Aer Lingus 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Aer Lingus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2014

Table of contents

-

Page 1

ANNUAL REPORT 2014 -

Page 2

...'s Responsibilities Statement Corporate governance Statement Report of the Remuneration Committee on Director's Remuneration Letter from the Chair of the Audit Committee Independent Auditor's Report to the Members of Aer Lingus plc Financial Statements Shareholder Information Operating and Financial... -

Page 3

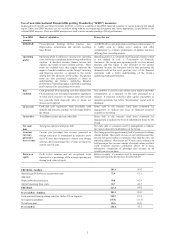

... Income tax credit/ (charge) (Loss)/ profit for the year Total equity (Loss)/ profit per share Gross cash (2) (5) Gross debt (2) Net cash (2) Key financial statistics Average fare revenue per seat Average fare revenue per passenger Passenger fare revenue per ASK EBITDAR margin Operating margin... -

Page 4

...of airlines that have differing fleet ownership models Operating profit is a commonly used financial measure which is not defined in IAS 1, Presentation of Financial Statements. The Group uses operating profit as a key internal measure and this figure is also provided in the income statement because... -

Page 5

...-on-year. Aer Lingus finished 2014 in very strong financial shape with net cash of â,¬545.3 million, up 29.9% from our net cash balance at the end of 2013. In January 2015 International Consolidated Airlines Group ("IAG") made a proposal to acquire 100% of the shares in the Company for a total price... -

Page 6

... Aer Lingus' growth plans ï,· The growth in Aer Lingus' transatlantic traffic will be accelerated and new US destinations will to be added to the network. ï,· Aer Lingus' European services, including on the Dublin, Cork and Shannon to London Heathrow routes, will benefit from sales and marketing... -

Page 7

...and security for its employees. As always, I would like to express my sincere thanks to all our customers, our excellent Aer Lingus staff and management, my fellow Directors and to you, our shareholders, for your continued support of Aer Lingus. Sincerely, COLM BARRINGTON Chairman 27 March 2015 5 -

Page 8

... to Boston and New York in February and March 2014 as well as new long haul services to San Francisco and Toronto in April 2014. All long haul routes performed strongly throughout the peak summer months and into winter 2014. Long haul passenger fare revenue grew by 28.4%. Over the course of the year... -

Page 9

...on our A330 fleet and in -flight services attuned to the time of day at which the flight occurs. These new services will be fully introduced with our summer 2015 schedule. Further commercial initiatives will be fully implemented in early 2015 including: ï,· Arrivals lounge in Dublin airport (Q2 2015... -

Page 10

...2014 mainline passengers in 2014, respectively. Aer Lingus serves both point-to-point traffic as well as increasingly serving passengers wishing to use the Dublin transatlantic hub to travel to destinations either behind or beyond this gateway in Europe and North America. The Irish air travel market... -

Page 11

...of protecting margins in the context of seasonally weaker demand. The Group will be increasing mainline short haul seat capacity by 2.4% over the peak summer 2015 season. Aer Lingus' competes in two separate short haul markets, namely Ireland to UK and central European cities and Ireland to European... -

Page 12

...costs mainly relating to aircraft hire, fuel, certain maintenance contracts and en-route/airport charges. At 31 December 2014, Aer Lingus had bought US$117.0 million for 2015 at an average rate of US$1.35. Our strategy Aer Lingus seeks to generate attractive and sustainable returns for shareholders... -

Page 13

... or leased aircraft Our results The effectiveness of Aer Lingus' strategy and "value carrier" operating model is clearly demonstrated by the strength of our 2014 results KPI Revenue growth Operating margin increase Passenger volume growth Load factor increase Revenue per seat increase Cost per... -

Page 14

... margin into the off-peak winter season. The response of load factor to capacity management is a key performance indicator in assessing network performance. London Heathrow: In July 2014, we transferred our London Heathrow operations to that airport's new Terminal 2 facility where Aer Lingus... -

Page 15

...aircraft). The Group's new routes to San Francisco and Toronto launched in April 2014 and have both performed ahead of targets. Existing direct services to Boston, New York, Chicago and Orlando also continue to perform strongly. Dublin hub: A key element driving the success of our long haul business... -

Page 16

...this growth through our increase in seat capacity. Seat Growth 13% Aer Lingus long haul capacity growth 2015 Overall long haul growth in 2015 This growth may be analysed as: Dublin to Washington Additional New York summer service Increased frequency from Dublin to San Francisco Other Business class... -

Page 17

... resulted in savings of â,¬4.9 million in 2014. The benefit of the exits under the new voluntary severance programme will be realised later in 2015 and subsequent years. Staff cost stabilisation Aer Lingus agreed staff cost stabilisation measures within the context of the agreed solution to address... -

Page 18

... upgrade of our existing long haul business class service to a fully "lie flat" capability on all of A330 fleet flying between Dublin and the US for summer 2015. Post-flight experience: 2015 will also see the introduction of a new customer loyalty programme which will replace the current Gold Circle... -

