The provision of services to certain employee benefit plans, including certain Health Care, Group Insurance and Large Case Pensions benefit plans... -

Page 45

... health status of Medicare members as supported by information maintained and provided by health care providers. We collect claim and encounter data from providers and generally rely on providers to appropriately code their submissions and document their medical records. CMS pays increased premiums... -

Page 46

... members, including freezing 2011 rates based on 2010 levels, with additional reductions in future years based on regionally adjusted benchmarks. Beginning with the 2014 contract year, Health Care Reform also requires minimum MLRs for Medicare Advantage and Medicare Part D plans of 85%. Since 2012... -

Page 47

.... Our Medicaid products, dual eligible products and State Children's Health Insurance Program ("SCHIP") contracts also are subject to federal and state regulations and oversight by state Medicaid agencies regarding the services we provide to Medicaid enrollees, payment for those services, network... -

Page 48

...or suspension or exclusion from participation in government programs. For example, effective April 2010 through June 2011, CMS imposed intermediate sanctions on us suspending the enrollment of and marketing to new members of all Aetna Medicare Advantage and Standalone PDP contracts. In addition, CMS... -

Page 49

... of members or for the coverage of products (such as prescription drugs) by a plan, billing for unnecessary medical services by a health care provider, improper marketing, and violations of patient privacy rights. Companies involved in public health care programs such as Medicare, Medicaid and dual... -

Page 50

..., administration of, and/or changes to drug formularies, maximum allowable cost list pricing, average wholesale prices and/or clinical programs; disclosure of data to third parties; drug utilization management practices; the level of duty a PBM owes its customers; configuration of pharmacy networks... -

Page 51

... the Social Security Administration's Death Master File to identify additional potentially unclaimed death benefits and locate applicable beneficiaries. As a result of these changes, in the fourth quarter of 2013, we increased our estimated liability for unpaid life insurance claims with respect to... -

Page 52

...&A and elsewhere in the Annual Report and our Annual Report on Form 10-K is forward-looking within the meaning of the 1995 Act or SEC rules. This information includes, but is not limited to: the "Outlook for 2014" on page 5, "Risk Management and Market-Sensitive Instruments" beginning on page 17 and... -

Page 53

... and/or cash flows. In addition, 2014 is the first year that Health Care Reform's guaranteed issue requirements, which do not allow us to medically underwrite our small group and individual members, will apply. We do not have prior experience with pricing Public Exchange products or utilization... -

Page 54

... provider networks, optimizing our business platforms, managing certain significant technology projects, further improving relations with health care providers, negotiating contract changes with customers and providers, implementing other business process improvements and participating in Insurance... -

Page 55

..., the individual coverage mandate, guaranteed issue, rating limits in the individual and small group markets, and significant new industry-wide assessments, fees and taxes. In addition, while the federal government has issued a number of regulations implementing Health Care Reform, many significant... -

Page 56

... the funding available for Medicare, Medicaid, or dual eligible programs, changing the tax treatment of health or related benefits, or a significant alteration of Health Care Reform. The likelihood of adverse changes is increasing due to state and federal budgetary pressures, and our business and... -

Page 57

... in 2015. We cannot predict changes in future Medicare funding levels, the impact of future federal budget actions or ensure that such changes or actions will not have an adverse effect on our Medicare operating results. Furthermore, under Health Care Reform, 2011 Medicare Advantage payment rates... -

Page 58

... are approved. Beginning in 2014, our plans may be excluded from participating in Public Exchanges if they are deemed to have a history of "unreasonable" rate increases. We have requested significant increases in our premium rates in our individual and small group Health Care businesses for 2014 and... -

Page 59

... suspend the enrollment of and marketing to new members of all Aetna Medicare Advantage and PDP contracts. As a result of these sanctions, our 2011 Medicare membership and operating results were adversely affected because we did not participate in the annual enrollment process for 2011 and were not... -

Page 60

... health care providers to appropriately code claim submissions and document their medical records. If these records do not appropriately support our risk adjusted premiums, CMS may require us to refund premium payments", beginning on page 57. Our Commercial business will be subject to audits related... -

