Abbott Laboratories 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Abbott Laboratories annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

ABBOTT 2014 ANNUAL REPORT

Dr. Chester Barnes

with his grandson, Nathan

Los Angeles, California

MitraClip

2014 ANNUAL REPORT

Table of contents

-

Page 1

ABBOTT 2014 ANNUAL REPORT 2014 ANNUAL REPORT Dr. Chester Barnes with his grandson, Nathan Los Angeles, California MitraClip 13 -

Page 2

... Statements and Notes Management Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm Financial Instruments and Risk Management Financial Review Summary of Selected Financial Data Directors and Corporate Officers Shareholder and Corporate... -

Page 3

ABBOTT 2014 ANNUAL REPORT MILES WHITE Chairman of the Board and Chief Executive Officer D E A R F E L LOW S H A R E H O L D E R: Our purpose at Abbott is to help people live the best lives they can, through better health. In 2014, through our strong performance and strategic actions, we ... -

Page 4

... branded-generics business to Mylan Inc., focusing this business entirely on faster-growing markets. We further focused our company on enhancing human health by agreeing to sell our Animal Health business to Zoetis and by entering a large and growing new therapeutic area - electrophysiology... -

Page 5

ABBOTT 2014 ANNUAL REPORT ABBOT T VISION OUR FIVE-P OINT APPROACH FOR S U S TA I N E D S U C C E S S • Productive R&D • Well-Managed Intellectual Property • Gross-Margin Improvements • Expanding Presence in Fast-Growing Markets • Compelling Corporate Brand Identity WE ARE BUILDING A NEW ... -

Page 6

...body. • Our Nutrition business has averaged more than 70 new-product launches annually over the past several years. This includes innovations customized for the markets we serve, such as Eleva, a new formula designed to promote absorption of key eye and brain nutrients for infants in China. And we... -

Page 7

ABBOTT 2014 ANNUAL REPORT LIFE . Good health is the great enabler, helping people live not just longer, but better. 5 -

Page 8

ABBOTT 2014 ANNUAL REPORT TO THE FULLEST. Abbott's fundamental purpose is helping people get healthy and stay healthy, at all stages of life, so they can enjoy their best possible lives. We draw on our key strengths - our diversity of products and markets, our unwavering commitment to quality, a ... -

Page 9

ABBOTT 2014 ANNUAL REPORT Laura Cleverly Southsea, England FreeStyle Libre 7 -

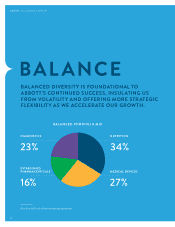

Page 10

ABBOTT 2014 ANNUAL REPORT BAL ANCE BALANCED DIVERSITY IS FOUNDATIONAL TO ABBOTT'S CONTINUED SUCCESS, INSULATING US FROM VOLATILITY AND OFFERING MORE STRATEGIC FLEXIBILITY AS WE ACCELERATE OUR GROWTH. BAL ANCED PORTFOLIO MIX DIAGNOSTICS NUTRITION 23% ESTABLISHED PHARMACEUTICALS 34% MEDICAL ... -

Page 11

ABBOTT 2014 ANNUAL REPORT BAL ANCED AND DIVERSE PORTFOLIO B A L A N C E D C U S TO M E R M I X An even split of payer types helps drive growth and reduces volatility >10,000 PRODUCTS 50% CONSUMERFACING THIRD -PART Y PAYERS 50% We are not dependent upon any single product to deliver growth 9 -

Page 12

ABBOTT 2014 ANNUAL REPORT PRESENCE WE ARE WELL ESTABLISHED IN THE LARGEST AND FASTEST-GROWING MARKETS IN THE WORLD, WHICH POSITIONS US TO GROW AND HAVE THE GREATEST IMPACT ON GLOBAL HEALTH. INTERNATIONAL STRENGTH EMERGING MARKET PRESENCE 70% Sales from outside the U.S. ~50% Sales from emerging ... -

