Aarons 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of contents

-

Page 1

Ready for some good news? Annual Report 2009 -

Page 2

Financial Highlights ...3 Letter to Shareholders ...4-5 Aaron's Good News ...6-13 Store Locations ...8-9 Financial Information...14-41 Common Stock Market Prices and Dividends ...42 Board of Directors and Officers ...43 Corporate and Shareholder Information ...44 -

Page 3

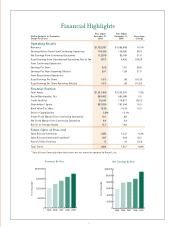

The Good News From Aaron's: Delivering satisfaction to 1.3 million customers $1.753 billion in revenues 24% increase in earnings per share -

Page 4

...the sale and lease ownership and specialty retailing of residential and office furniture, consumer electronics, home appliances and accessories in over 1,700 company-operated and franchised stores in the United states and canada. The company's major operations are the Aaron's sales & Lease ownership... -

Page 5

... Shareholders' Equity Book Value Per Share Debt to Capitalization Pretax Profit Margin From Continuing Operations Net Profit Margin From Continuing Operations Return on Average Equity Stores Open at Year-end Sales & Lease Ownership Sales & Lease Ownership Franchised* Aaron's Office Furniture... -

Page 6

... will open during the next few years. It is particularly rewarding to note that again this year several prominent, independent rent-to-own operators converted their stores to Aaron's franchised stores, and we welcome these new franchisees to the Aaron's family. Financial strength is always good news... -

Page 7

...that time, the sales and lease ownership business has been the engine of corporate growth. In 2008, the Company sold substantially all of the assets of its legacy business, then known as the Aaron's Corporate Furnishings division. The new name, Aaron's, Inc., aligns the corporate name with our store... -

Page 8

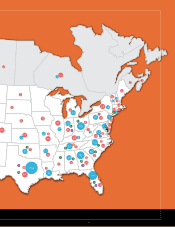

... centers provide merchandise repair service. Market share Growth is Good News in a Difficult Economy. At year-end, the Company had 829,000 corporate customers and 451,000 franchised customers, a 16% increase in total customers over the number at the end of 2008. Our target customer base, households... -

Page 9

... that "an increasing number of consumers with annual household incomes of $60,000 to $80,000 are choosing to lease instead of using cash to pay for the entire cost of televisions and bedroom sets" in order to conserve liquidity. He also noted the potential to add another 1,000 stores in the United... -

Page 10

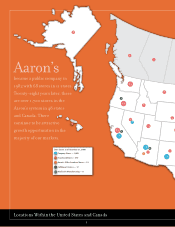

... Twenty-eight years later, there are over 1,700 stores in the Aaron's system in 48 states continue to be attractive growth opportunities in the majority of our markets. Store Count as of December 31, 2009 Company Stores - 1,082 Franchised Stores - 597 Aaron's Office Furniture Stores - 15 Fulfillment... -

Page 11

2 5 12 1 5 8 6 1 1 1 12 28 18 13 5 15 9 3 1 5 15 27 17 12 13 18 1 25 13 12 2 1 47 6 8 29 1 86 28 4 4 1 38 22 29 20 1 15 1 11 5 11 7 2 29 1 20 1 64 45 1 3 2 1 23 1 31 7 51 1 3 1 1 34 1 2 86 2 2 18 6 1 2 4 40 164 101 1 3 1 19 9 -

Page 12

... news to communities as Aaron's brings needed jobs. Unlike many companies, Aaron's added jobs in 2009, expanding the Company workforce by 4%. Net systemwide store count increased 8.8% in 2009 as the Company opened 85 new Company-operated stores and 84 franchised stores. Weakness in the real estate... -

Page 13

...in television advertising. several business journalists noted that Aaron's has bucked the trend of corporate dividend cuts and declining payout ratios and has raised the quarterly cash dividend each year since 2004. Aaron's was cited by U.s. News & World Report as one of a select group of retailers... -

Page 14

.... our NAscAR race sponsorships generate an estimated $80+ million in value of in-broadcast exposure during the race season and our Lucky Dog mascot is a valuable asset at trackside, at store openings and promotional events and in our advertising. David Reutimann, driver of the Aaron's Dream Machine... -