Page 61

... to drugs for individuals enrolled in health care benefit plans, and restrictions on the use of average wholesale prices. For additional information about these risks, see: • "Our business activities are highly regulated. Our Medicare, Medicaid, mail order pharmacy and certain other products are... -

Page 62

... about our members and customers in the ordinary course of our business. The use and disclosure of such information is regulated at the federal, state and international levels, and these laws, rules and regulations are subject to change and increased enforcement activity, such as a new audit program... -

Page 63

... our contracts with CMS and to assess the quality of the services we provide to our Medicare members. CMS uses various payment mechanisms to allocate and adjust premiums paid to Medicare Advantage plans according to their members' health status as supported by data prepared by health care providers... -

Page 64

...additional expenses and given rise to litigation against us. These risks are particularly high in our Medicare, Medicaid and dual eligible programs, where third parties perform pharmacy benefit management, medical management and other member related services for us. Any failure of our or these third... -

Page 65

...other covered services, as well as changes in members' healthcare utilization patterns and provider billing practices. Our health care and other benefit costs also can be affected by changes in our, products, contracts with providers, medical management, underwriting, rating and/or claims processing... -

Page 66

...include other types of medical and dental provider organizations, various specialty service providers (including pharmacy benefit management services providers), integrated health care delivery organizations, third-party administrators, HIT companies and, for certain plans, programs sponsored by the... -

Page 67

..., our premiums and our administrative and health care and other benefit costs. Our revenues from government-funded health programs, including our Medicare, Medicaid and dual eligible businesses and our government customers in our Commercial business, are dependent on annual funding by the federal... -

Page 68

... Health Care Reform fees, taxes and assessments), and we cannot offset the impact of these actions with supplemental premiums and/or changes in benefit plans, then our business and operating results could be adversely affected. In addition, if states allow certain programs to expire or choose... -

Page 69

... processing patterns and/or procedures, changes in membership and product mix, changes in the utilization of medical and/or other covered services, changes in medical cost trends, changes in our medical management practices and the introduction of new benefits and products. We estimate health care... -

Page 70

..., customer demands, business consolidations, strategic alliances, new market entrants, legislative and regulatory changes and marketing practices. As a result of Health Care Reform, the declining number of commercially insured people and other factors, our ability to grow profitably through the sale... -

Page 71

.... Integration of our recent acquisitions, including Coventry, increases these challenges, and we may not be successful in integrating various systems in a timely or cost-effective manner. Information technology projects are long-term in nature and may take longer to complete and cost more than we... -

Page 72

...state departments of insurance have increased their scrutiny of the marketing practices of brokers and agents who market Medicare products. These investigations and enforcement actions could result in penalties and the imposition of corrective action plans and/or changes to industry practices, which... -

Page 73

...our business. These risks may be enhanced if employers shift to defined contribution health care benefits plans and make greater utilization of Private Exchanges or encourage their employees to purchase health insurance on the Public Exchanges. We can provide no assurance that we will be able Annual... -

Page 74

...or our own products and/or business practices (including social media activities). This risk will increase further as we raise premium rates by more than we have in recent years to price for the expanded benefits required by, and the fees, assessments and taxes imposed by, Health Care Reform and any... -

Page 75

...improve the delivery of health care services, it may also reduce competition and the number of potential contracting parties in certain locations. These health systems are also increasingly considering forming health plans to directly offer health insurance in competition with us, a process that has... -

Page 76

...different provider network options are important factors when customers consider our products and services. Our customers, particularly our self-insured customers, also consider our hospital and other medical provider discounts when evaluating our products and services. For certain of our businesses... -

Page 77

... service levels, compromising growth, increasing compliance risk or increasing complexity; Coordinate and manage each company's provider network in a manner that maintains provider relationships, supports Aetna's future strategy and achieves anticipated cost savings; Coordinate the companies' sales... -

Page 78

... into new agreements with prospective customers, providers and vendors; Grow profitably in certain geographic areas and lines of business that historically have not been an area of focus for Aetna; or Accurately assess and effectively contain and manage known and unknown liabilities of Coventry. If... -

