Aarons 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

VISION

Our Company achieved the greatest expansion in its

history in 2001.

During the year a record 117 additional Aaron’s Sales

& Lease Ownership stores came on line, reflecting the strength

of this division. Our year-end total store count was 648 stores,

with an increase of 26% in sales and lease ownership stores for the year.

This positions our Company to make substantial gains in market share and to

increase profitability as new stores mature throughout 2002 and 2003.

Our revenues likewise reached a record high as demand was strong for sales

and lease ownership products and services despite the tragic events of Sept. 11

and the recession that began earlier in the year.

The credit goes to our 4,200 Aaron Associates. They energized our strategic

plan, seized unprecedented opportunities and focused on our mission of pro-

viding high quality products and services to our market, a large sector of

the population.

GROWTH

The stage was set for record expansion with our decision in late 2000

to acquire a large number of store locations formerly operated by one of the

nation’s leading furniture retailers. By early July of last year we had obtained

82 locations in the most desirable market areas matching our customer base;

and by year-end 2001 we had opened Aaron’s stores in 75 of those locations.

Had we not taken advantage of this unusual opportunity, it would have

required several years longer to reach the current level of stores open.

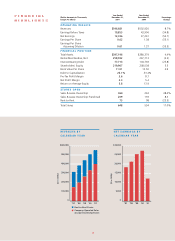

For the year, our consolidated revenues increased 9% to $546.7 million

compared to $502.9 million for 2000. Systemwide revenues, including franchised

stores, advanced 12% to $735.4 million. Earnings were $12.3 million or $.61

per diluted share, reflecting the start-up of our record expansion in stores and

the effects of the recession on the rent-to-rent division.

Such growth entails substantial costs. Start-up expenses during the year

related to the opening of the record number of stores reduced pre-tax earnings

by approximately $14 million or $.42 per diluted share. In addition, it was

necessary to consolidate and streamline the rent-to-rent division, which

experienced a decline in business due to the economic downturn, resulting

TO OUR SHAREHOLDERS: