3M 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

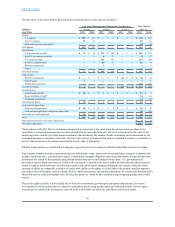

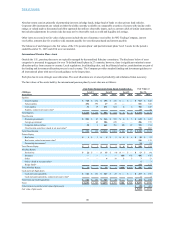

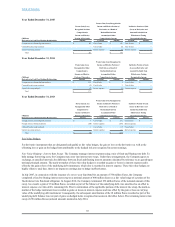

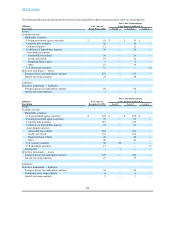

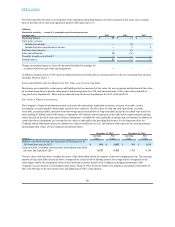

liabilitiesthatarerecognizedordisclosedatfairvalueintheCompany’sfinancialstatementsonarecurringbasisfor2015and2014.

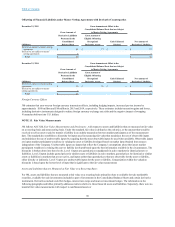

3Musesvariousvaluationtechniques,whichareprimarilybaseduponthemarketandincomeapproaches,withrespecttofinancial

assetsandliabilities.Followingisadescriptionofthevaluationmethodologiesusedfortherespectivefinancialassetsandliabilities

measuredatfairvalue.

Available-for-salemarketablesecurities—exceptcertainU.S.municipalsecurities:

Marketablesecurities,exceptcertainU.S.municipalsecurities,arevaluedutilizingmultiplesources.Aweightedaveragepriceis

usedforthesesecurities.Marketpricesareobtainedforthesesecuritiesfromavarietyofindustrystandarddataproviders,security

masterfilesfromlargefinancialinstitutions,andotherthird-partysources.Thesemultiplepricesareusedasinputsintoa

distribution-curve-basedalgorithmtodeterminethedailyfairvaluetobeused.3MclassifiesU.S.treasurysecuritiesaslevel1,while

allothermarketablesecurities(excludingcertainU.S.municipalsecurities)areclassifiedaslevel2.Marketablesecuritiesare

discussedfurtherinNote9.

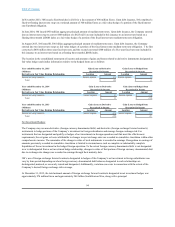

Available-for-salemarketablesecurities—certainU.S.municipalsecuritiesonly:

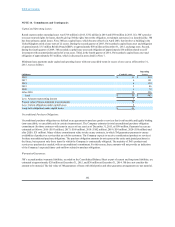

Inthefourthquarter2014,3MobtainedamunicipalbondwiththeCityofNevada,Missouri,whichrepresent3M’sonlyU.S.

municipalsecuritiesholdingasofDecember31,2015.Duetothenatureofthissecurity,thevaluationmethodutilizedwillinclude

thefinancialhealthoftheCityofNevada,anyrecentmunicipalbondissuancesbyNevada,andmacroeconomicconsiderations

relatedtothedirectionofinterestratesandthehealthoftheoverallmunicipalbondmarket,andassuchwillbeclassifiedasalevel3

security.

Available-for-saleinvestments:

Investmentsincludeequitysecuritiesthataretradedinanactivemarket.Closingstockpricesarereadilyavailablefromactive

marketsandareusedasbeingrepresentativeoffairvalue.3Mclassifiesthesesecuritiesaslevel1.

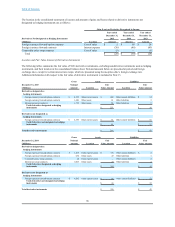

Derivativeinstruments:

TheCompany’sderivativeassetsandliabilitieswithinthescopeofASC815,DerivativesandHedging,arerequiredtoberecorded

atfairvalue.TheCompany’sderivativesthatarerecordedatfairvalueincludeforeigncurrencyforwardandoptioncontracts,

commoditypriceswaps,interestrateswaps,andnetinvestmenthedgeswherethehedginginstrumentisrecordedatfairvalue.Net

investmenthedgesthatuseforeigncurrencydenominateddebttohedge3M’snetinvestmentarenotimpactedbythefairvalue

measurementstandardunderASC820,asthedebtusedasthehedginginstrumentismarkedtoavaluewithrespecttochangesin

spotforeigncurrencyexchangeratesandnotwithrespecttootherfactorsthatmayimpactfairvalue.

3Mhasdeterminedthatforeigncurrencyforwards,commoditypriceswaps,currencyswaps,foreigncurrencyoptions,interestrate

swapsandcross-currencyswapswillbeconsideredlevel2measurements.3Musesinputsotherthanquotedpricesthatare

observablefortheasset.Theseinputsincludeforeigncurrencyexchangerates,volatilities,andinterestrates.Derivativepositionsare

primarilyvaluedusingstandardcalculations/modelsthatuseastheirbasisreadilyobservablemarketparameters.Industrystandard

dataprovidersare3M’sprimarysourceforforwardandspotrateinformationforbothinterestratesandcurrencyrates,withresulting

valuationsperiodicallyvalidatedthroughthird-partyorcounterpartyquotesandanetpresentvaluestreamofcashflowsmodel.

99