Page 79

... a result of the completion of the proposed acquisition of the InterGlobal group and as we seek to grow our foreign operations over the next several years. We may not be able to compete effectively in the HIT business and earn a profit. Our HIT business increases our risk of patent infringement and... -

Page 80

..., including investments in operations (such as information technology and other strategic and capital projects), dividends, acquisitions, share and/or debt repurchases, reinsurance or other capital uses, impacts our financial strength, claims paying ability and credit ratings issued by recognized... -

Page 81

...financial market conditions, interest rates and the accuracy of actuarial estimates of future benefit costs. We have pension plans that cover a large number of current employees and retirees. Even though our employees stopped earning future pension service credits in the Aetna Pension Plan effective... -

Page 82

...of tax Total assets Short-term debt Long-term debt Total Aetna shareholders' equity Per common share data: Cumulative annual dividends declared Net income attributable to Aetna: Basic Diluted (1) 2013 $ 47,294.6 1,913.6 (6.8) 49,871.8 - 8,252.6 $ 14,025.5 For the Years Ended December 31, 2012 2011... -

Page 83

.... Health care costs have been reduced by Insured member co-payments related to our mail order and specialty pharmacy operations of $110 million, $127 million and $130 million for 2013, 2012 and 2011, respectively. Refer to accompanying Notes to Consolidated Financial Statements. Annual Report... -

Page 84

... unrealized (losses) gains on the non-credit related component of impaired debt securities that we do not intend to sell and subsequent changes in the fair value of any previously impaired debt security. Refer to accompanying Notes to Consolidated Financial Statements. Annual Report- Page... -

Page 85

... long-term assets Separate Accounts assets Total assets Liabilities and shareholders' equity: Current liabilities: Health care costs payable Future policy benefits Unpaid claims Unearned premiums Policyholders' funds Collateral payable under securities loan agreements Current portion of long-term... -

Page 86

...of common shares Dividends declared Balance at December 31, 2012 Net income (loss) Other (decreases) increases in non-controlling interest Other comprehensive income (Note 9) Common shares issued to acquire Coventry Common shares issued for benefit plans, including tax benefits Repurchases of common... -

Page 87

...investment premium Loss on early extinguishment of long-term debt Changes in assets and liabilities: Accrued investment income Premiums due and other receivables Income taxes Other assets and other liabilities Health care and insurance liabilities Other, net Net cash provided by operating activities... -

Page 88

... new long-term care customers. Large Case Pensions manages a variety of retirement products (including pension and annuity products) primarily for tax-qualified pension plans. These products provide a variety of funding and benefit payment distribution options and other services. Large Case Pensions... -

Page 89

...") and include the accounts of Aetna and the subsidiaries that we control. All significant intercompany balances have been eliminated in consolidation. The Company has evaluated subsequent events from the balance sheet date through the date the financial statements were issued and determined there... -

Page 90

... intend to sell an investment within the next twelve months, in which case it is classified as current on our balance sheets. We have classified our debt and equity securities as available for sale and carry them at fair value. Refer to Note 10 beginning on page 107 for additional information on how... -

Page 91

... or paid related to a recognized asset or liability; or a foreign currency fair value or cash flow hedge. Net Investment Income and Realized Capital Gains and Losses Net investment income on investments supporting Health Care and Group Insurance liabilities and Large Case Pensions products (other... -

Page 92

...' accounts are reflected in policyholders' funds, and the reserve for anticipated future losses is reflected in future policy benefits on our balance sheets. Unrealized capital gains and losses on investments supporting Health Care and Group Insurance liabilities and Large Case Pensions products... -

Page 93

... cash flow evaluations used discount rates that correspond to a weighted-average cost of capital consistent with a market-participant view. The discount rates are consistent with those used for investment decisions and take into account the operating plans and strategies of the Health Care and Group... -

Page 94

... fee-for-service medical, dental and pharmacy claims, capitation costs and other amounts due to health care providers pursuant to risk-sharing arrangements related to Health Care's POS, PPO, HMO, Indemnity, Medicare and Medicaid products. Unpaid health care claims include our estimate of payments... -