Page 13

ABBOTT 2014 ANNUAL REPORT GLOBAL MARKET BREADTH 11 L ARGEST MARKETS 64% of sales Well distributed across the world's largest healthcare markets 11 -

Page 14

RELE VANCE OUR BUSINESS IS WELL ALIGNED WITH IMPORTANT GLOBAL ECONOMIC AND DEMOGRAPHIC TRENDS, POSITIONING US FOR RELIABLE LONG-TERM GROWTH. E C O N O M I C G R O W T H 2014 -201 9 Growth in Total Gross Domestic Product AG I N G P O P U L AT I O N Percent of Population Over 50 Years Old 2.0% D E... -

Page 15

ABBOTT 2014 ANNUAL REPORT GROWING MIDDLE CL ASS IN EMERGING MARKETS As economies expand and incomes rise, people and their governments have more resources to devote to health 13 -

Page 16

ABBOTT 2014 ANNUAL REPORT LE ADING PRESENCE AROUND THE WORLD > 150 Sales in more than 150 countries We have a strong commercial presence in every region of the world 14 -

Page 17

... 2014 ANNUAL REPORT LE ADERSHIP WITH LEADING PRODUCTS IN EVERY BUSINESS, ABBOTT IS WELL POSITIONED NOT JUST TO RESPOND TO EXTERNAL CHANGES-BUT TO DRIVE CHANGE IN THE MANY MARKETS WE SERVE. LEADING PRODUCT BRANDS BUILDING A LEADING BRAND #1 We have the number 1 or 2 brand in 75 important product... -

Page 18

ABBOTT 2014 ANNUAL REPORT NUTRITION SCIENCE-BASED NUTRITION FOR EVERY STAGE OF LIFE Vy Äăng Lê Khánh of Ho Chi Minh City, Vietnam is a happy, healthy first-grader who's always on the go. Her parents trust PediaSure to help ensure Vy is getting all the nutrients she needs. 16 PEDIASURE, COMPLE... -

Page 19

...majority of the operational sales growth in this business. In 2014, we deepened our roots and supported our continuing growth in these regions through targeted investments in local infrastructure, opening new nutrition manufacturing plants in China and India. These facilities, combined with a newly... -

Page 20

...almond flavor, developed and launched in India • Ensure brand launched in China; represents a significant long-term growth opportunity 44% Abbott is the worldwide leader in adult nutrition, a segment that represents almost half of our sales in this business. 65 new product launches in 2014 18 -

Page 21

ABBOTT 2014 ANNUAL REPORT INFANT ADULT PERFORMANCE 2014 BUSINESS HIGHLIGHTS • Opened state-of-the-art nutrition manufacturing plants in China, India, and the United States • Opened nutrition R&D center in China • Announced a partnership with Fonterra to develop a dairy-farm hub in China ... -

Page 22

ABBOTT 2014 ANNUAL REPORT MEDIC AL DE VICES TECHNOLOGIES THAT CHANGE LIVES Dr. Chester Barnes is 88 years old and enjoys an active, fulfilling life thanks, in part, to Abbott's MitraClip. M I T R A C L I P, VA LV E R E PA I R D E V I C E 20 -

Page 23

... businesses share a fundamental commitment to delivering advanced technologies that dramatically improve outcomes, while contributing to lower overall healthcare costs. In 2014, Abbott expanded the scope of this organization when we entered the transcatheter electrophysiology market by acquiring... -

Page 24

ABBOTT 2014 ANNUAL REPORT 2014 Business Review MEDICAL DEVICES LEADERSHIP IN PATIENTFOCUSED TECHNOLOGY In our Medical Devices business, Abbott harnesses the power of innovation to make a clear, positive difference in people's lives. Many of our products - like our Absorb bioresorbable vascular ... -

Page 25

ABBOTT 2014 ANNUAL REPORT VISION CARE VASCULAR DEVICES DIABETES CARE 2014 S A L E S B Y D I V I S I O N (in billions) BREAKTHROUGH IN DIABETES MONITORING VISION FREESTYLE LIBRE $1.22 VASCULAR $2.98 DIABETES With the launch of this next-generation technology, Abbott created an entirely new... -

Page 26

ABBOTT 2014 ANNUAL REPORT DIAGNOSTICS STRONG PARTNERSHIPS, BETTER RESULTS As Chief Executive of KingMed Diagnostics, China's largest independent diagnostics laboratory, Liang Yaoming trusts Abbott systems and solutions to provide accurate, efficient results. 24 A R C H I T EC T , DIAGNOS TIC S YS... -

Page 27

... health problems and their associated costs. With a more than 60-year history in diagnostics, we're positioned for growth. We're expanding our presence in the core laboratory market segment to improve the efficiency, speed, and accuracy of patient tests, while managing the vast amount of information... -

Page 28

ABBOTT 2014 ANNUAL REPORT 2014 Business Review DIAGNOSTICS TRANSFORMING THE CONTINUUM OF CARE Abbott offers a broad range of innovative diagnostics instrument systems and solutions for hospitals, reference labs, molecular labs, blood banks, physician offices, and clinics. Our diagnostic products... -

Page 29

ABBOTT 2014 ANNUAL REPORT CORE LABORATORY MOLECULAR POINT OF CARE LEADING BRANDS DIAGNOSTIC LE ADERSHIP • ARCHITECT Immunoassay systems and tests • ABBOTT PRISM Blood-screening system • ACCELERATOR Advanced lab-automation system • M2000 Molecular testing system • IRIDICA Breakthrough... -

Page 30

ABBOTT 2014 ANNUAL REPORT ESTABLISHED PHARMACEUTICALS TRUSTED BRANDS IN FAST-GROWING MARKETS Thanks to a trusted medicine that helped him take control of his cholesterol, Alberto Wilson is better able to relax and enjoy the things - and the people - that really matter ... -

Page 31

... this deal, Abbott became one of the top ten pharmaceutical companies in Latin America. At the end of the year, we completed our acquisition of Veropharm, making us a top-five branded-generics company in Russia. And in July, we agreed to sell the Developed Markets portion of this business to Mylan... -

Page 32

... of our Developed Markets pharmaceuticals business to Mylan, Abbott will focus its energies in emerging markets • Acquisition of CFR Pharmaceuticals makes Abbott a top-ten company in Latin America • Acquisition of Veropharm strengthens Abbott's commercial presence, R&D capability, manufacturing... -

Page 33

... 2014 ANNUAL REPORT REGIONAL PORTFOLIOS GLOBAL STRENGTH TRUSTED BRANDS PROJECTED GROWTH OF GROSS D O M E S T I C P R O D U C T 2 0 1 4 -2 0 1 9 Abbott is the No. 1 pharmaceutical company in India, Chile, Colombia, and Peru, and top five in Russia. NUMBER ONE TOTAL DEVELOPED MARKETS 27 CHINA... -

Page 34

... Income 35 Consolidated Statement of Cash Flows 36 Consolidated Balance Sheet 38 Consolidated Statement of Shareholders' Investment 39 Notes to Consolidated Financial Statements 57 Management Report on Internal Control Over Financial Reporting 58 Reports of Independent Registered Public Accounting... -

Page 35

... per share data) Year Ended December 31 Net Sales Cost of products sold, excluding amortization of intangible assets Amortization of intangible assets Research and development Selling, general and administrative Total Operating Cost and Expenses Operating Earnings Interest expense Interest income... -

Page 36

...2014, $(13) in 2013 and $(29) in 2012 Other Comprehensive Income (Loss) Comprehensive Income (Loss) Supplemental Accumulated Other Comprehensive Income Information, net of tax as of December 31: Cumulative foreign currency translation (loss) adjustments Net actuarial (losses) and prior service (cost... -

