Aarons 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In addition to selection, service and value, Aaron’s offers a

superior shopping experience. The typical Aaron’s store is 9,000

square feet, attractively merchandised in a leased endcap or

free-standing building. The Aaron’s store format has proven

successful in urban, suburban and rural markets. In many

cases, Aaron’s stores draw customers from more than 20 miles

away. The stores are open six days a week. In-house real estate

and marketing departments coordinate to develop signature

signage and store décor. Stores are remodeled on a regular

schedule. Approximately 50% of Company-operated stores are

more than five years old and, as a group, are still showing same

store revenue growth.

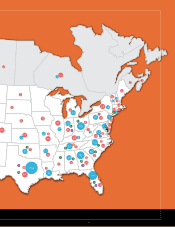

Last year was one of growth; growth in market share, customer

count, store base, revenues, earnings and most other metrics.

This growth is good news to communities as Aaron’s brings

needed jobs. Unlike many companies, Aaron’s added jobs in

2009, expanding the Company workforce by 4%. Net system-

wide store count increased 8.8% in 2009 as the Company

opened 85 new Company-operated stores and 84 franchised

stores. Weakness in the real estate market has afforded Aaron’s

the opportunity to secure attractive new store locations at

reduced prices. In addition, the Company has been able to

renew leases of existing stores on favorable terms.

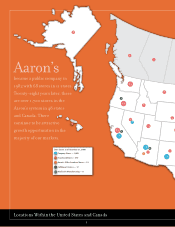

Aaron’s plans to increase net store count by 5% to 9% in 2010,

a combination of Company-operated and franchised stores. At

year-end 2009, Aaron’s had 1,071 Company-operated sales and

lease ownership stores, 590 franchised stores, 11 Company-

operated RIMCO stores, seven franchised RIMCO stores and 15

Aaron’s Office Furniture stores for a total of 1,694 stores.

The franchise system is a key strength of Aaron’s. The franchise

program, which was initiated in 1992, now numbers nearly

600 stores. Franchisees benefit from the Company’s market-

ing expertise, buying power and nationally-recognized brand.

Franchisees also participate in extensive in-house training

programs and benefit from the Company’s real estate exper-

tise. Franchisees pay an upfront fee and an ongoing royalty fee

based on a percentage of weekly revenues.

During 2009, the Company awarded area development agree-

ments to open 159 additional franchised stores. At the end of

December 2009, there were 269 franchise stores in the pipeline

that are expected to open in the next few years. Validating

the Company’s business model is the recent trend of small,

privately-held, rent-to-own operators becoming Aaron’s fran-

chisees and converting their stores to our lease ownership

model.

The franchise program has been an integral component of

Aaron’s growth and is a significant asset to our business model.

The program has facilitated the expansion and growth of the

Aaron’s brand, leveraging the growth of Company-operated

stores. Experienced and successful franchisees bring invaluable

management and business expertise to Aaron’s and continue

to be a key part of the Company’s expansion plans.

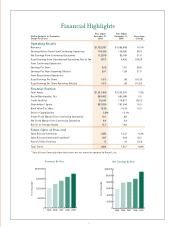

Aaron’s capital structure is also good news for shareholders.

At the end of 2009, the Company had more than $109 mil-

lion cash on hand, no outstanding debt under its $140 million

revolving credit facility, a relatively small amount of other

long-term debt, and the capability of self-funding capital

spending in 2010 and beyond. A new Aaron’s store normally

requires $600,000 to $700,000 of cash to operate in its first

year and typically reaches positive cash flow during its second

year of operation. Capital is required to cover operating losses

until monthly revenues sufficiently offset operating expenses.

Currently less than 20% of Company-operated stores are under

two years old, which bodes well for the Company’s financial

stability. Unlike many companies, Aaron’s has not cut cash

dividends in recent quarters but has increased the payout to

shareholders for six consecutive years.

Marketing expertise is good news for Aaron’s. The Company

has successfully built a national brand, a recognizable logo and

a strong, credible identity. The power of the Aaron’s brand has

been carefully developed and managed by a talented, internal

marketing team. Aaron’s has an active sports marketing cam-

paign, ranging from its sponsorship of the national champion

University of Alabama Crimson Tide football team, to its well-

established partnerships in NASCAR. The Aaron’s logo is highly

visible in collegiate stadiums, racetracks and arenas in major

markets throughout the U.S.

Aaron’s is perhaps best known for its long affiliation with

Michael Waltrip Racing. David Reutimann drives the Aaron’s

#00 Dream Machine in the NASCAR Sprint Cup Series races

reinforcing Aaron’s advertising offering customers a chance to

“Drive Dreams Home.” The Aaron’s Lucky Dog mascot is inte-