Page 95

...MLR rebates for the current calendar year. Other premium revenue for group life, long-term care and disability products is recognized as income, net of allowances for termination and uncollectible accounts, over the term of the coverage. Other premium revenue for Large Case Pensions' limited payment... -

Page 96

... employer groups in 2013, 2012 and 2011. Under these annual contracts, CMS pays us a portion of the premium, a portion of, or a capitated fee for, catastrophic drug costs and a portion of the health care costs for low-income Medicare beneficiaries and provides a risk-sharing arrangement to limit our... -

Page 97

... D programs, Medicaid managed care plans, group and individual health insurance, coverage for specialty services such as workers' compensation administrative services, and network rental services. In November 2012, we issued $2.0 billion of long-term debt to fund a portion of the cash purchase price... -

Page 98

... has been accounted for in Aetna's post-Merger financial statements as transaction-related costs and reflected as a selling, general and administrative expense in Aetna's statements of income. Certain of Coventry's named executive officers received payments pursuant to employment agreements entered... -

Page 99

...May 7, (Millions) Cash and cash equivalents Investments Premiums and other receivables, net Intangible assets acquired Property and equipment Other assets Total assets acquired Health care costs payable Long-term debt Net deferred tax liabilities (1) Other liabilities Total liabilities assumed Total... -

Page 100

...with the November 2012 $2.0 billion offering of long-term debt to fund a portion of the cash purchase price of the Coventry acquisition, we recognized an asset for deferred debt issuance costs, which is being amortized over the weighted-average contractual life of the long-term debt. During 2013, we... -

Page 101

... align Coventry's presentation to Aetna's accounting policies. • Elimination of revenue and directly identifiable costs related to the sale of Aetna's Missouri Medicaid business, Missouri Care, Incorporated ("Missouri Care"), to WellCare Health Plans, Inc. on March 31, 2013. Completed Disposition... -

Page 102

...of which is tax deductible. All of the goodwill related to this acquisition was assigned to our Health Care segment. Prodigy Health Group In June 2011, we acquired Prodigy, a third-party administrator of self-funded health care plans, for approximately $600 million, net of cash acquired. We recorded... -

Page 103

... outstanding stock options were included in the calculation of diluted EPS for 2013, and the stock options not included in the calculation of diluted EPS for 2012 and 2011 were not material. In connection with the May 7, 2013 acquisition of Coventry, we issued approximately 52.2 million Aetna common... -

Page 104

... voluntary early retirement program that we announced in July 2011. Refer to the reconciliation of operating earnings to net income attributable to Aetna in Note 19 beginning on page 135 for additional information. 6. Health Care Costs Payable The following table shows the components of the change... -

Page 105

... was assigned to the Group Insurance segment, with the remainder assigned to the Health Care segment. Other acquired intangible assets at December 31, 2013 and 2012 were comprised of the following: (Millions) 2013 Provider networks Customer lists Value of business acquired Technology Other Definite... -

Page 106

... out of our business and only support Aetna's future policy benefits obligations under that group annuity contract. Refer to Notes 2 and 19 beginning on pages 83 and 135 for additional information. On the Effective Date, we completed the acquisition of Coventry. As a result, on that date we acquired... -

Page 107

..., 2013 and 2012 of $6.6 million and $9.6 million, respectively. Investment risks associated with our experience-rated and discontinued products generally do not impact our operating results (refer to Note 20 beginning on page 137 for additional information on our accounting for discontinued products... -

Page 108

...the Federal Home Loan Mortgage Corporation and carry agency guarantees and explicit or implicit guarantees by the U.S. Government. At December 31, 2013, our residential mortgage-backed securities had an average credit quality rating of AAA and a weighted average duration of 5.1 years. Our commercial... -

Page 109

... below are the debt and equity securities we held at December 31, 2013 and 2012 that were in an unrealized capital loss position, aggregated by the length of time the investments have been in that position: Less than 12 months (Millions) December 31, 2013 Debt securities: U.S. government securities... -