Page 37

... assets Trade accounts payable and other liabilities Income taxes Net Cash From Operating Activities Cash Flow From (Used in) Investing Activities: Acquisitions of property and equipment Acquisitions of businesses and technologies, net of cash acquired Purchases of investment securities Proceeds... -

Page 38

... Trade receivables, less allowances of-2014: $310; 2013: $312 Inventories: Finished products Work in process Materials Total inventories Deferred income taxes Other prepaid expenses and receivables Current assets held for disposition Total Current Assets Investments Property and Equipment, at Cost... -

Page 39

... 2014 ANNUAL REPORT C O N S O L I D AT E D B A L A N C E S H E E T (dollars in millions) December 31 Liabilities and Shareholders' Investment Current Liabilities: Short-term borrowings Trade accounts payable Salaries, wages and commissions Other accrued liabilities Dividends payable Income taxes... -

Page 40

... programs Shares: 2014: 5,818,599; 2013: 5,718,575; 2012: 6,691,748 Purchased Shares: 2014: 54,984,304; 2013: 44,184,393; 2012: 37,463,358 End of Year Shares: 2014: 186,894,515; 2013: 137,728,810; 2012: 99,262,992 Earnings Employed in the Business: Beginning of Year Net earnings Separation of AbbVie... -

Page 41

...2013. See Note 2 for additional information. In July 2014, Abbott announced that it will sell its developed markets branded generics pharmaceuticals business to Mylan Inc. (Mylan) for equity ownership of a newly formed entity that will combine Mylan's existing business and Abbott's developed markets... -

Page 42

...future use. These costs include initial payments incurred prior to regulatory approval in connection with research and development collaboration agreements that provide rights to develop, manufacture, market and/or sell pharmaceutical products. The fair value of IPR&D projects acquired in a business... -

Page 43

... Pharmaceutical Products segment. Abbott will retain its branded generics pharmaceuticals business in emerging markets. At the close of this transaction Abbott and Mylan entered into transitional services agreements pursuant to which Abbott and Mylan will provide various back office support services... -

Page 44

... markets generics pharmaceuticals and animal health businesses AbbVie Total 2014 2013 2012 NOTE 4 -SUPPLEMENTAL FINANCIAL INFORMATION $2,076 - $2,076 $2,191 - $2,191 $÷2,444 18,380 $20,824 Other (income) expense, net, for 2014 primarily relates to impairment charges related to non-publically... -

Page 45

...income) expense and gains/losses related to cash flow hedges are recorded as Cost of product sold. Net actuarial losses and prior service cost is included as a component of net periodic benefit plan cost-see Note 13 for additional information. NOTE 6-BUSINESS ACQUISITIONS In September 2014, Abbott... -

Page 46

...at December 31, 2014 and 2013, respectively. In 2014, the acquisition of CFR Pharmaceuticals increased intangible assets by approximately $1.8 billion. Approximately $804 million of net intangible assets related to the developed markets branded generics pharmaceuticals businesses was reclassified to... -

Page 47

... and prior years, Abbott management approved plans to realign its worldwide pharmaceutical and vascular manufacturing operations and selected domestic and international commercial and research and development operations in order to reduce costs. In 2013, Abbott recorded employee severance charges of... -

Page 48

... fair market value of restricted stock awards and units vested in 2014, 2013 and 2012 was $281 million, $274 million and $385 million, respectively. Exercisable Options Weighted Average Remaining Life (Years) 3.1 The 2009 Incentive Stock Program authorizes the granting of nonqualified stock options... -

Page 49

... the option's exercise price and annual dividend rate at the time of grant. NOTE 10-DEBT AND LINES OF CREDIT Certain Abbott foreign subsidiaries enter into foreign currency forward exchange contracts to manage exposures to changes in foreign exchange rates for anticipated intercompany purchases by... -

Page 50

ABBOTT 2014 ANNUAL REPORT N O T E S T O C O N S O L I D AT E D F I N A N C I A L S TAT E M E N T S The following table summarizes the amounts and location of certain derivative financial instruments as of December 31: Fair Value-Assets 2013 Balance Sheet Caption Deferred income taxes and other ... -