Page 15

... improve. The RIMCO stores, the custom wheels and tires business, have also failed to meet expectations; however, some recent improvements should bode well for stronger future results. The Good News continues Aaron's management team is the best in the business. Most key executives have been with... -

Page 16

...,758 185,622 29,781 7,248 1,032,303 Financial Position Lease Merchandise, Net Property, Plant and Equipment, Net Total Assets Debt Shareholders' Equity At Year End Stores Open: Company-Operated Franchised Lease Agreements in Effect Number of Employees 1,097 597 1,171,000 10,000 1,053 504 1,017,000... -

Page 17

..., which we believe represents a higher unit revenue volume than the typical rent-to-own store. Most of our stores are cash flow positive in the second year of operations following their opening. We also use our franchise program to help us expand our sales and lease ownership concept more quickly... -

Page 18

...rent agreement, to 0% salvage value. Sales and lease ownership merchandise is generally depreciated at a faster rate than our office furniture merchandise. Our policies require weekly lease merchandise counts by store managers and write-offs for unsalable, damaged, or missing merchandise inventories... -

Page 19

... in non-retail sales (which mainly represents merchandise sold to our franchisees), to $328.0 million in 2009 from $309.3 million in 2008, was due to the growth of our franchise operations and our distribution network. The total number of franchised sales and lease ownership stores at December... -

Page 20

...lease ownership stores added over the past several years, contributing to an 8.1% increase in same store revenues, and a 17.6% increase in franchise royalties and fees. Discontinued Operations Loss from discontinued operations (which represents the loss from the former Aaron's Corporate Furnishings... -

Page 21

... in non-retail sales (which mainly represents merchandise sold to our franchisees), to $309.3 million in 2008 from $261.6 million in 2007, was due to the growth of our franchise operations and our distribution network. The total number of franchised sales and lease ownership stores at December... -

Page 22

... revenue growth of new and existing company-operated stores, partially offset by lower product costs. PROPERTY, PLANT AND EQUIPMENT. The increase of $3.2 million in Liquidity and capital Resources General Cash flows from continuing operations for the year ended December 31, 2009 and 2008 were... -

Page 23

...expect to continue our policy of paying dividends. If we achieve our expected level of growth in our operations, we anticipate we will supplement our expected cash flows from operations, existing credit facilities, vendor credit and proceeds from the sale of lease return merchandise by expanding our... -

Page 24

... qualify and are accounted for as operating leases. We do not have any retained or contingent interests in the stores nor do we provide any guarantees, other than a corporate level guarantee of lease payments, in connection with the sale-leasebacks. The operating leases that resulted from these... -

Page 25

... by our vendors within short time horizons. We do not have significant agreements for the purchase of lease merchandise or other goods specifying minimum quantities or set prices that exceed our expected requirements for three months. Deferred income tax liabilities as of December 31, 2009 were... -

Page 26

... & Shareholders' Equity: Accounts Payable and Accrued Expenses Dividends Payable Deferred Income Taxes Payable Customer Deposits and Advance Payments Credit Facilities Total Liabilities Shareholders' Equity: Common Stock, Par Value $.50 Per Share; Authorized: 100,000,000 Shares; Shares Issued... -

Page 27

consolidated statements of Earnings (In Thousands, Except Per Share) Year Ended December 31, 2009 Year Ended December 31, 2008 Year Ended December 31, 2007 Revenues: Lease Revenues and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Other $1,310,709 43,394 327,999 52,941 17,744 1,... -

Page 28

... Exchange of Common Stock for Class A Common Stock Reissued Shares Net Earnings From Continuing Operations Loss From Discontinued Operations Foreign Currency Translation Adjustment Comprehensive Income Balance, December 31, 2009 The accompanying notes are an integral part of the Consolidated... -

Page 29

... Value of Lease Merchandise Sold or Disposed Change in Deferred Income Taxes Loss (Gain) on Sale of Property, Plant, and Equipment Gain on Asset Dispositions Change in Income Tax Receivable Change in Accounts Payable and Accrued Expenses Change in Accounts Receivable Excess Tax Benefits from Stock... -

Page 30

... office furniture stores depreciate merchandise over the lease ownership agreement period, generally 12 to 24 months when leased, and 60 months when not leased, or when on a rent-to-rent agreement, to 0% salvage value. The Company's policies require weekly lease merchandise counts by store managers... -

