Abbott Laboratories 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Abbott Laboratories annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ABBOTT 2014 ANNUAL REPORT

2

LETTER TO OUR SHAREHOLDERS

In 2014 we saw the new Abbott in full.

2012 was our year of separation, 2013 a

year of establishing the template of the

new company we’d become. Last year

was our first opportunity to run that

company flat out. And we were very

happy with what we saw and how we

performed. 2014 was a very good year for

Abbott — one that clearly demonstrated

how we’ll compete and succeed in the

years ahead.

Throughout the year, we built for the

future in multiple ways. All of them

made our company stronger, more

competitive, and better able to help

more people in more ways. Our strategic

actions in 2014 significantly enhanced

our established competitive strengths:

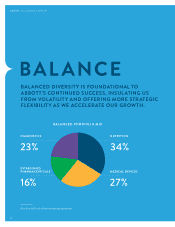

BALANCE

Well-balanced diversity is the foundation

of Abbott’s strategy and success. Our

four major businesses are of roughly

equal size, and that balance extends

across geographies and our mix of

payers. We constantly shape our

portfolio to ensure that we’re in the

right markets and that our success

isn’t over-reliant on any single therapy,

technology, or country.

This year, we took several actions in

our Established Pharmaceuticals

business, strengthening its product

portfolio, building its geographic

presence, and increasing its focus on

growth markets. First, we expanded

this business through our acquisitions

of CFR Pharmaceuticals and Veropharm,

which significantly enhanced our

product portfolio and our presence

throughout Latin America and Russia,

respectively, making Abbott a top-ten

player in both regions. At the same

time we agreed to sell our developed-

markets branded-generics business

to Mylan Inc., focusing this business

entirely on faster-growing markets.

We further focused our company on

enhancing human health by agreeing to

sell our Animal Health business to Zoetis

and by entering a large and growing new

therapeutic area — electrophysiology for

people with atrial fibrillation — through

our acquisition of Topera.

GLOBAL PRESENCE

Today’s Abbott is one of the most

globalized of all healthcare companies,

with about half of our sales now in

faster-growing geographies. To support

our strong global growth, we’re

expanding infrastructure around the

world. In 2014, we added a new vaccine

facility in the Netherlands, nutrition

plants in China, India, and the United

States, and are adding a new optics

facility in Malaysia to meet growing

demand in those regions.

In a highly innovative move, we also

agreed to co-develop a dairy-farm hub

in China, which will deepen our roots

in the country and strengthen our

supply chain. These investments are

a reflection of the strong underlying

demand for high-quality adult and

pediatric nutrition products. Our intent

is to design and manufacture products

around the world to ensure that they’re

geared to local needs and preferences,

that we can produce them eciently,

and that we build our presence and

strengthen our relationships with key

stakeholders in every country in which

we do business.

RELEVANCE

Abbott is well positioned to grow with

the major trends in our business and the

broader global environment.

The growth of developing economies

and the global middle class has vastly

expanded our markets and ability to help

more people around the world. A related

and equally powerful trend driving

our business is the aging of the global

population. Today, about 23 percent of

the people in the key markets we serve

are age 50 or older; the United Nations

projects this to grow to 40 percent

by 2050.

Abbott has a wide range of leading

products designed specifically for older

people — who use more healthcare than

others. Cataract removal, for instance,

is the world’s most-performed surgery;

we’re currently the No. 2 provider of

cataract surgical instruments and lenses,

and are gaining market share through

the introduction of new products such

as our new Catalys system. This patient

group also often requires intraocular

lenses to help them focus their sight. To

that end, this year we began the global

rollout of two new Tecnis Symfony lenses.

And in our Vascular business we

launched our MitraClip device in the

U.S. to treat mitral valve regurgitation,

a heart condition that is strongly

correlated with age.

STRONG CASH FLOW

$3.5 Billion

Returned to shareholders

through dividends and

share repurchases