Aarons 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

Aaron’s Sales & Lease Ownership has created a

winning concept that drives the record-breaking growth of

this division. Aaron’s simply makes shopping and ownership

of merchandise fast, easy and convenient with a low-price guarantee and top brand-named products.

There’s nothing like it in the marketplace today.

It is a new kind of specialty retailing with lease options, bridging the gap between the older form of rent-to-

own and the traditional approach to credit retailing by the home furnishings industry. Aaron’s is reaching the

broader market composed of lease ownership, credit retail and rental customers.

Aaron’s successfully targets the higher end of this market, which is demonstrated by the fact that approxi-

mately 40 percent of our customers pay by either check or credit card, unlike typical rent-to-own customers.

Aaron’s also has set a standard of monthly payments for lease ownership, a substantial difference versus the

weekly payment system of the rent-to-own industry. As a result, Aaron’s gains higher end accounts and at the

same time reduces the expenses of processing them.

The new concept developed by Aaron’s is now filling a huge void created by the demise of several major

credit furniture retailers, which in the past two years closed approximately 2,000 stores with an estimated

$3.5 billion in annual sales volume. That is the market served by Aaron’s, and to seize such an unprecedented

opportunity, the Company acquired more than 80 store locations from one of the industry’s formerly largest credit

retailers. Most of these locations have been converted into Aaron’s stores and have come on line within the past

year, dramatically expanding our ability to increase market share quickly and add to the Company’s profitability.

Aaron’s customers start with automatic approval, as no credit is needed since the transaction is on a lease-to-

own plan. Yet it requires no long-term obligation, allowing the customer to return the merchandise at any time.

Delivery is the same day of the order or the next day. There is no delivery charge, no application fee and no

balloon payment. Terms are fully disclosed: cash and carry price, monthly payment and total cost under the

lease ownership plan. The payment options include cash, check or credit card.

Aaron’s stores are larger with more appealing designs, usually located in suburban areas with generally higher

income level customers than the traditional rent-to-own business attracts. The size of Aaron’s stores, averaging

9,000 square feet, is three times that of a typical competitor’s store. This provides our customers a far wider

selection of top brand named products as well as the stylish proprietary furniture lines manufactured by

MacTavish Furniture Industries.

The result is strong acceptance by customers each time a new store opens, regardless of whether it is located

in a large city or a smaller one. Demonstrating the immediate popularity of Aaron’s in new markets and the

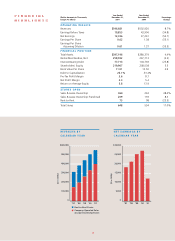

dominance of its concept is the 21% increase in revenues for the Aaron’s Sales & Lease Ownership division in

2001, an exceptional performance in the retailing industry. Same-store revenues increased 7.7% for the year in

the division.

AARON’S SALES & LEASE OWNERSHIP:

A WINNING CONCEPT

WINNING