Aarons 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

million in 2002, reflecting the net addition of 78 franchised

stores since the beginning of 2002 and improved operating

revenues at older franchised stores.

Cost of Sales

The 5.5% decrease in retail cost of sales is primarily a

result of a decrease in sales in our rent-to-rent division,

where sales decreased $3.9 million to $25.2 million in 2003

from $29.1 million in 2002, a 13.4% decline. This decrease

was primarily due to the decline in same store revenues and

to closing or merging under-performing stores. This decrease

is partially offset by a $1.0 million increase to $25.7 million

in 2003 from $24.7 million in 2002, representing a 3.9%

increase, in our sales and lease ownership division driven by

the increases in same store revenues and additional store

openings described above. Retail cost of sales as a percentage

of retail sales remained comparable between 2003 and 2002.

Cost of sales from non-retail sales increased 35.6%,

primarily due to the growth of our franchise operations as

described above, corresponding to the similar increase in

non-retail sales. As a percentage of non-retail sales, non-retail

cost of sales increased slightly to 92.8% in 2003 as compared

to 92.6% in 2002, primarily due to changes in product mix.

Expenses

The 17.6% increase in 2003 operating expenses was driven

by the growth of our sales and lease ownership division

described above. As a percentage of total revenues, operating

expenses improved to 45.0% for 2003 from 45.8% for 2002,

with the decrease driven by the maturing of new Company-

operated sales and lease ownership stores added over the past

several years and a 10.1% increase in same store revenues.

The 20.3% increase in depreciation of rental merchandise

was driven by the growth of our sales and lease ownership

division described above. As a percentage of total rentals and

fees, depreciation of rental merchandise decreased slightly to

35.3% in 2003 from 35.4% in 2002. The decrease as a per-

centage of rentals and fees reflects an improvement in rental

margins, partially offset by increased depreciation expense as

a result of a larger number of short-term leases in 2003.

The increase in interest expense as a percentage of total

revenues was primarily due to a higher long-term average

debt balance during 2003 arising from the Company’s

August 2002 private debt placement.

The 32.1% increase in income tax expense between years

was driven primarily by a comparable increase in pretax

income, offset by a slightly lower effective tax rate of 37.0%

in 2003 compared to 37.1% in 2002.

Net Earnings

The 32.7% increase in net earnings was primarily due

to the maturing of new Company-operated sales and lease

ownership stores added over the past several years; a 10.1%

increase in same store revenues; and a 16.5% increase in

franchise fees, royalty income, and other related franchise

income. As a percentage of total revenues, net earnings

improved to 4.8% in 2003 from 4.3% in 2002.

Balance Sheet

Cash. In prior balance sheet and statement of cash

flow presentations, checks outstanding were classified as a

reduction to cash. Since the financial institutions with checks

outstanding and those with deposits on hand did not and do

not have legal right of offset, we have reclassified checks out-

standing in certain zero balance bank accounts to accounts

payable at December 31, 2004 and for all consolidated

balance sheets and consolidated statements of cash flows

presented. This reclassification has the effect of increasing

both cash and accounts payable and accrued expenses by

$4.6 million, $3.8 million, and $6.7 million for the years

ended December 31, 2003, 2002, and 2001, respectively.

Rental Merchandise. The increase of $82.6 million in

rental merchandise, net of accumulated depreciation, to

$425.6 million from $343.0 million at December 31, 2004

and 2003, respectively, is primarily the result of a net

increase of 116 Company-operated sales and lease ownership

stores and two fulfillment centers since December 31, 2003.

Prepaid Expenses and Other Assets. The increase of

$23.9 million in prepaid expenses and other assets to

$50.1 million from $26.2 million at December 31, 2004

and 2003, respectively, is primarily the result of recording

an income tax receivable of $20.0 million, in connection with

calculating the Company’s 2004 provision for income taxes.

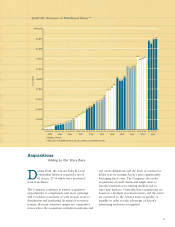

Goodwill and Other Intangibles. The increase of $19.4

million to $74.9 million from $55.5 million on December 31,

2004 and 2003, respectively, is the result of a series of acqui-

sitions of sales and lease ownership businesses, net

of amortization of certain finite-life intangible assets. The

aggregate purchase price for these asset acquisitions in

2004 totaled approximately $38.5 million, and the principal

tangible assets acquired consisted of rental merchandise

and certain fixtures and equipment.

Deferred Income Taxes Payable. The increase of $39.9

million in deferred income taxes payable at December 31,

2004 from December 31, 2003 is primarily the result of

March 2002 tax law changes, effective September 2001,

that allowed additional accelerated depreciation of rental

merchandise for tax purposes. Additional tax law changes

effective May 2003 increased the allowable acceleration and

extended the life of the March 2002 changes to December

31, 2004.

Credit Facilities. The $37.1 million increase in the

amounts we owe under our credit facilities to $116.7

million from $79.6 million on December 31, 2004 and 2003,

respectively, reflects net borrowings under our revolving

credit facility during 2004, primarily to fund purchases of

rental merchandise, acquisitions, and working capital. Also

contributing to the increase is a new capital lease with a

related party with an outstanding balance of $6.7 million

as of December 31, 2004.

Liquidity and Capital Resources

General

Cash flows from operating activities for the years ended

December 31, 2004 and 2003 were $34.7 million and

$68.5 million, respectively. Our cash flows include profits on

the sale of rental return merchandise. Our primary capital

requirements consist of buying rental merchandise for both

Company-operated sales and lease ownership and rent-to-

rent stores. In 2005, we anticipate that we will make cash

payments for income taxes approximating $58 million. As

Aaron Rents continues to grow, the need for additional rental

merchandise will continue to be our major capital require-

ment. These capital requirements historically have been

financed through:

• cash flow from operations

• bank credit

• trade credit with vendors