3M 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

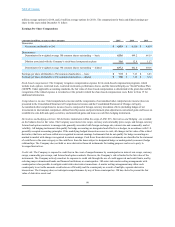

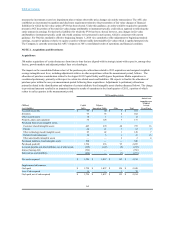

millionaverageoptionsfor2014,and2.0millionaverageoptionsfor2013).Thecomputationsforbasicanddilutedearningsper

sharefortheyearsendedDecember31follow:

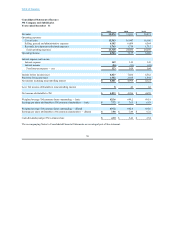

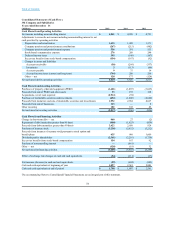

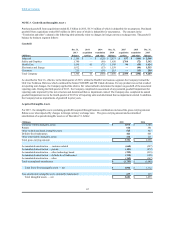

EarningsPerShareComputations

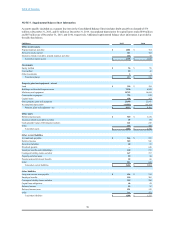

(Amountsinmillions,exceptpershareamounts) 2015 2014 2013

Numerator:

Netincomeattributableto3M $ 4,833 $ 4,956 $ 4,659

Denominator:

Denominatorforweightedaverage3Mcommonsharesoutstanding—basic 625.6 649.2 681.9

DilutionassociatedwiththeCompany’sstock-basedcompensationplans 11.6 12.8 11.7

Denominatorforweightedaverage3Mcommonsharesoutstanding—diluted 637.2 662.0 693.6

Earningspershareattributableto3Mcommonshareholders—basic $ 7.72 $ 7.63 $ 6.83

Earningspershareattributableto3Mcommonshareholders—diluted $ 7.58 $ 7.49 $ 6.72

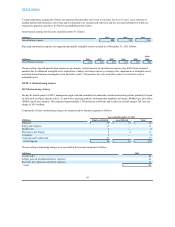

Stock-basedcompensation:TheCompanyrecognizescompensationexpenseforitsstock-basedcompensationprograms,which

includestockoptions,restrictedstock,restrictedstockunits,performanceshares,andtheGeneralEmployees’StockPurchasePlan

(GESPP).Underapplicableaccountingstandards,thefairvalueofshare-basedcompensationisdeterminedatthegrantdateandthe

recognitionoftherelatedexpenseisrecordedovertheperiodinwhichtheshare-basedcompensationvests.RefertoNote15for

additionalinformation.

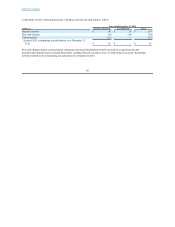

Comprehensiveincome:Totalcomprehensiveincomeandthecomponentsofaccumulatedothercomprehensiveincome(loss)are

presentedintheConsolidatedStatementofComprehensiveIncomeandtheConsolidatedStatementofChangesinEquity.

Accumulatedothercomprehensiveincome(loss)iscomposedofforeigncurrencytranslationeffects(includinghedgesofnet

investmentsininternationalcompanies),definedbenefitpensionandpostretirementplanadjustments,unrealizedgainsandlosseson

available-for-saledebtandequitysecurities,andunrealizedgainsandlossesoncashflowhedginginstruments.

Derivativesandhedgingactivities:AllderivativeinstrumentswithinthescopeofASC815,DerivativesandHedging,arerecorded

onthebalancesheetatfairvalue.TheCompanyusesinterestrateswaps,currencyandcommoditypriceswaps,andforeigncurrency

forwardandoptioncontractstomanagerisksgenerallyassociatedwithforeignexchangerate,interestrateandcommoditymarket

volatility.Allhedginginstrumentsthatqualifyforhedgeaccountingaredesignatedandeffectiveashedges,inaccordancewithU.S.

generallyacceptedaccountingprinciples.Iftheunderlyinghedgedtransactionceasestoexist,allchangesinfairvalueoftherelated

derivativesthathavenotbeensettledarerecognizedincurrentearnings.Instrumentsthatdonotqualifyforhedgeaccountingare

markedtomarketwithchangesrecognizedincurrentearnings.Cashflowsfromderivativeinstrumentsareclassifiedinthestatement

ofcashflowsinthesamecategoryasthecashflowsfromtheitemssubjecttodesignatedhedgeorundesignated(economic)hedge

relationships.TheCompanydoesnotholdorissuederivativefinancialinstrumentsfortradingpurposesandisnotapartyto

leveragedderivatives.

Creditrisk:TheCompanyisexposedtocreditlossintheeventofnonperformancebycounterpartiesininterestrateswaps,currency

swaps,commoditypriceswaps,andforwardandoptioncontracts.However,theCompany’sriskislimitedtothefairvalueofthe

instruments.TheCompanyactivelymonitorsitsexposuretocreditriskthroughtheuseofcreditapprovalsandcreditlimits,andby

selectingmajorinternationalbanksandfinancialinstitutionsascounterparties.3Mentersintomasternettingarrangementswith

counterpartieswhenpossibletomitigatecreditriskinderivativetransactions.Amasternettingarrangementmayalloweach

counterpartytonetsettleamountsowedbetweena3Mentityandthecounterpartyasaresultofmultiple,separatederivative

transactions.TheCompanydoesnotanticipatenonperformancebyanyofthesecounterparties.3Mhaselectedtopresentthefair

valueofderivativeassetsand

60