Page 19

... By usage 50 36 10 Short haul (mainline) ï,· Long haul (mainline) 4 Contract flying Total fleet Seasonality: Seasonal earnings are a feature of the airline industry. Aer Lingus' profile is however, more pronounced than most of our direct peer group. Aer Lingus has been successful in growing its... -

Page 20

...of new direct services from Dublin to Toronto and San Francisco. These new services added â,¬68.9 million to long haul revenues. In addition, revenue from Aer Lingus' existing l ong haul routes positively contributed to growth of â,¬ 39.5 million year-on-year, with additional frequency to Boston and... -

Page 21

...contract flying operations). Passenger revenue In 2014 passenger fare revenue increased by 9.4% mainly driven by increased capacity deployed on our long haul routes, coupled with a resilient short haul performance. The Group generates approximately half of its bookings outside Ireland. This results... -

Page 22

....5 million). Retail revenue per passenger increased by 1.5% reflecting baggage charges (supported by a revised baggage charge model), seat selection fees and a new "Plus" product. The mix between long and short haul fare passengers impacted the yield improvement in 2014 with long haul passengers as... -

Page 23

... years 2015 and in 2016 stabilisation payments of â,¬1,800 per employee will be paid. Finally these increases were offset by â,¬4.9 million cost reduction associated with the 137 employees who left Aer Lingus in 2013 and 2014 under a voluntary severance scheme. Airport and en-route charges Airport... -

Page 24

... new transatlantic routes and re-launch of our business class service Ground operations and other costs Ground operations and other costs increased by 20.4% in 2014 reflecting higher catering costs, in-flight entertainment and other direct costs associated with expanded transatlantic flying, higher... -

Page 25

... 2014 935.5 (390.2) 545.3 2013 897.4 (477.6) 419.8 Reconciliation of profit before tax to free cash flow (â,¬ million) Free cash flow of â,¬146.6 million is â,¬70.3 million higher than the prior year (2013: â,¬76.3 million) driven by improved operating profit performance, offset by higher capital... -

Page 26

...provide greater certainty on fuel costs. As a result at 31 December 2014, Aer Lingus was 90% hedged for the next 12 month period at an average price per tonne of $830 per metric tonne. This compares with 61% for the corresponding period at 31 December 2013. During 2014 the Group recognised a loss of... -

Page 27

... a natural currency hedge, however there remains a net shortfall due to a number of US$ denominated costs such as fuel, aircraft hire and certain maintenance costs. At 31 December 2014, Aer Lingus had bought US$117.0 million for 2015 at an average rate of US$1.35. In addition we sold forward GBP£62... -

Page 28

..., largely driven by aircraft rotables, the fit out of the three Boeing 757s, fit out of airport lounges and a number of IT capital improvement project s. The depreciation charge of â,¬90.0 million offset this expenditure, leading to a reduction in the carrying amount of the Group's fixed assets... -

Page 29

... with increased fuel, aircraft hire, additional staff and higher airport charges. On a cumulative basis our first six month operating result was 39.6% ahead of the first half of 2013 with revenues up 6.0% driven by average fare per seat up 5.5% and passengers up 3.6%. In June 2014, the Group issued... -

Page 30

.... Passenger revenue of â,¬1,162.6 million was 8.4% ahead of 2013 and operating costs 7.6% higher. At the time of release of our Q3 2014 results announcement, we upgraded full year 2014 operating profit, before exceptional items, to be ahead of 2013 (i.e. â,¬61.1 million). Q4 2014 The Group reported... -

Page 31

... reach Competition Investor Relations Market Risks Cost & Revenue Key risk clusters Pensions Change Management Industrial Relations IT Infrastructure Fleet BCDR * Customer Focus *Business Continuity and Disaster Recovery The Aer Lingus Enterprise Risk Management process incorporates all... -

Page 32

...Strategic and Financial) Aer Lingus operates in a sector where certain market parameters can strongly impact on our performance. Fuel and airport/en-route charges represented some 51% of the Group's total costs in 2014. Jet fuel prices and foreign exchange rates are volatile and airport charges are... -

Page 33

...the Irish Government's decision to not sell its shares on grounds other than price, this may have a negative impact on the Company's ability to attract shareholding in the Company. The Board and Executive Committee remain focused on implementing Aer Lingus' current strategic plans on a "business as... -

Page 34

...10m annual benefits at maturity); additional aircraft for summer schedule; move to Heathrow Terminal 2; re-launch of business class service, new website and mobile app and the launch of new retail products including merchandising. CORE recently re-launched with cost savings of â,¬40 million targeted... -

Page 35

... Emergency Response Plan for aircraft related crisis events. Comprehensive Business Resilience Planning process to be developed, encompassing Major Disruption planning, Crisis Management and IT Disaster Recovery, with formalised governance and Executive oversight. Corporate Safety & Risk Office... -

