3M 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

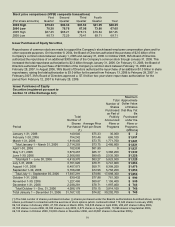

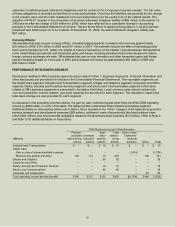

Health Care Business (17.5% of consolidated sales):

2006 2005 2004

Sales (millions) $4,011 $3,760 $3,596

Sales change analysis:

Local currency (volume and price) 6.0% 4.2% 0.6%

Translation 0.7 0.4 4.2

Total sales change 6.7% 4.6% 4.8%

Operating income (millions) $1,845 $1,114

Percent change 65.6% 14.6% 7.2%

Percent of sales 46.0% 29.6% 27.0%

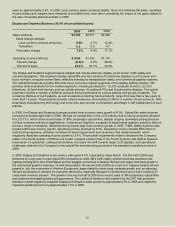

The Health Care segment serves markets that include medical, surgical, pharmaceutical, dental and orthodontic, and

health information systems. Products provided to these and other markets include medical and surgical supplies, skin

health and infection prevention products, pharmaceuticals, drug delivery systems, dental and orthodontic products, health

information systems and microbiology products. As discussed below, the global branded pharmaceuticals business was

sold in December 2006 and January 2007.

In total, the combination of the following items positively impacted total year 2006 Health Care operating income by

$673 million, primarily in the fourth quarter of 2006. As discussed in Note 2, in early December 2006, the Company sold

its branded pharmaceuticals business in the Asia Pacific region, including Australia and South Africa. The Company also

sold its branded pharmaceuticals business in the United States, Canada and Latin America in late December 2006. The

operating income gain related to this sale, which is included in Health Care, totaled $1.074 billion. In addition, as discussed

in Note 4, the Health Care segment for the year 2006 included $293 million in restructuring costs, primarily employee-

related severance and benefit costs. Of the $293 million, $166 million was related to the pharmaceuticals business

and $15 million related to Health Care severance and other costs. In addition, $112 million of severance and benefit

costs were recorded in the fourth quarter of 2006 related to worldwide staff overhead reduction actions taken to

streamline the Company's cost structure in response to the sale of 3M¶VEUDQGHGSKDUPDFHXWLFDOVEXVLQHVV7KH

Health Care business is being charged with these overhead costs until such overhead costs are reduced to zero

through various restructuring actions. These costs will reduce cash flows in 2007 when the related severance is paid.

Health Care also included $95 million of expensed in-process research and development costs related to the Brontes

acquisition and $13 million in environmental reserves related to the pharmaceuticals business.

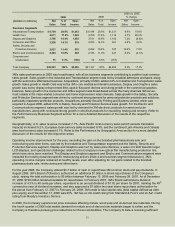

In 2006, Health Care sales were $4.011 billion. Organic local-currency growth was 5.3%, with acquisitions adding an

additional 0.7% of growth. Local-currency growth was lHGE\WKHPHGLFDOVXSSOLHVDQGGHQWDOEXVLQHVVHV0¶V

pharmaceutical business was approximately 19% of Health Care sales in 2006. Pharmaceutical local-currency sales

declined 3.5% in 2006, while the remaining businesseV¶ORFDOFXUUHQF\VDOHVJURZWKLQFUHDVHG

Asia Pacific areas. Operating income for 2006 was up 65.6%, impacted by the gain on sale of our branded

pharmaceuticals business, restructuring impacts and other items as discussed in the preceding paragraph, which

positively impacted operating income growth by 60.4%.

In 2005, Health Care reported local-currency sales growth RI0¶VFRUHPHGLFDODQGGHQWDOEXVLQHVVHVDQGKHDOWK

information systems businesses experienced local-currency sales growth of approximately 6%. The strength of these

businesses helped overcome the sales growth challenges of the pharmaceutical business. Sales of certain products

ZLWKLQ0¶VSKDUPDFHXWLFDOVEXVLQHVVSULPDULO\FRPSULVHGRISUHVFULSWLRQGUXJVIRULQKDODWLRQZRPHQ¶VKHDOWKDQG

cardiovascular conditions, declined due to price pressure in Europe and decreased demand for some of these older

products. Health Care continued to focus on operational efficiency, which helped drive a 14.6% increase in operating

income in 2005.

/RRNLQJDKHDGDVGLVFXVVHGLQWKHSUHFHGLQJ³2YHUYLHZ´VHction, the sale of our branded pharmaceuticals business

will impact both sales growth and operating income margins in Health Care and the total company in 2007. Sales

growth in 2007 will be negatively impacted as significant pharmaceuticals sales will be in the base 2006 period. In

addition, Health Care operating income is expected to decline in 2007 by approximately 2 percentage points year-on-

year, negatively impacted by this sale. As a result, 3M believes the following disaggregated information for 3M Health

&DUH¶VUHPDLQLQJEXVLQHVVHVDIWHUWKHVDOHRISKDUPDFHXWicals) and for pharmaceuticals on a stand-alone basis provides

useful information.

*HRJUDSKLFDOO\+HDOWK&DUH¶VORFDOFXUUHQF\VDOHVJURZWKwas strongest in the United States, Europe and

$ 973