Page 51

... cleanup costs at a number of locations in the United States and Puerto Rico under federal and state remediation laws and is investigating potential contamination at a number of company-owned locations. Abbott has recorded an estimated cleanup cost for each site for which management believes Abbott... -

Page 52

... on January 1, 2013, Abbott transferred to AbbVie Accumulated other comprehensive income (loss), net of income taxes, of approximately $1.4 billion. The projected benefit obligations for non-U.S. defined benefit plans was $2.5 billion and $2.0 billion at December 31, 2014 and 2013, respectively. The... -

Page 53

... rate 8% 5% 2025 2013 7% 5% 2019 2012 7% 5% 2019 The discount rates used to measure liabilities were determined based on high-quality fixed income securities that match the duration of the expected retiree benefits. The health care cost trend rate represent Abbott's expected annual rates of change... -

Page 54

ABBOTT 2014 ANNUAL REPORT N O T E S T O C O N S O L I D AT E D F I N A N C I A L S TAT E M E N T S The following table summarizes the bases used to measure the defined benefit and medical and dental plan assets at fair value: Basis of Fair Value Measurement Quoted Significant Significant Prices in... -

Page 55

... 2013, Abbott recognized a tax benefit in the tax provision related to continuing operations of approximately $103 million for the retroactive extension of the research tax credit and the look-through rules of section 954(c)(6) of the Internal Revenue Code to the beginning of 2012. The $1.58 billion... -

Page 56

...various domestic and international tax matters. Impact of foreign operations is primarily derived from operations in Puerto Rico, Switzerland, Ireland, Singapore, and the Netherlands. In 2014, this benefit was more than offset by the tax expense accrued as a result of Abbott's one-time repatriation... -

Page 57

... INFORMATION Abbott's principal business is the discovery, development, manufacture and sale of a broad line of health care products. Abbott's products are generally sold directly to retailers, wholesalers, hospitals, health care facilities, laboratories, physicians' offices and government agencies... -

Page 58

...Share (a) Market Price Per Share-High Market Price Per Share-Low 2014 2013 (d) In 2012, the reported amounts include assets associated with the businesses transferred to AbbVie as part of the separation. (e) Includes amounts related to developed markets established pharmaceuticals and animal health... -

Page 59

... the company's internal control over financial reporting. This report appears on page 58. Miles D. White Chairman of the Board and Chief Executive Officer Thomas C. Freyman Executive Vice President, Finance and Chief Financial Officer Robert E. Funck Vice President, Controller February 27, 2015 57 -

Page 60

... LLP Chicago, Illinois February 27, 2015 The Board of Directors and Shareholders of Abbott Laboratories: We have audited Abbott Laboratories and subsidiaries' internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control-Integrated Framework... -

Page 61

...2014 ANNUAL REPORT REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Abbott Laboratories: We have audited the accompanying consolidated balance sheet of Abbott Laboratories and subsidiaries (the "Company") as of December 31, 2013, and the related... -

Page 62

...third-party trade payables and receivables. The contracts are marked-to-market, and resulting gains or losses are reflected in income and are generally offset by losses or gains on the foreign currency exposure being managed. At December 31, 2014 and 2013, Abbott held $14.1 billion and $13.8 billion... -

Page 63

... impacted worldwide diagnostic sales. Worldwide sales for this business increased 6.4 percent in 2014 and 8.3 percent in 2013, excluding foreign exchange. In the Established Pharmaceutical Products segment, Abbott announced in July 2014 that it will sell its developed markets branded generics... -

Page 64

... primarily related to DES and other coronary products as well as lower DES market share in the U.S. Operating margins improved from 33.2 percent in 2012 to 36.5 percent in 2014 as cost improvement initiatives were executed across the business. Abbott's short- and long-term debt totaled $7.8 billion... -

