Aarons 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004

Table of contents

-

Page 1

Annual Report 2004 -

Page 2

... office furniture, household appliances, computers and accessories with over 1,050 Company-operated and franchised stores in the United States, Puerto Rico and Canada. The Company's major operations are the Aaron's Sales & Lease Ownership Division, the Rent-to-Rent Division and MacTavish Furniture... -

Page 3

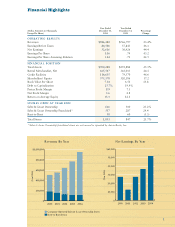

...25.1% 24.1 46.6 17.2 15.8 Sales & Lease Ownership Sales & Lease Ownership Franchised* Rent-to-Rent Total Stores 616 357 58 1,031 500 287 60 847 23.2% 24.4 (3.3) 21.7% * Sales & Lease Ownership franchised stores are not owned or operated by Aaron Rents, Inc. Revenues By Year $1,000,000 $60,000... -

Page 4

... added a net of 186 Aaron's Sales & Lease Ownership stores to our system including 70 new franchised stores, an overall increase in store count of 24%. At the end of 2004, we had 1,031 Company-operated and franchised stores open in 45 states, Puerto Rico, and Canada, including 58 stores in the rent... -

Page 5

... capacity as manager for our furniture manufacturing plants, was promoted to Vice President, Manufacturing. We are proud of the career opportunities with Aaron Rents, and it is gratifying to recognize and promote talented employees who have contributed to the Company's success for a number of years... -

Page 6

4 -

Page 7

... carry price, lease payment and total cost under the lease ownership plan. Payment options include cash, check and credit cards. The lease-to-own plan requires no long-term obligation so a customer is free to return merchandise at any time without additional financial responsibility. Aaron's Sales... -

Page 8

... public address and scoreboard video announcements, premium give-away opportunities and one promotional night in each of the AFL's 19 team markets. The AFL will be featured in over 800 Aaron's stores with in-store marketing materials and direct-mail circulars. This AFL partnership includes logo... -

Page 9

... 2004 Electronics and Appliances 52% Furniture 35% Computers 12% Franchised Sales & Lease Ownership Stores Company-Operated Sales & Lease Ownership Stores Rent-to-Rent Stores Franchise Operations A Growth Multiplier T he Aaron's Sales & Lease Ownership franchise program set new records in 2004... -

Page 10

... The Aaron's Franchise Association and the Aaron's Management Team, comprised of both franchise principals and representatives of the Company, provide opportunities for communication and cross-fertilization. Aaron's leadership in franchising is confirmed through annual surveys of franchise programs... -

Page 11

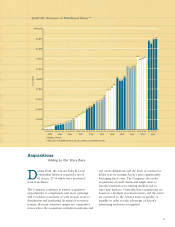

... 2003 2004 *Number of stores **Revenues of franchised stores are not revenues of Aaron Rents, Inc. Acquisitions Adding to Our Store Base D uring 2004, the Aaron's Sales & Lease Ownership Division acquired a net of 61 stores, 17 of which were purchased from franchisees. The Company continues... -

Page 12

... revenues. To the corporate market, Aaron's is the "Source for Workplace Solutions," offering free in-office consultation and short-term or special event rentals. Customers can expect next-day delivery on a broad range of office furnishings, including panel systems, and have the option of purchasing... -

Page 13

... greats Warrick Dunn and Kurt Warner make the down payments on new houses and work with local organizations to equip and furnish the homes. Aaron's Sales & Lease Ownership has provided all of the furniture for homes in Atlanta, Tampa and Baton Rouge. In 2004, ACORP was proud to again partner... -

Page 14

...,265 280,545 $258,932 77,282 403,881 77,713 219,967 $267,713 63,174 387,657 104,769 208,538 Stores Open: Company-Operated Franchised Rental Agreements in Effect Number of Employees 674 357 582,000 6,400 560 287 464,800 5,400 482 232 369,000 4,800 439 209 314,600 4,200 361 193 281... -

Page 15

...of the term. Retail sales represents sales of both new and rental return merchandise from our sales and lease ownership and rent-to-rent stores. Non-retail sales mainly represents merchandise sales to our franchisees from our sales and lease ownership division. Other revenues includes franchise fees... -

Page 16

... at December 31, 2004. Insurance Programs Aaron Rents maintains insurance contracts to fund workers compensation and group health insurance claims. Using actuarial analysis and projections, we estimate the liabilities associated with open and incurred but not reported workers compensation claims... -

Page 17

... new Company-operated sales and lease ownership stores added over the past several years and an 11.6% increase in same store revenues. As explained in our discussion of critical accounting policies above, effective September 30, 2004, we began recording rental merchandise carrying value adjustments... -

Page 18

...-term lease, which replaced many retail sales. The 35.3% increase in non-retail sales in 2003 reflects the significant growth of our franchise operations. The 20.4% increase in other revenues was primarily attributable to franchise fees, royalty income, and other related revenues from our franchise... -

Page 19

..., respectively. Our cash flows include profits on the sale of rental return merchandise. Our primary capital requirements consist of buying rental merchandise for both Company-operated sales and lease ownership and rent-torent stores. In 2005, we anticipate that we will make cash payments for income... -

