Aarons 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

309 E. Paces Ferry Rd., N.E.

Atlanta, Georgia 30305-2377

(404) 231-0011

www.aaronrents.com

Table of contents

-

Page 1

309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 www.aaronrents.com -

Page 2

2001 Annual Report -

Page 3

... furniture, consumer electronics, household appliances and accessories, with 648 stores in 43 states and Puerto Rico. The Company is positioned as "America's Premier Name in Furniture Rental and Lease Ownership." Its major operations are the Aaron's Sales & Lease Ownership division, the Rent-to-Rent... -

Page 4

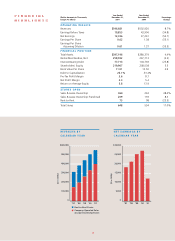

...4.9 Total Assets Rental Merchandise, Net Interest-Bearing Debt Shareholders' Equity Book Value Per Share Debt to Capitalization Pre-Tax Profit Margin Net Profit Margin Return on Average Equity STORES OPEN Sales & Lease Ownership Sales & Lease Ownership Franchised Rent-to-Rent Total Stores 364 209... -

Page 5

... lease ownership stores for the year. This positions our Company to make substantial gains in market share and to increase profitability as new stores mature throughout 2002 and 2003. Our revenues likewise reached a record high as demand was strong for sales and lease ownership products and services... -

Page 6

... $47 million at cost in furniture for our increasing number of stores. Construction began on expansion of our large manufacturing facility in Cairo, Georgia, adding 100,000 square feet to almost double its capacity. Our seventh regional distribution center was opened in North Carolina, enhancing our... -

Page 7

..., capitalizing on our much larger store base and the proven Aaron's concept of superior service and very competitive pricing. We will constantly work to improve the products and services for our customers. And we will grow Aaron's into the premier, market-dominant company in our industry, recognized... -

Page 8

...cash and carry price, monthly payment and total cost under the lease ownership plan. The payment options include cash, check or credit card. Aaron's stores are larger with more appealing designs, usually located in suburban areas with generally higher income level customers than the traditional rent... -

Page 9

..., leather upholstery and leading brands of washers and dryers as well as professionally designed and coordinated furniture suites produced by the Company's own manufacturing division and top national manufacturers. The marketing program is built around the "Drive Dreams Home" sponsorship of NASCAR... -

Page 10

...SALES & LEASE OWNERSHIP R E N TA L R E V E N U E S $600,000 573* Other 1% 500,000 456* 400,000 ($ in 000s) 368* 300,000 318* 200,000 282* 100,000 Electronics and Appliances 55% 0 '97 '98 '99 '00 '01 Furniture 37% Computers 7% Franchise Revenues Company-Operated Revenues *Number of Stores... -

Page 11

...from the Company's nationwide volume purchasing plan, which reduces the cost of products and provides advantages in competitive pricing to customers. The Aaron's support program for franchise principals includes the full range of services needed, from start-up to ongoing profitable operations. First... -

Page 12

...franchise fees, and the Company's proprietary products and services. In addition, Aaron's is judged on the performance and strength of its management, the relationship with franchise owners, and the opportunities available for the growth of franchised stores... 1999 2000 2001 9 * Number of Stores -

Page 13

...to generate cash flow indispensable to the Company's growth. Known for the high quality of its products and services, the division accounts for a significant portion of the temporary furniture rental market in the United States and ranks as the second largest business in the industry. Aaron provides... -

Page 14

... Humanity home in Fort Worth, Texas, the fifth house constructed by Aaron's volunteers since they began participating in this program to help provide affordable housing to people in need. Aaron's Associates also donated store products in the form of a housewarming gift to the new home's owners. In... -

Page 15

...part of the production and supply chain for Aaron's stores. The Company's seventh regional distribution center was completed in Winston-Salem, North Carolina, another link in the national network. Most Aaron's stores are now within a 250-mile radius of a distribution center, assuring timely shipment... -

Page 16

... Stores Open: Company-Operated Franchised Rental Agreements in Effect Number of Employees 1 439 209 314,600 4,200 361 193 281,000 3,900 320 155 254,000 3,600 291 136 227,400 3,400 292 101 219,800 3,100 Systemwide revenues include revenues of franchised Aaron's Sales & Lease Ownership stores... -

Page 17

... costs of sales and lease ownership locations formerly operated by one of the nation's largest furniture retailers along with other new store openings. In addition, the Company recorded non-cash charges of $5.6 million related to the future real estate lease obligations of closed rent-to-rent stores... -