Page 36

.... Prior to joining Aer Lingus Mr. Bot was Chief Financial Officer of TNT N.V and TNT Express N.V. from 2010 to 2014 and also held the positions of Executive Board member, management Board member and group director business control. His early career was spent with McKinsey & Company, where he spent... -

Page 37

...of the Irish Government's Global Irish Network advisory group and the Global Irish Economic Forum. John has over 25 years of executive level experience leading global sales, marketing, and operations. Previously he was Chief Executive Officer at G24 Innovations, a leading thin film solar company. He... -

Page 38

... representatives and professional bodies associated with international financial services in Ireland. Mr. Slattery is also a former chairman of Financial Services Ireland. He was a member of the Review Group on Public Service Expenditure, established by the Irish Government in 2009 and of the 2nd... -

Page 39

... Financial Officer See Board of Directors on page 34. Federico Balzola Chief People and Change Officer Federico Balzola was appointed as Chief People and Change Officer of Aer Lingus Group plc with effect from 1 September 2014 and is a member of the Company's Executive Team. Formerly Southern Europe... -

Page 40

... incident reporting and occupational accident investigation procedures. It is Aer Lingus policy to have as a constant objective the creation and maintenance of a safe working environment for its staff, contractors and their employees and other members of the public. The Group has a Safety Statement... -

Page 41

... high level of compliance and adoption of best security practice. The Corporate Security Office is responsible for development and implementation of the Aer Lingus Air Carrier Security Programme, which sets out the security policies and processes by which regulatory requirements are met. Our... -

Page 42

... and regulation. All staff involved in these operations receive appropriate training and Aer Lingus ensures that the processes applied, both internally and by third parties engaged to treat such waste, are in line with best practice. Non-hazardous waste from aircraft is also subject to controls and... -

Page 43

... Irish Cancer Society, St Vincent de Paul and BBC Northern Ireland Children in Need. UNICEF - Change for Good In 2014, Aer Lingus passengers and cabin crew raised over US$820,000 by placing unused currency in special envelopes on flights. This brings the total amount generated by this long running... -

Page 44

... of Aer Lingus Group plc and the Auditors' report thereon, for the year ended 31 December 2014. Principal activities and future developments The principal activities during the year continued to be the provision of air travel services. The Chairman's Introduction and Chief Executive Officer's Review... -

Page 45

... IAG offer. Principal risks and uncertainties Information on the principal risks and uncertainties facing the Group are detailed on pages 29 to 33. The Financial Risk Management policies are set out in Note 5 to the consolidated financial statements. Directors and Secretary The names of the current... -

Page 46

.... Christoph Mueller and Ms. Nicola Shaw were re-elected as Directors at the Company's Annual General Meeting (AGM) held on 2 May 2014 . Mr. Stephen Kavanagh subsequently joined the Board with effect 1 March 2015. The interests of the Directors in office at 31 December 2014 in the shares of the Group... -

Page 47

...in business. The Directors are also required by applicable law and the Listing Rules issued by the Irish Stock Exchange, to prepare a Dire ctors' Report and reports relating to Directors' remuneration and corporate governance. In accordance with the Transparency (Directive 2004 /109/EC) Regulations... -

Page 48

... by Transparency (Directive 2004/109/EC) (Amendment) Regulations 2012 the following sections of the Company's Annual Report shall be treated a s forming part of this report The Chairman's Introduction and Chief Executive's Review on pages 3 to 7; Operating, Financial and Quarterly Review on pages... -

Page 49

... Rules of the Irish Stock Exchange (ISE), the Directors are required in this statement to describe how the principles of the Codes have been applied by the Company in the year. A copy of the UK Corporate Governance Code (September 2012) can be obtained from the Financial Reporting Council's website... -

Page 50

... new Chief Executive Officer. From 1 March 2015, the Company reverted to the conventional model of separate Chairman and Chief Executive Officer. The Chairman and the Company Secretary work closely together in planning a forward programme of Board meetings and establishing their agendas. During 2014... -

Page 51

... and 2012. The board evaluation in respect of the financial year ending 31 December 2013 conducted in 2014 was facilitated internally. Remuneration Details of Directors' remuneration is set out in the Report of the Remuneration Committee on Directors' Remuneration on pages 5 7 to 70. Share ownership... -

Page 52

... the attention of the Board Remuneration Committee any internal control or accounting issues that it believes should be taken into account when determining remuneration; and to review the Company's good faith reporting policy. The Audit Committee report for year ended 31 December 2014 is set out in... -

Page 53

... times during the year. Attendance at meetings held is set out in the table on page 54. The following is a summary of the principal work undertaken by the Safety Committee during 2014 at each of its meetings in 2014, the Committee reviewed reports from management on air safety, health and safety... -

