Aarons 1999 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1999 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Change in Fiscal Year End

During 1995, the Company changed its fiscal year end

from March 31 to December 31, which resulted in a nine

month fiscal year ended December 31, 1995. The decision

to change the fiscal year end was made for more convenience

in both internal and external communications. To aid com-

parative analysis, the Company has elected to present the

results of operations for the twelve months ended December

31, 1995 (unaudited), along with the years ended December

31, 1999, December 31, 1998, December 31, 1997 and

December 31, 1996.

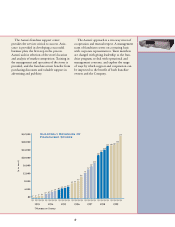

Results of Operations

Year Ended December 31, 1999 versus Year Ended

December 31, 1998

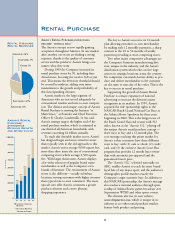

Total revenues for 1999 increased $57.7 million (15.2%) to

$437.4 million compared to $379.7 million in 1998 due

primarily to a $28.9 million (10.0%) increase in rentals and

fees revenues, plus a $26.4 million (139.1%) increase in

non-retail sales. Of this increase in rentals and fees revenues,

$32.7 million was attributable to the Aaron’s Rental Purchase

division. Rentals and fees from the Company’s rent-to-rent

operations increased $2.0 million excluding $5.8 million of

rentals and fees from the Company’s convention furnishings

division, which was sold in the fourth quarter of 1998.

Revenues from retail sales decreased $280,000 (.4%) to

$62.3 million in 1999 from $62.6 million for the same

period last year. The decrease was the result of new sales in

the rent-to-rent division decreasing and the discontinued sale

of prepaid cellular air time in the rental purchase division.

Non-retail sales, which primarily represent merchandise

sold to Aaron’s Rental Purchase franchisees, increased

$26.4 million (139.1%) to $45.4 million compared to

$19.0 million for the same period last year. The increased

sales are due to the growth of the franchise operations

coupled with the addition of a new distribution center.

Other revenues for 1999 increased $2.7 million (30.5%)

to $11.5 million compared to $8.8 million in 1998. This

increase was attributable to franchise fee and royalty income

increasing $1.8 million (25.3%) to $9.1 million compared to

$7.3 million last year, reflecting the net addition of 19 new

franchised stores in 1999 and increasing operating revenues

at mature franchised stores.

Cost of sales from retail sales increased $868,000 (2.0%)

to $45.3 million compared to $44.4 million, and as a per-

centage of sales, increased slightly to 72.6% from 70.9%

primarily due to product mix. Cost of sales from non-retail

sales increased $24.8 million (140.8%) to $42.5 million

from $17.6 million, and as a percentage of sales, increased to

93.5% from 92.9%. The reduced margins on non-retail sales

was primarily the result of lower margins on certain products

sold to franchisees.

Operating expenses increased $12.2 million (6.4%) to

$201.9 million from $189.7 million. As a percentage of total

revenues, operating expenses were 46.2% in 1999 and 50.0%

in 1998. Operating expenses decreased as a percentage of

total revenues between years primarily due to increased

revenues in the Aaron’s Rental Purchase division and the sale

of the Company’s convention furnishings division which

had higher operating expenses than traditional rent-to-rent

and rental purchase operations.

Depreciation of rental merchandise increased $13.2

million (14.8%) to $102.3 million, from $89.2 million, and

as a percentage of total rentals and fees, was 32.2% compared

to 30.8% in 1998. The increase as a percentage of rentals and

fees is primarily due to a greater percentage of the Company’s

rentals and fees coming from the Aaron’s Rental Purchase

division which depreciates its rental merchandise at a faster

rate than the rent-to-rent division.

Interest expense increased $544,000 (15.3%) to $4.1

million compared to $3.6 million. As a percentage of total

revenues, interest expense remained unchanged at 0.9%.

The Company manages its exposure to changes in short-

term interest rates, particularly to reduce the impact on its

floating-rate term notes, by entering into interest rate swap

agreements. The counterparties to these contracts are high

credit quality commercial banks. Consequently, credit risk,

which is inherent in all swaps, has been minimized to a large

extent. Interest expense is adjusted for the differential to be

paid or received as interest rates change. The effect of such

adjustments on interest expense has not been significant.

The level of floating-rate debt fixed by swap agreements

was $40.0 million during the year and the Company does

not expect a significant change in this amount in 2000.

Accordingly, the Company does not believe it has material

exposure of potential, near-term losses in future earnings,

and/or cash flows from reasonably possible near-term

changes in market rates.