Page 110

... 2.1 276.8 Fair Value Unrealized Losses Supporting remaining products Fair Value Unrealized Losses Total Fair Value Unrealized Losses Net realized capital (losses) gains for the three years ended December 31, 2013, 2012 and 2011, excluding amounts related to experience-rated contract holders and... -

Page 111

...earnings. Our maximum exposure to loss as a result of our investment in these partnerships is our investment balance at December 31, 2013 and 2012 of approximately $205 million and $215 million, respectively, and the risk of recapture of tax credits related to the real estate partnerships previously... -

Page 112

...million for 2013, 2012 and 2011, respectively, related to investments supporting our experience-rated and discontinued products. 9. Other Comprehensive (Loss) Income Shareholders' equity included the following activity in accumulated other comprehensive loss in 2013, 2012 and 2011: Net Unrealized... -

Page 113

... market information or by using a matrix pricing model. These financial assets and liabilities would then be classified as Level 2. If quoted market prices are not available, we determine fair value using broker quotes or an internal analysis of each investment's financial performance and cash... -

Page 114

... as Level 3 because we price these securities through an internal analysis of each investment's financial statements and cash flow projections. Significant unobservable inputs consist of earnings and revenue multiples, discount for lack of marketability and comparability adjustments. An increase or... -

Page 115

Financial assets and liabilities measured at fair value on a recurring basis in our balance sheets at December 31, 2013 and 2012 were as follows: (Millions) December 31, 2013 Assets: Debt securities: U.S. government securities States, municipalities and political subdivisions U.S. corporate ... -

Page 116

... Level 3 during 2013 primarily were due to quoted prices for certain securities no longer being available in active markets. Gross transfers out of Level 3 during 2012 primarily relate to equity securities that were valued using quoted prices in an active market and debt securities that were valued... -

Page 117

... methodologies used for estimating the fair value of our financial assets and liabilities that are carried on our balance sheets at adjusted cost or contract value. Mortgage loans: Fair values are estimated by discounting expected mortgage loan cash flows at market rates that reflect the rates at... -

Page 118

...18.5 611.1 7,408.7 Separate Accounts Measured at Fair Value in our Balance Sheets Separate Accounts assets in our Large Case Pensions business represent funds maintained to meet specific objectives of contract holders. Since contract holders bear the investment risk of these assets, a corresponding... -

Page 119

... Separate Accounts financial assets between Levels 1 and 2 during the years ended December 31, 2013 and 2012. Offsetting Financial Assets and Liabilities Certain financial assets and liabilities are offset in our balance sheets or are subject to master netting arrangements or similar agreements with... -

Page 120

... pension plans, and other postretirement employee benefit ("OPEB") plans that provide certain health care and life insurance benefits for retired employees, including those of our former parent company. During each of 2013, 2012 and 2011 we made voluntary cash contributions of $60 million to our tax... -

Page 121

... the fair value of plan assets and the plan's benefit obligation is referred to as the plan's funded status. This funded status is an accounting-based calculation and is not indicative of our mandatory funding requirements, which are described on page 117. The funded status of our pension and OPEB... -

Page 122

... balance sheets at December 31, 2013 and 2012 for our pension and OPEB plans were comprised of the following: Pension Plans (Millions) Accrued benefit assets reflected in other long-term assets Accrued benefit liabilities reflected in other current liabilities Accrued benefit liabilities reflected... -

Page 123

... plans were as follows: Pension Plans 2013 2012 4.17% 4.98% 7.00 7.50 N/A N/A 2011 5.50% 7.50 N/A OPEB Plans 2013 2012 3.94% 4.78% 4.10 4.25 - - 2011 5.20% 5.50 - Discount rate Expected long-term return on plan assets Rate of increase in future compensation levels We assume different health care... -

Page 124

...traded in markets where quoted market prices are readily available. The fair values of private equity and hedge fund limited partnerships are estimated based on the net asset value of the investment fund provided by the general partner or manager of the investments, the financial statements of which... -

Page 125

....6 million of cash and cash equivalents and other receivables. The changes in the balances of Level 3 Pension Assets during 2013 and 2012 were as follows: 2013 Real Estate Beginning balance Actual return on plan assets Purchases, sales and settlements Transfers out of Level 3 Ending balance $ $ 469... -