Page 54

... the Audit Committee), an annual review of Aer Lingus' system of internal financial control and risk management systems and reported to the Board in this regard; the Risk Committee reviewed and approved the Company's Corporate Risk Assessment Process for 2014 and reported to the Audit Committee and... -

Page 55

... and information system for controlling capital expenditure including use of appropriate authorisation levels; long term business plan; detailed annual budget process, with budget reviewed and approved by Board; monthly monitoring of historic and forecast performance against budget which is reported... -

Page 56

Committees Name Colm Barrington David Begg(1) Montie Brewer Position Chairman Director Director Chief Financial Officer (from 1 September 2014) Director Director Director Director Director Board Audit 12/12 9/12 12/12 9/11 Remuneration 7/7 Nominations 9/9 Safety 4/4 3/4 3/4 4/4 Risk Bernard Bot(2)... -

Page 57

...provision in Irish company law. The Group's corporate website, http://corporate.aerlingus.com, contains information in respect of the Company's annual general meeting and any extraordinary general meetings. Regulation 21 of European Communities (Takeover Bids (Directive 2004/25/EC)) Regulations 2006... -

Page 58

... airlines as well as aircraft finance leases and exchange and interest rate hedging contracts with financial institutions. These agreements contain provisions which allow for their early termination in the event of a change of control. Directors' statement pursuant to the Transparency Regulations... -

Page 59

... it provides a clear summary of executive remuneration at Aer Lingus. Introduction 2014 was another successful year for Aer Lingus. The Group delivered significant growth in long haul and resilient short haul operations. Profitability improved, total network passengers surpassed 11 million for the... -

Page 60

... a review of the Group's Long -Term Incentive Plan. However, following the changes in Group management described above, the Committee decided not to make changes to this aspect of the remuneration framework during a year of transition. 2015 will be a year of continued change for Aer Lingus. In... -

Page 61

... each component of remuneration for Executive Directors in 2015: Element Operation Framework used to assess performance Maximum opportunity Base salaries are reviewed annually, taking into account personal performance, Company performance, changes in responsibilities and market practice. Salary... -

Page 62

... the Chief Executive The Company operates the LTIP to performance, measured 50% against a Officer incentivise the delivery of the business comparator group of European Maximum award of 125% of strategy and returns to shareholders over the airlines and 50% against the salary for the Chief Financial... -

Page 63

... 2015 in relation to his previous position and ten months from his appointment as Chief Executive Officer on 1 March 2015 The use of median vesting of 30% in the 'target' column is illustrative only. Details of the LTIP targets and vesting schedule are shown on pag e 64 and 65 Remuneration for 2014... -

Page 64

... Incentive Plan (LTIP). Due to retirement from the Board on 1 September 2014 his 2012 and 2013 LTIP awards were subject to prevesting forfeiture. Mr. Bernard Bot Bernard Bot was appointed Chief Financial Officer Designate on 18 July 2014 and became Chief Financial Officer and Executive Director on... -

Page 65

... related target; the Committee decided that it was appropriate to include this additional strategic non-financial measure. This measure will be linked to customer feedback based on our survey, Voice of the Customer. At Aer Lingus, customer service is at the heart of generating long-term shareholder... -

Page 66

... from the Board. Mr. Bernard Bot did not receive an LTIP award in 2012 as he was not an employee of the Company at the time of grant. 2014 awards In 2014 Mr. Christoph Mueller received an award with a market value at grant date of 150% of 2014 basic salary. The new Chief Financial Officer (Mr... -

Page 67

...market share price of â,¬2.20 on at least 25 days of the 40 days to 7 September 2014. This target was not achieved and the 500,000 share options l apsed. Directors' Pension Benefits Information regarding the pension benefits of the Directors is outlined in Table 2.1 on page 68. Mr. Christoph Mueller... -

Page 68

... at any annual general meeting where this is required. Recommendation to shareholders for the election of Non-Executive Directors beyond six years will only be made following review by the Board. None of the Non- Executive Directors is a party to any service contract with the Company that provides... -

Page 69

... other services to the Company. Towers Watson continues to provide the Company with market remuneration data for Board, Executive Director and other senior management roles. In May 2014 the Remuneration Committee formally reviewed its external consultants. As a result of this process the Committee... -

Page 70

..., relocation benefits, health insurance, death in service and income protection benefits. In addition to the amounts above, an amount has been charged to the income statement in relation to the estimated cost of shares which could vest under the share option award granted to Mr. Mueller prior to... -

Page 71

...â,¬12,000 in 2014 in respect of his assumption of additional responsibilities in chairing a legal committee to support management in relation to the Company's application to the High Court for a capital reduction, the issues faced by the pension schemes of which Aer Lingus Limited is a participating... -

