8x8 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 8x8 annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON STOCK AND RELATED SECURITY HOLDER

MATTERS

We completed our initial public offering on July 2, 1997 under the name 8x8, Inc. From that date through April 3,

2000, our common stock was traded on the NASDAQ National Market (the NASDAQ) under the symbol "EGHT."

From April 4, 2000 through July 18, 2001, our common stock was traded on the NASDAQ under the symbol

"NTRG." Since July 19, 2001 our common stock has traded under the symbol "EGHT." In July 2002, our listing was

transferred to the Nasdaq SmallCap Market. We have never paid cash dividends on our common stock and have no

plans to do so in the foreseeable future. As of May 13, 2004, there were 299 holders of record of our common stock.

The following table sets forth the range of high and low closing prices for each period indicated:

Period Hi

g

hLow

Fiscal 2004:

First

q

uarte

r

$ 0.64 $ 0.23

Second

q

uarte

r

$ 1.90 $ 0.41

Third

q

uarte

r

$ 7.52 $ 1.33

Fourth

q

uarte

r

$ 5.47 $ 2.75

Fiscal 2003:

First

q

uarte

r

$ 1.05 $ 0.31

Second

q

uarte

r

$ 0.60 $ 0.29

Third

q

uarte

r

$ 0.43 $ 0.20

Fourth

q

uarte

r

$ 0.37 $ 0.18

ITEM 6. SELECTED FINANCIAL DATA

_________

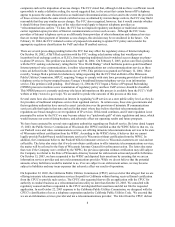

Years Ended March 31, (1) (7)

2004 2003 (6) 2002 (2) 2001 (3)(5) 2000 (4)(5)

(in thousands, except per share amounts)

Total revenues..................................................

.

$ 9,308 $ 11,003 $ 14,691 $ 18,228 $ 25,384

N

et loss..............................................................

.

$ (3,039) $ (11,403) $ (9,105) $ (74,399) $ (24,848)

Net loss per share:

Basic.................................................................

.

$ (0.09) $ (0.40) $ (0.33) $ (2.99) $ --

Diluted.............................................................. $ (0.09) $ (0.40) $ (0.33) $ (2.99) $ (1.38)

Total assets.......................................................

.

$ 15,571 $ 6,705 $ 19,653 $ 39,145 $ 59,983

Convertible subordinated debentures ......... $ -- $ -- $ -- $ 6,238 $ 5,498

Contingently redeemable common stock...... $ -- $ 669 $ 813 $ -- $ --

Accumulated deficit.........................................

.

$ (151,718) $ (148,679) $ (137,276) $ (128,146) $ (53,747)

Total stockholders' equity..............................

.

$ 12,786 $ 2,164 $ 13,234 $ 21,632 $ 47,390

_________

(1) Fiscal 2001 was a 52 week and 2 day fiscal year. Fiscal year 2000 was a 53-week fiscal year, while fiscal

2004, 2003 and 2002 were 52-week fiscal years.

(2) Net loss and net loss per share include an extraordinary gain of $779,000 resulting from the early

extinguishment of our convertible subordinated debentures.

(3) Net loss and net loss per share include a restructuring charge of $33.3 million, an in-process research and