Page 65

... plan assets. The discount rates used to measure liabilities were determined based on high-quality fixed income securities that match the duration of the expected retiree benefits. The health care cost trend rates represent Abbott's expected annual rates of change in the cost of health care benefits... -

Page 66

ABBOTT 2014 ANNUAL REPORT FINANCIAL REVIEW RESULTS OF OPERATIONS SALES The following table details the components of sales growth by reportable segment for the last three years: Total % Change Total Net Sales 2014 vs. 2013 2013 vs. 2012 Total U.S. 2014 vs. 2013 2013 vs. 2012 Total International ... -

Page 67

ABBOTT 2014 ANNUAL REPORT FINANCIAL REVIEW Excluding the unfavorable effect of exchange, total Established Pharmaceutical Products sales increased 14.9 percent in 2014 and 7.5 percent in 2013. The Established Pharmaceutical Products segment is focused on several key emerging markets including ... -

Page 68

.... Acquired intangible assets consist of developed technology and are being amortized over 16 years. In 2014, Abbott management approved plans to streamline operations in order to reduce costs and improve efficiencies in various Abbott businesses including nutritional and established pharmaceuticals... -

Page 69

... and prior years, Abbott management approved plans to realign its worldwide pharmaceutical and vascular manufacturing operations and selected domestic and international commercial and research and development operations in order to reduce costs. In 2013, Abbott recorded employee severance charges of... -

Page 70

... its employee stock compensation awards and separated its defined benefit programs for pensions and post-employment medical and dental benefit plans. See notes 9 and 13 for additional information. In July 2014, Abbott announced that it will sell its developed markets branded generics pharmaceuticals... -

Page 71

... Before Tax Developed markets generics pharmaceuticals and animal health businesses AbbVie Total Net Earnings Developed markets generics pharmaceuticals and animal health businesses AbbVie Total Year Ended December 31 2014 2013 2012 The specific requirements (e.g. scope of clinical trials) for... -

Page 72

... the first to market with a new branded generic for a particular pharmaceutical product, further geographic expansion of existing brands, new product enhancements, and strategic licensing activities. Abbott is also actively working on development plans for several key brands such as Creon, Duphaston... -

Page 73

...benefit for the retroactive impact of U.S. tax law changes, which is expected to be realized in future years. Trade accounts payable and other liabilities in Net cash from operating activities in 2012 includes the payment of approximately $1.5 billion related to a litigation accrual recorded in 2011... -

Page 74

... net sales. CAPITAL EXPENDITURES Capital expenditures of $1.1 billion in 2014 and 2013 and $1.8 billion in 2012 were principally for upgrading and expanding manufacturing and research and development facilities and equipment in various segments, investments in information technology, and laboratory... -

Page 75

... total shareholder return on its common shares with the Standard & Poor's 500 Index and the Standard & Poor's 500 Health Care Index. Abbott Laboratories S&P 500 Index S&P 500 Health Care $150 $100 $50 2009 2010 2011 2012 2013 2014 Assuming $100 invested on 12/31/09 with dividends reinvested. 73 -

Page 76

...Shareholders' investment Book value per share Other Statistics: Gross profit margin Research and development to net sales Net cash from operating activities Capital expenditures Cash dividends declared per common share (d) Common shares outstanding (in thousands) Number of common shareholders Market... -

Page 77

... of Medicine, New Haven, Conn. Miles D. White* Chairman of the Board and Chief Executive Officer Corlis D. Murray Senior Vice President, Quality Assurance, Regulatory and Engineering Services John F. Ginascol Vice President, Nutrition, Supply Chain Thomas C. Freyman* Executive Vice President... -

Page 78

... INFORM ATION FOR SHAREHOLDERS Abbott is an Illinois High Impact Business and is located in a U.S. federal Foreign Trade Sub-Zone (Sub-Zone 22F). Dividends may be eligible for a subtraction from base income for Illinois income tax purposes. If you have any questions, please contact your tax advisor... -

Page 79

-

Page 80

ABBOT T.COM