Page 72

...% of â,¬0.521 per share 130% of â,¬0.521 per share 170% of â,¬0.521 per share Table 2.4 LTIP Awards (1) LTIP Award (Number of Year shares) 600,000 2011 Performance Period 1 January 2011 - 31 December 2013 1 January 2012 - 31 December 2014 1 January 2013 - 31 December 2015 Vesting Status Vested... -

Page 73

... for further changes in 2014. Each year we will review them a nd update if required in order to take account of revisions to the UK Corporate Governance Code. The Audit Committee's Terms of Reference are available under the Investor Relations section of our website at http://corporate.aerlingus.com... -

Page 74

... a public tender is conducted at least every ten years and this is currently under consideration by the Irish Government. We anticipate the new requirements around tendering will apply to accounting periods commencing on or after 17 June 2016. The current lead partner will rotate off the Aer Lingus... -

Page 75

..., Aer Lingus incurred â,¬41,425 of non -audit services with PwC in 2014, representing 12.1% of audit fees in 2014. The profit forecast review in 2013 was in connection with a potential circular to shareholders related to the IASS pension scheme. This circular was not issued. Financial reporting and... -

Page 76

...and liabilities and their carrying amounts in the consolidated financial statements. Deferred income tax is determined using tax rates and laws that have been enacted or substantively enacted by the reporting date and which are expected to apply when the related deferred income tax asset is realised... -

Page 77

...). During 2014, the Company introduced a Group wide anti-fraud policy, which applies to all those who work for Aer Lingus at all levels of the organisation and in any geographical location. At the same time, the existing whistle blower and Good Faith Reporting Policy and Code of Business Ethics were... -

Page 78

... and Company statements of changes in equity for the year then ended; and the notes to the financial statements, which include a summary of significant accounting policies and other explanatory information. Certain required disclosures have been presented elsewhere in the Annual Report, rather... -

Page 79

...on 3 December 2014 during the year, the number of elements involved and the which did not require any additional contributions by the resulting accounting complexities. Group and developments through to the date of signing of the financial statements. We considered the disclosures in relation to the... -

Page 80

...about the future We assessed the key assumptions which comprise passenger numbers and yield, price and certain costs such as fuel and results of the business. airport charges by reference to historical experience and other observable data where appropriate. We reviewed the fleet replacement plan and... -

Page 81

... unit that provides air transportation for passengers and cargo and the Group's flight equipment is deployed through a single route scheduling system. The consolidated financial statements are a consolidation of the principal operating company, Aer Lingus Limited, and a number of wholly owned... -

Page 82

... to shareholders by the Board on Directors' remuneration. We have no exceptions to report arising from these responsibilities. _____ Corporate governance statement Under the Listing Rules of the Irish Stock Exchange we are required to review the part of the Corporate Governance Statement relating to... -

Page 83

Consolidated income statement Year ended 31 December Note 2014 â,¬'000 2013 â,¬'000 1,425,115 Revenue Operating expenses (before net exceptional items) Staff costs Depreciation and amortisation Aircraft operating lease costs Fuel and oil costs Maintenance expenses Airport charges En-route ... -

Page 84

... which may be reclassified to the income statement Available-for-sale reserve - Amortisation of available-for-sale reserve - Deferred tax impact 11 (134) 17 (117) Cash flow hedges - Fair value losses - Deferred tax impact - Transfer to fuel costs - Deferred tax impact - Transfer to other gains - net... -

Page 85

...,774 Total assets EQUITY Called-up share capital Share premium Other reserves Retained earnings Total equity LIABILITIES Non-current liabilities Trade and other payables Finance lease obligations Derivative financial instruments Post employment benefit obligations Provisions for other liabilities... -

Page 86

The Notes on pages 90 to 139 form an integral part of these financial statements. BERNARD BOT Director STEPHEN KAVANAGH Director Approved by the Board of Directors on 27 March 2015. 84 -

Page 87

... of Companies. The Company's result for the financial year is a loss of â,¬2,000 (2013: profit of â,¬27,000). The Notes on pages 90 to 139 form an integral part of these financial statements. BERNARD BOT Director STEPHEN KAVANAGH Director Approved by the Board of Directors on 27 March 2015. 85 -

Page 88

... (loss)/income for the year (as restated1) Exercise of share awards Share based payment reserve Deferred tax impact Dividends paid (4 cent per share) Capital reduction Balance at 31 December 2013 Balance at 1 January 2014 Loss for the period Other comprehensive (loss)/income for the year Total... -

Page 89

Company statement of changes in equity Calledup share capital â,¬'000 Balance at 1 January 2013 Profit for the year ended 31 December 2013, being total comprehensive income for the year Exercise of share awards Share based payment reserve Dividends paid (4 cent per share) Capital reduction Balance ... -

Page 90

... statement of cash flows Year ended 31 December Note Cash flows from operating activities Cash generated from operations Income tax paid Net cash generated from operating activities Cash flows from investing activities Purchases of non-current assets Investment in joint venture Proceeds from sales... -