Page 126

... improve portfolio and operational risk characteristics. Public and private equity investments are used primarily to increase overall plan returns. Real estate investments are viewed favorably for their diversification benefits and above-average dividend generation. Fixed income investments provide... -

Page 127

... Plans Our stock-based employee compensation plans (collectively, the "Plans") provide for awards of stock options, SARs, PSARs, restricted stock units ("RSUs"), MSUs, PSUs, deferred contingent common stock and the ability for employees to purchase common stock at a discount. At December 31, 2013... -

Page 128

... related to employment termination or retirement. At the end of the ten-year period, any unexercised SARs and stock options expire. We estimate the grant date fair value of SARs using a modified Black-Scholes option pricing model. We did not grant a material number of SARs in 2013, 2012 or 2011... -

Page 129

...The weighted-average per MSU grant date fair values listed above were calculated using the assumptions noted in the following table: 2012 2013 Two-year Three-year 1.7% 1.6% 1.6% 28.8% 30.3% 39.7% .4% .2% .3% 48.48 $ 44.79 $ 44.79 $ 2011 1.6% 36.5% .6% 36.87 Dividend yield Historical volatility Risk... -

Page 130

...: Dividend yield Expected settlement period (in years) Historical volatility Risk-free interest rate Initial price 1.25% 6.12 40.4% .6% 64.25 $ During 2013, 2012 and 2011, the following activity occurred under the Plans: (Millions) $ Cash received from stock option exercises Intrinsic value of... -

Page 131

...net deferred tax assets at December 31, 2013 and 2012 were as follows: (Millions) Deferred tax assets: Reserve for anticipated future losses on discontinued products Employee and postretirement benefits Investments, net Deferred policy acquisition costs Insurance reserves Debt fair value adjustments... -

Page 132

... consolidated balance sheet. As discussed in Note 3 beginning on page 91, our total long-term debt outstanding increased by $1.8 billion as a result of the acquisition of Coventry, which includes $216.6 million to adjust the Coventry long-term debt to its estimated fair value at the Effective Date... -

Page 133

...-rate debt to refinance long-term debt maturing in June 2016. At December 31, 2013, these interest rate swaps had a pretax fair value gain of $48.4 million, which was reflected net of tax in accumulated other comprehensive loss within shareholders' equity. In November 2012, we issued $500 million of... -

Page 134

... 1,813.0 422.2 Purchase Not to Exceed 2013 Shares Cost 2012 Shares Cost 2011 Shares Cost 32.3 $ 1,417.5 N/A $ 504.7 Prior to February 2011, our policy had been to pay an annual dividend of $.04 per share. In February 2011, we announced that our Board increased our cash dividend to shareholders to... -

Page 135

....0 2012 1,813.7 $ 6,372.8 2011 1,871.7 5,938.6 17. Reinsurance Effective October 1, 1998, we reinsured certain policyholder liabilities and obligations related to individual life insurance (in conjunction with our former parent company's sale of this business). These transactions were in the form... -

Page 136

...excess of loss reinsurance coverage on a portion of Aetna's group Commercial Insured Health Care business. In May 2013, we entered into two agreements with unrelated reinsurers to reinsure a portion of our Medicare Advantage business and a portion of our group Commercial Insured Health Care business... -

Page 137

... of our practices related to the payment of claims for services rendered to our members by health care providers with whom we do not have a contract ("out-of-network providers"). Among other things, these lawsuits allege that we paid too little to our health plan members and/or providers for these... -

Page 138

... commences upon final court approval of the settlement. These payments will fund claims submitted by health plan members who are members of the plaintiff class and health care providers who are members of the plaintiff class. These payments also will fund the legal fees of plaintiffs' counsel and... -

Page 139

... and past business practices, including our overall claims processing and payment practices, our business practices with respect to our small group products, student health products or individual customers (such as market withdrawals, rating information, premium increases and medical benefit ratios... -

Page 140

... coverage, limited benefit health products, student health products, pharmacy benefit management practices, sales practices, and claim payment practices (including payments to out-of-network providers and payments on life insurance policies). As a leading national health and related benefits company... -