Page 31

... using discounted expected future cash flows, market values or replacement values for similar assets. The amount by which the carrying value exceeds the fair value of the asset is recognized as an impairment loss. The Company performed an impairment analysis on the Aaron's Office Furniture long... -

Page 32

... of the projected claims run off for both reported and incurred but not reported claims. COMPREHENSIVE INCOME - For the years ended December 31, Land Buildings and Improvements Leasehold Improvements and Signs Fixtures and Equipment Assets Under Capital Leases: with Related Parties with Unrelated... -

Page 33

... accounted for as operating leases. The Company does not have any retained or contingent interests in the stores nor does the Company provide any guarantees, other than a corporate level guarantee of lease payments, in connection with the saleleasebacks. OTHER DEBT - Other debt at December 31, 2009... -

Page 34

... of business. Future minimum lease payments required under operating leases that have initial or remaining non-cancelable terms in excess of one year as of December 31, 2009, are as follows: 2.8 (1.8) 36.0% 3.1 .4 38.5% 2.6 .0 37.6% The Company files a federal consolidated income tax return in... -

Page 35

...does management expect to incur any, significant losses under these guarantees. Rental expense was $88.1 million in 2009, $81.8 million in 2008, and $70.8 million in 2007. At December 31, 2009, the Company had non-cancelable commitments primarily related to certain advertising and marketing programs... -

Page 36

... the time of grant. No assumption for a future dividend rate increase has been included unless there is an approved plan to increase the dividend in the near term. Shares are issued from the Company's treasury shares upon share option exercises. The results of operations for the year ended December... -

Page 37

... of the Company's obligations are deferred. Substantially all of the amounts reported as non-retail sales and non-retail cost of sales in the accompanying consolidated statements of earnings relate to the sale of lease merchandise to franchisees. Franchise agreement fee revenue was $3.8 million... -

Page 38

... sold its corporate furnishings division. The sales and lease ownership division offers electronics, residential furniture, appliances and computers to consumers primarily on a monthly payment basis with no credit requirements. The Company's franchise operation sells and supports franchisees of... -

Page 39

... operations are as follows: Year Ended December 31, 2009 Year Ended December 31, 2008 Year Ended December 31, 2007 (In Thousands) Revenues From External Customers: Sales and Lease Ownership Franchise Other Manufacturing Revenues of Reportable Segments Elimination of Intersegment Revenues Cash... -

Page 40

...,000 for team decals, apparel and driver travel to corporate promotional events. The sponsorship agreement expired at the end of the year and was not renewed. Motor sports promotions and sponsorships are an integral part of the Company's marketing programs. In the second quarter of 2009, the Company... -

Page 41

... on lease at closing as compared to certain benchmark ranges set forth in the purchase agreement. The assets transferred include all of the Aaron's Corporate Furnishings division's lease contracts with customers and certain other contracts, certain inventory and accounts receivable and store leases... -

Page 42

...of their operations and their cash flows for each of the three years in the period ended December 31, 2009, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Aaron... -

Page 43

... Accounting Oversight Board (United States), the consolidated balance sheets of Aaron's, Inc. as of December 31, 2009 and 2008, and the related consolidated statements of earnings, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2009. Our report... -

Page 44

... last five fiscal years of the Company, the yearly percentage change in the cumulative total shareholder returns (assuming reinvestment of dividends) on the Company's Common Stock with that of the S&P SmallCap 600 Index and a Peer Group. For 2009, the Peer Group consisted of Rent-A-Center, Inc. The... -

Page 45

... Vice President, Merchandising and Logistics Aaron's Office Furniture Division Ronald M. Benedit Vice President, Operations John A. Allevato Vice President, Divisional Analyst for RIMCO Operations Christy E. Cross Vice President, Sales (1) Member of Audit Committee (2) Member of Compensation... -

Page 46

... Item 1A of the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission. General Counsel Kilpatrick Stockton LLP Atlanta, Georgia Aaron's Canada, ULC 309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 Form 10-K Shareholders may obtain a copy of... -

Page 47

-

Page 48

309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 www.aaronsinc.com www.shopaarons.com