Page 91

Company statement of cash flows Year ended 31 December Note Cash flows from operating activities Net cash used in operations Cash flows from investing activities Interest received Increase in/(repayment) of amounts owed by subsidiary undertaking Dividends paid Net cash used in investing activities ... -

Page 92

...information Aer Lingus Group plc (the "Company") and its subsidiaries (together "the Group") operate as an Irish airline primarily providing passenger and cargo transportation services from Ireland to the UK and Europe ("short haul") and also to the US ("long haul"). The Company is a public limited... -

Page 93

..., statement of comprehensive income, statement of changes in equity, statement of cashflows or earnings per share. The impact on the statement of financial position as at 31 December 2013 is shown below: As at 31 December 2013 As previously reported â,¬'000 Trade and other receivables - current 73... -

Page 94

... income statement, below operating profit. See Note 17 for further details on the Group's investment in its Joint Venture. 2.3 Segment reporting Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision-maker. The chief operating... -

Page 95

... to the income statement during the financial period in which they are incurred. Depreciation is calculated using the straight-line method to allocate their cost to their residual values over their estimated useful lives as follows: Useful lives Flight equipment Aircraft fleet and major spares... -

Page 96

... and rewards of ownership. Loans and receivables are subsequently carried at amortised cost using the effective interest method. Gains or losses arising from changes in the fair value of the financial assets through the income statement category are presented in the income statement within "Other... -

Page 97

... loss relating to the ineffective por tion of the interest rate swaps is recognised in the income statement within "Other gains - net". If a hedge no longer meets the criteria for hedge accounting, the adjustment to the carrying amount of a hedged item for which the effective interest method is used... -

Page 98

... reporting period and otherwise as non current assets. 2.16 Share capital Ordinary shares issued are classified as equity. Incremental costs directly attributable to the issue of new shares or options are shown in equity as a deduction, net of tax, from the proceeds received. Where any Group company... -

Page 99

.... The tax effects of income tax losses available for carry forward are recognised as an asset when it is probable that future taxable profits will be available against which these losses can be utilised. 2.20 Employee benefits Post employment benefit obligations The Group companies operate various... -

Page 100

...2.23 Frequent Flyer Programme The Group maintains a loyalty points programme, the Gold Circle Club, which allows customers to accumulate points when they purchase flights. The points can be redeemed for free flights, products and services with Aer Lingus and its partners, subject to a minimum number... -

Page 101

... of the financial costs of events that may not occur for some years. The basis for these estimates are reviewed and updated at least annually and where information becomes available that may give rise to a material change. Measurement uncertainty associated with aircraft maintenance provisions also... -

Page 102

... the statement of comprehensive income. Refer to Note 26 for further detail. 4 Going Concern After making enquiries, considering the net cash available at the reporting date and considering the projections in the Group's 2015 budget and five year plan, the Directors consider that the Company has... -

Page 103

... greater certainty on fuel costs. As a result at 31 December 2014, Aer Lingus was 90% hedged for the next 12 month period at an average price per tonne of $830 per metric tonne. This compares with 61% for the corresponding period at 31 December 2013. The products used by the Group treasury function... -

Page 104

... context of the Group's trading performanc e and prospects. Aer Lingus paid a dividend per share of four cent in respect of 2013. Given Aer Lingus' improved operating performance in 201 4 compared to 2013, the Board has agreed to recommend to shareholders that this increased profitability should be... -

Page 105

... foreign exchange contracts is determined using forward exchange rates at the statement of financial position date, with the resulting value discounted back to present value ï,· The fair value of fuel price swaps is determined using forward fuel prices at the reporting date, with the resulting value... -

Page 106

...allows the Group to benefit from an integrated revenue pricing and route network. The Group's flight equipment is deployed through a single route scheduling system. When making resource allocation decisions, the chief operating decision maker (the Group CEO) evaluates route profitability data, which... -

Page 107

... expense Share of profit of joint venture (Loss)/ Profit before income tax 62,643 9,327 (180,338) (108,368) 9,934 (13,686) 611 (111,509) 2013 â,¬'000 54,785 6,359 (17,354) 43,790 10,837 (15,075) 6 39,558 Substantially all of the Group's non-current assets are located in Ireland. The reportable... -

Page 108

...: 2014 â,¬'000 Non-current assets (a) Restructuring and termination cost (b) Professional and legal fees (c) IASS solution - once-off pension contribution (d) Post retirement income streaming (e) (5,104) (6,208) (190,700) 21,674 (180,338) (a) Non-current assets The gain in 2013 represents a profit... -

Page 109

... issues and fees relating to the capital reduction exercise. (d) IASS solution - once-off pension contribution In December 2014, Aer Lingus shareholders voted in favour of the IASS solution which sought to address issues arising from the funding deficit in the Irish Airlines (General Employees... -