Page 141

.... 19. Segment Information Our operations are conducted in three business segments: Health Care, Group Insurance and Large Case Pensions. The acquired Coventry operations are reflected in our Health Care segment on and after May 7, 2013. Our Corporate Financing segment is not a business segment; it... -

Page 142

... sale in fees and other revenue. • In 2012, we recorded a charge of $78.0 million ($120.0 million pretax) related to the settlement of purported class action litigation regarding Aetna's payment practices related to out-of-network health care providers. • In 2012, we incurred a loss on the early... -

Page 143

...external customers by product in 2013, 2012 and 2011 were as follows: (Millions) Health care premiums Health care fees and other revenue Group life Group disability Group long-term care Large case pensions, excluding group annuity contract conversion premium Group annuity contract conversion premium... -

Page 144

... retirement experience compared to assumptions we previously made in estimating the reserve. The reserve at each of December 31, 2013 and December 31, 2012 reflects management's best estimate of anticipated future losses, and is included in future policy benefits on our balance sheet. The activity... -

Page 145

... liabilities supporting discontinued products at 2013 and 2012 were as follows: (1) (Millions) Assets: Debt and equity securities available for sale Mortgage loans Other investments Total investments Other assets Collateral received under securities loan agreements Current and deferred income taxes... -

Page 146

... excess of loss reinsurance coverage on a portion of Aetna's group Commercial Insured Health Care business. The Company's similar reinsurance agreements with Vitality Re Limited and Vitality Re II Limited expired in January 2014. In connection with the integration of the Coventry acquisition and to... -

Page 147

...Audit Committee of Aetna's Board of Directors engages KPMG LLP, an independent registered public accounting firm, to audit our consolidated financial statements and express their opinion thereon. Members of that firm also have the right of full access to each member of management in conducting their... -

Page 148

...Financial Plaza 755 Main Street Hartford, CT 06103 Report of Independent Registered Public Accounting Firm The Board of Directors and Shareholders Aetna Inc.: We have audited the accompanying consolidated balance sheets of Aetna Inc. and subsidiaries (the "Company") as of December 31, 2013 and 2012... -

Page 149

... of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements. Because of its inherent limitations... -

Page 150

...income attributable to Aetna Net income attributable to Aetna per share - basic (1) Net income attributable to Aetna per share - diluted (1) Dividends declared per share Common stock prices, high Common stock prices, low 2012 Total revenue Income before income taxes Income taxes Net income including... -

Page 151

..., 2013, the companies included in the S&P MHCI were: Aetna Inc., Centene Corporation, CIGNA Corporation, Health Net, Inc., Humana Inc., Magellan Health Services, Inc., Molina Healthcare, Inc., UnitedHealth Group Incorporated, Wellcare Health Plans, Inc. and Wellpoint, Inc. Shareholder returns over... -

Page 152

... Human Resources Shawn M. Guertin Executive Vice President, Chief Financial Officer and Chief Enterprise Risk Officer Steven B. Kelmar Chief of Staff, Office of the Chairman Executive Vice President Corporate Affairs Dijuana Lewis Executive Vice President Consumer Products and Enterprise Marketing... -

Page 153

... INFORMATION Annual Meeting The annual meeting of shareholders of Aetna Inc. ("Aetna" or the "Company") will be held on Friday, May 30, 2014 at The Ritz-Carlton, Denver in Denver, Colorado. Corporate Headquarters 151 Farmington Avenue Hartford, CT 06156 Phone: 860-273-0123 Stock Exchange Listing... -

Page 154

... checks, address changes, stock transfers and other account matters. Computershare CIP ("CIP") Current shareholders and new investors can purchase Aetna common shares and reinvest cash dividends through the CIP sponsored by Computershare. Contacting Computershare by mail: Computershare Trust Company... -

Page 155

..., stock appreciation rights, market stock units, restricted stock units, performance stock units, performance stock appreciation rights) or who own shares acquired through the Employee Stock Purchase Plan ("ESPP") should address all questions to UBS Financial Services, Inc. regarding their accounts... -

Page 156

www.aetna.com