Page 20

... liability companies ("LLCs") whose owners include certain Aaron Rents' executive officers and controlling shareholder. Eleven of these related party leases relate to properties purchased from Aaron Rents in October and November 2004 by one of the LLCs for a total purchase price of approximately... -

Page 21

...Within the next 12 months, we anticipate that we will make cash payments for income taxes approximating $58 million. Market Risk We manage our exposure to changes in short-term interest rates, particularly to reduce the impact on our variable payment construction and lease facility and floatingrate... -

Page 22

... in this report and other filings with the Securities and Exchange Commission. All statements which address operating performance, events, or developments that we expect or anticipate will occur in the future - including growth in store openings, franchises awarded, and market share, and statements... -

Page 23

...$559,884 Accounts Payable & Accrued Expenses Dividends Payable Deferred Income Taxes Payable Customer Deposits & Advance Payments Credit Facilities Total Liabilities Commitments & Contingencies Shareholders' Equity Common Stock, Par Value $.50 Per Share; Authorized: 50,000,000 Shares; Shares Issued... -

Page 24

... Other Comprehensive Income (Loss) Derivatives Designated Marketable As Hedges Securities (In Thousands, Except Per Share) BALANCE, DECEMBER 31, 2001 Reacquired Shares Stock Offering Dividends, $.018 per share Reissued Shares Net Earnings Change in Fair Value of Financial Instruments, Net of... -

Page 25

... Deferred Income Taxes Gain on Marketable Securities Loss (Gain) on Sale of Property, Plant & Equipment Change in Income Taxes Receivable, Included in Prepaid Expenses and Other Assets Change in Accounts Payable & Accrued Expenses Change in Accounts Receivable Other Changes, Net Cash Provided... -

Page 26

... selling residential and office furniture, consumer electronics, appliances, computers, and other merchandise throughout the U.S., Puerto Rico, and Canada. The Company manufactures furniture principally for its rent-to-rent and sales and lease ownership operations. Cash - In prior balance sheet and... -

Page 27

... prior to the month due are recorded as deferred rental revenue. Until all payments are received under sales and lease ownership agreements, the Company maintains ownership of the rental merchandise. Revenues from the sale of merchandise to franchisees are recognized at the time of receipt by... -

Page 28

... - From time to time, the Company closes under-performing stores. The charges related to the closing of these stores primarily consist of reserving the net present value of future minimum payments under the stores' real estate leases. As of both December 31, 2004 and 2003, accounts payable and... -

Page 29

... is a summary of the Company's property, plant, and equipment at December 31: (In Thousands) 2004 2003 Land Buildings & Improvements Leasehold Improvements & Signs Fixtures & Equipment Assets Under Capital Lease: With Related Parties With Unrelated Parties Construction in Progress Less: Accumulated... -

Page 30

...Capital Leases with Related Parties - In October and November 2004 the Company sold 11 properties, including leasehold improvements, to a separate limited liability corporation ("LLC") controlled by a group of Company executives and managers, including the Company's chairman, chief executive officer... -

Page 31

... guarantees. Rental expense was $50.1 million in 2004, $44.1 million in 2003, and $39.0 million in 2002. The Company maintains a 401(k) savings plan for all full-time employees with at least one year of service with the Company and who meet certain eligibility requirements. The plan allows employees... -

Page 32

.... Deferred franchise and area development agreement fees, included in customer deposits and advance payments in the accompanying consolidated balance sheets, approximated $4.8 million and $3.8 million as of December 31, 2004 and 2003, respectively. Franchised Aaron's Sales & Lease Ownership store... -

Page 33

... a monthly payment basis with no credit requirements. The rent-to-rent division rents and sells residential and office furniture to businesses and consumers who meet certain minimum credit requirements. The Company's franchise operation sells and supports franchises of its sales and lease ownership... -

Page 34

... units that service different customer profiles using distinct payment arrangements. The reportable segments are each managed separately because of differences in both customer base and infrastructure. Revenues From External Customers: Sales & Lease Ownership $804,723 Rent-to-Rent 108,453 Franchise... -

Page 35

... over financial reporting as of December 31, 2004. In making this assessment, the Company's management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control - Integrated Framework. Based on our assessment, management believes... -

Page 36

... thereon. Atlanta, Georgia March 7, 2005 Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting The Board of Directors and Shareholders of Aaron Rents, Inc. We have audited management's assessment, included in the accompanying Management Report on... -

Page 37

...," respectively. The number of shareholders of record of the Company's Common Stock and Class A Common Stock at February 25, 2005 was 281. The closing prices for the Common Stock and Class A Common Stock at February 25, 2005 were $20.32 and $18.50, respectively. Cash Dividends Per Share Subject to... -

Page 38

Store Locations in the United States, Puerto Rico, and Canada AT D E C E M B E R 3 1 , 2 0 0 4 Company-Operated Sales & Lease Ownership 616 Franchised Sales & Lease Ownership 357 Rent-to-Rent 58 Total Stores 1,031 Manufacturing & Fulfillment Centers 23 36 -

Page 39

... Rents, Inc. Corporate and Shareholder Information Corporate Headquarters 309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 http://www.aaronrents.com Subsidiaries Aaron Investment Company 4005 Kennett Pike Greenville, Delaware 19807 (302) 888-2351 Aaron Rents, Inc. Puerto Rico... -

Page 40

309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 www.aaronrents.com