Page 110

...Termination benefits paid or payable to staff who left the Group during the year or who were committed to leave at year end are disclosed within Note 10. 13 Income Tax Income tax (credit)/charge recognised in the Income Statement 2014 â,¬'000 Current taxation Withholding taxes deducted at source... -

Page 111

2014 â,¬'000 (Loss)/Profit on ordinary activities before tax multiplied by standard Irish corporation tax rate of 12.5% (2013:12.5%) Effects of: Net expenses not (taxable)/deductible for tax purposes Differences in tax rates Other adjusting items Income tax (credit)/charge for the year (384) 6 (1,... -

Page 112

... to determine whether long-lived assets were recoverable. As at 31 December 2013, the Group's market capitalisation was lower than its net asset value and an impairment assessment was performed using a value-in-use basis to calculate recoverable value with the entire business treated as a single... -

Page 113

...for the period 2015-2018, with a long term assumption for growth of the business from 2019. Amounts included in the forecasts in respect of both revenue and operating costs reflect recent experience and management's expectation of long term market trends. The average operating margin included in the... -

Page 114

...-current liabilities Net assets Summarised statement of comprehensive income Revenue Depreciation Other operating expenses Interest expense Other net income Profit on operating activities before tax Profit on operating activities after tax Reconciliation of summarised financial information Opening... -

Page 115

... 2007 to manage the Group's Long Term Incentive Plan (LTIP). The Group controls the operations of the company and as such consolidates its results in the Group Accounts. Aer Lingus ESOP Trustee Limited was wound up on 22 August 2014. Aer Lingus 2009 DCS Trustee Limited (the "Corporate Trustee") was... -

Page 116

... discounted using a rate based on the market interest rate and the risk premium appropriate to the unlisted securities. â,¬0.2 million (2013: â,¬0.2 million) was amortised from the available-for-sale reserve to the income statement in the year. The effective interest rates of the financial assets... -

Page 117

... to the forward foreign exchange rates and forward fuel prices at the reporting date. During 2014, the fair value of fuel forward contract open positions decreased significantly due to the fact that fuel prices were US$449 per metric tonne lower than at 31 December 2013. This was partially offset... -

Page 118

... and retail stock for sale on board and in-flight equipment. 2014 â,¬'000 Sundry inventory There were no write-downs of inventory during the current or prior year. 22 Trade and other receivables 2014 â,¬'000 Trade and other receivables Other amounts receivables Prepayments and accrued income 53,845... -

Page 119

... this â,¬211.7 million related to the pension escrow). The restricted cash balances are not available for immediate use by the Group. The Group holds deposits in order to meet certain finance lease obligations, which are denominated in the same currency, and non-current deposits are mainly comprised... -

Page 120

...held as restricted cash in Aer Lingus Group plc pending distribution to the ultimate beneficiaries of the ESOT. 24 Trade and other payables 2014 â,¬'000 Trade payables Accruals and deferred income Ticket sales in advance excluding taxes and charges² Employment related taxes Other amounts payable 66... -

Page 121

...interest rates at the reporting date were as follows: 2014 â,¬ Finance lease obligations Finance lease obligation - minimum lease payments 2014 â,¬'000 No later than one year Later than one year but no later than five years Later than five years Future finance charges on finance leases Capital value... -

Page 122

... Employees" (collectively the "Irish Pensions Schemes"). Aer Lingus Limited is the sponsoring company for the Group's participation in the Irish Pension Schemes. Although similar rules apply to both Irish Pension Schemes, the contribution rates and benefits differed between the schemes in 2014. Aer... -

Page 123

... plan to a new current employee defined contribution pension plan in respect of future service pension contributions for employees of Aer Lingus who are currently IASS members and in respect of the once-off payments for Aer Lingus IASS members who are still in receipt of income from Aer Lingus... -

Page 124

... individual accounts in the new current employee defined contribution pension plan and the new deferred defined contribution pension plan on receipt of correctly executed and signed waivers. These waive any and all rights to legal action against Aer Lingus Limited and the IASS Trustee in relation to... -

Page 125

...these plans. The Internal Revenue Code, as set forth by the Internal Revenue Service, also provides regulations and guidance for the administration of pension and medical schemes. The pension schemes set up under trust and operated by Aer Lingus in Ireland are exempt approved schemes under the Taxes... -

Page 126

... benefits are frozen. The Group also operates a defined benefit scheme in respect of two retired Irish former executives of the Group and their spouses. The risks of these schemes relate primarily to demographic assumptions around mortality and to future asset performance. Future financial statement... -

Page 127

... of the reporting period: -Male (currently aged 40) -Female (currently aged 40) Sensitivities The sensitivity of the post employment benefit liabilities to changes in the weighted principal assumptions is: Change in assumption Discount rate Discount rate Inflation rate North American Pension Scheme... -

Page 128

...provide an income equating to a pension until members reach the age of 65 at which point benefits cease. The risks of these schemes relate primarily to future medical cost inflation and to financial assumptions including changes to discount rates. The Group has not changed the process used to manage... -