Page 18

... profits on the sale of rental return merchandise. In 2001, the Company extended its payment terms with vendors as a source of additional cash flows. The Company's primary capital requirements consist of acquiring rental merchandise for both rent-to-rent and Company-operated Aaron's Sales & Lease... -

Page 19

...'s current estimates and within policy stop loss limits, the Company will be required to pay additional amounts beyond those accrued at December 31, 2001. Additionally, if the actual group health insurance liability develops in excess of the annual projection, the Company will be required to pay... -

Page 20

...Thousands, Except Share Data) Year Ended December 31, 2001 Year Ended December 31, 2000 ASSETS Cash Accounts Receivable Rental Merchandise Less: Accumulated Depreciation Property, Plant & Equipment, Net Goodwill, Net Prepaid Expenses & Other Assets Total Assets LIABILITIES & SHAREHOLDERS' EQUITY... -

Page 21

... REVENUES Rentals & Fees Retail Sales Non-Retail Sales Other $403,385 60,481 66,212 16,603 546,681 $359,880 62,417 65,498 15,125 502,920 $318,154 62,296 45,394 11,515 437,359 COSTS & EXPENSES Retail Cost of Sales Non-Retail Cost of Sales Operating Expenses Depreciation of Rental Merchandise... -

Page 22

...(218,933) 95,840 (11,393) (149,683) Additions to Property, Plant & Equipment Book Value of Property Retired or Sold Additions to Rental Merchandise Book Value of Rental Merchandise Sold Contracts & Other Assets Acquired Cash Used by Investing Activities FINANCING ACTIVITIES Proceeds from Revolving... -

Page 23

... Puerto Rico. The Company manufactures furniture principally for its rent-to-rent and sales and lease ownership operations. Rental Merchandise consists primarily of residential and office furniture, consumer electronics, appliances and other merchandise and is recorded at cost. The sales and lease... -

Page 24

... 63,174 $ NOTE D: DEBT Bank Debt - The Company has a revolving credit agreement dated March 30, 2001 with several banks providing for unsecured borrowings up to $110,000,000, which includes an $8,000,000 credit line to fund daily working capital requirements. Amounts borrowed bear interest at the... -

Page 25

... under the current and prior revolving credit agreements, respectively. The Company pays a .25% commitment fee on unused balances. The weighted average interest rate on borrowings under the revolving credit agreement (before giving effect to interest rate swaps) was 5.77% in 2001, 7.07% in... -

Page 26

... an officer of the Company is a partner under a lease expiring in 2008 for annual rentals aggregating $212,700. The Company maintains a 401(k) savings plan for all full-time employees with at least one year of service with the Company and who meet certain eligibility requirements. The plan allows... -

Page 27

... of service. Under the plans, 1,915,000 of the Company shares are reserved for issuance at December 31, 2001. The weighted average fair value of options granted was $9.68 in 2001, $8.11 in 2000, and $9.55 in 1999. Pro forma information regarding net earnings and earnings per share is required by... -

Page 28

... a monthly payment basis with no credit requirements. The rent-to-rent division rents and sells residential and office furniture to businesses and consumers who meet certain minimum credit requirements. The Company's franchise operation sells and supports franchises of its sales and lease ownership... -

Page 29

... cost of goods sold are adjusted when intersegment profit is eliminated in consolidation. Factors Used by Management to Identify the Reportable Segments The Company's reportable segments are business units that service different customer profiles using distinct payment arrangements. The reportable... -

Page 30

...the third quarter of 2001, the Company recorded non-cash charges totaling approximately $5.6 million, before income taxes, related to certain store closings and related exit costs. R E P O RT O F INDEPENDENT AUDITORS TO THE BOARD OF DIRECTORS AND SHAREHOLDERS OF AARON RENTS, INC.: We have audited... -

Page 31

... 14.59 15.35 13.44 .02 .02 U N I T E D S TAT E S A N D P U E R T O R I C O S T O R E L O C AT I O N S AT D E C E M B E R 3 1 , 2 0 0 1 Company-Operated Sales & Lease Ownership 364 Franchised Sales & Lease Ownership 209 Rent-to-Rent __75 Total Stores 648 Manufacturing & Distribution Centers 18 28 -

Page 32

... INFORMATION Corporate Headquarters 309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 http://www.aaronrents.com Subsidiaries Aaron Investment Company 10th & Market Streets Mellon Bank Building 2nd Floor Wilmington, Delaware 19801 (302) 888-2351 Aaron Rents, Inc. Puerto Rico...