Aarons 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

aron’s delivered good news in 2009 — to our cus-

tomers, our shareholders, our associates, and many

others who contributed to the Company’s success.

We continued our strong operating performance in the most

challenging economic climate in decades. The Aaron’s model

is especially good news for those who enter our stores, as

we offer a broad selection of high-quality home furnishings

to the credit-constrained consumer, with affordable prices,

first rate service, and the flexibility of returning the mer-

chandise at any time with no further obligation. The key to

our success is outstanding execution of a tested and proven

winning strategy and a superior business model.

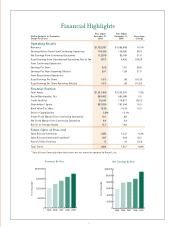

Company revenues in 2009 increased 10% compared to

the same period in 2008, and earnings from continuing

operations increased 32%. This is good news in any year, but

we feel it is an especially outstanding achievement in the

environment of 2009. Diluted earnings per share from con-

tinuing operations for the year were $2.07, a 31% increase

from the $1.58 recorded in 2008. Diluted earnings per share

after considering discontinued operations were up 24% to

$2.06 compared to $1.66 last year. At the end of the year,

almost 1.3 million consumers were customers of our Com-

pany-operated and franchised stores, an increase of 16%

over last year. The increase in customers resulted in record

revenues for the year of $1.753 billion. In addition, revenues

for our franchisees, which are not revenues of Aaron’s, Inc.,

increased 14% for the year to $759 million. Company-

operated stores achieved more than an 8% increase in same

store revenue growth in 2009, and our customer growth has

exceeded revenue growth over the past several years. Aaron’s

is clearly gaining market share, by attracting customers with

higher household incomes than it has historically. Employ-

ment trends are always a concern, but Aaron’s is succeeding

in some of the most difficult markets, posting same store

revenue growth in practically all states with double digit

unemployment levels.

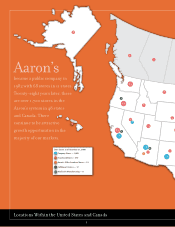

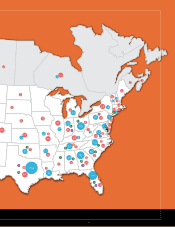

During the year, we opened 85 new Company-operated and

84 new franchised stores. At the end of 2009, there were

1,694 Aaron’s stores open (1,097 Company-operated and

597 franchised stores), an 8.8% increase over the system-

wide store count at the end of 2008. We expect to con-

tinue to expand our store base in 2010 with net growth in

the 5%–9% range with, for the most part, an equal mix of

Company-operated and franchised stores.

As in previous years, the franchise system grew during

the year, and we awarded area development agreements

to open 159 additional franchised stores. We ended 2009

with a pipeline of 269 awarded franchised stores which we

expect will open during the next few years. It is particularly

rewarding to note that again this year several prominent,

independent rent-to-own operators converted their stores

to Aaron’s franchised stores, and we welcome these new

franchisees to the Aaron’s family.

Financial strength is always good news, particularly so in the

current environment. The Company generated $193.7 mil-

lion in cash flow from operations in 2009, the highest level

in our history. We increased our dividend for the sixth year

in a row. At the end of 2009, cash on hand was $109.7 mil-

lion compared to $7.4 million at the end of 2008. We had no

borrowings under our revolving credit agreement and only a

relatively small amount of other debt.