Page 129

...of the post employment benefit liabilities to changes in the weighted principal assumptions is: Change in assumption Short term medical costs Discount rate Discount rate Inflation rate North American Medical Scheme North American Medical Scheme Income streaming Income streaming Increase/decrease by... -

Page 130

... relates to the timing of employee exit dates. The voluntary severance provision is expected to be materially utilised in the next financial year, with the remaining provision balance expected to be largely utilised in the next 7 years. 2 Aircraft maintenance A provision is made on a monthly... -

Page 131

... Aer Lingus has also issued separate proceedings against the Irish Government on the basis that the air travel tax infringed EU rules on free movement of services. These proceedings seek repayment of â,¬8 per passenger for each passenger subject to the higher rate and/or damages. On 5 February 2015... -

Page 132

.... In May 2013, Belfast International Airport issued proceedings in the High Court of Northern Ireland against Aer Lingus Limited seeking damages in respect of an alleged breach of contract in connection with the transfer by Aer Lingus Limited of its operations from Belfast International Airport to... -

Page 133

... of the Group's Long Term Incentive Plan ("LTIP") scheme the vested awards of participants were settled, resulting in 1,513,613 treasury shares being issued by the Group to LTIP participants. No new shares were subscribed for or purchased by ALG Trustee Limited during the year. Share capital The... -

Page 134

.... Share Ownership Restrictions to protect Air Carrier Rights Since the Company's entitlement to obtain or to continue to hold or enjoy the benefit of the licences, permits, consents or privileges that enable the Company to carry on business as an air carrier in Ireland and/or internationally (''the... -

Page 135

... awards or options. In the Statement of financial position of the Company, the share based payment reserve reflects the increase in the Company's investment in Aer Lingus Limited in respect of awards granted to employees of Aer Lingus Limited, as consideration for services provided to the Company... -

Page 136

... an early vesting of an award may occur at the discretion of the Remuneration Committee on a change of control of the Company. As at the reporting date, 1,303,384 shares (2013: 2,029,606 shares) are held as Treasury Shares in respect of the LTIP and are registered in the name of ALG Trustee Limited... -

Page 137

...costs 2013 Long Term Incentive Plan Staff costs 2014 Long Term Incentive Plan Staff costs Total 1,123 1,928 497 308 - 2013 â,¬'000 982 1,158 1,018 3,158 The fair value of the shares awarded were determined using a Monte Carlo simulation technique, taking account of peer group total share return... -

Page 138

... Employee participation Employee Share Ownership Trust ("ESOT") As at 31 December 2014, Aer Lingus Group plc holds 94,701 shares of Aer Lingus Group plc shares (0.02% of the issued share capital) (2013: 102,907 shares) on trust for the benefit of certain beneficiaries (those that cannot be located... -

Page 139

... compensation¹ 2014 â,¬'000 Short-term employee benefits Post employment benefits Termination benefits Share-based payments 5,882 612 1,060 766 8,320 2013 â,¬'000 5,306 530 440 1,727 8,003 ¹ Key management compensation comprises all amounts in respect of Directors, Non Executive Directors and... -

Page 140

... is the Company's principal regulator; Tourism Ireland and the Company engage in co-marketing activities; and The Company utilises postal services in the normal course of its business from An Post, whose chairman is Christoph Mueller, the former Chief Executive Officer of Aer Lingus Group plc. In... -

Page 141

...strengthen Ireland's connectivity and provide access to a global cargo network. There can be no certainty that any offer will be made. Given Aer Lingus' improved operating performance in 2014 compared to 2013, the Board has agreed to recommend to shareholders that this increased profitability should... -

Page 142

Shareholder Information (unaudited) 2015 financial calendar Annual General Meeting 2015 H1 period ends 2015 H1 results 2015 FY ends 1 May 2015 30 June 2015 July 2015 31 December 2015 Share price data â,¬ Share price movement during 2014 - High - Low Share price at 31 December 2014 Market ... -

Page 143

... a proxy form for the 2015 Annual General Meeting electronically. Shareholders who wish to submit proxies via the internet may do so by accessing the Registrars' website (see below). Instructions on using the service are sent to shareholders with their proxy form. Shareholders must register for this... -

Page 144

...and investors. News releases are also made available in this section of the website immediately after release to the Stock Exchanges. Company officers and advisors Directors Colm Barrington (Chairman) Bernard Bot (Chief Financial Officer) Montie Brewer (Non-Executive Director) Laurence Crowley (Non... -

Page 145

Operating and Financial Statistics For the year ended 31 December 2014 2014 Mainline long haul Number of routes flown Number of sectors flown (flights) Average sector length (in kilometres) Number of passengers (in thousands) Average fare (including airport charges/taxes)(in â,¬) Utilisation (... -

Page 146

Reimagined Redesigned Redeï¬ned...