3M 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

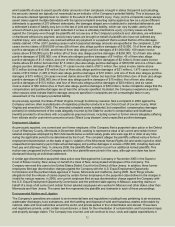

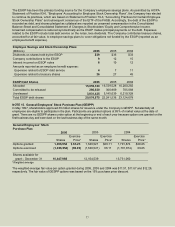

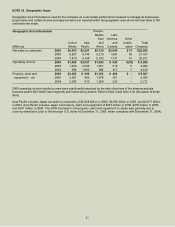

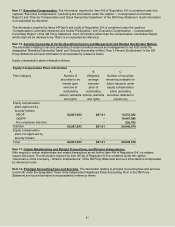

Business Segment Depr. Capital

Information Net Operating and Expendi-

(Millions) Sales Income

A

ssets Amort. tures

Industrial and Transportation 2006 $ 6,754 $1,343 $ 5,487 $ 286 $ 283

2005 6,144 1,211 5,125 274 257

2004 5,711 1,050 3,626 283 249

Health Care 2006 4,011 1,845 2,477 162 159

2005 3,760 1,114 2,166 131 138

2004 3,596 973 2,289 128 117

Display and Graphics 2006 3,765 1,062 3,015 230 326

2005 3,511 1,162 2,713 186 232

2004 3,346 1,115 2,552 174 249

Consumer and Office 2006 3,238 579 1,614 91 105

2005 3,033 561 1,520 107 97

2004 2,901 514 1,471 116 117

Safety, Security and 2006 2,621 575 1,901 112 149

Protection Services 2005 2,292 537 1,351 113 99

2004 2,125 465 1,317 101 99

Electro and Communications 2006 2,483 438 1,819 167 112

2005 2,333 447 1,799 145 102

2004 2,224 316 1,857 163 95

Corporate and 2006 51 (146) 4,981 31 34

Unallocated 2005 94 (178) 5,867 30 18

2004 108 (107) 7,611 34 11

Total Company 2006 $22,923 $5,696 $21,294 $1,079 $1,168

2005 21,167 4,854 20,541 986 943

2004 20,011 4,326 20,723 999 937

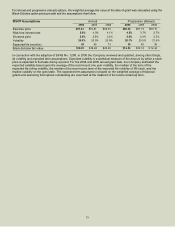

Segment assets for the operating business segments (excluding Corporate and Unallocated) primarily include accounts

receivable; inventory; property, SODQWDQGHTXLSPHQW±QHWJRRGZLOODQGLQWDQJLEOHDVVHWVDQGRWKHUPLVFHOODQHRXV

assets. Assets included in Corporate and Unallocated principally are cash, cash equivalents and marketable securities;

insurance receivables; deferred income taxes; certain investments and other assets, including prepaid pension assets;

and certain unallocated property, plant and equipment. Corporate and unallocated assets decreased approximately $0.9

billion in 2006, primarily due to decreases in prepaid pension and postretirement benefits, partially offset by increases in

cash, cash equivalents and marketable securities. Corporate and unallocated assets decreased approximately $1.7 billion

in 2005, primarily due to decreases in cash and cash equivalents. For management reporting purposes, corporate

JRRGZLOOZKLFKDW'HFHPEHUWRWDOHGDSSUR[LPDWHO\$320 million) is not allocated to the six operating business

VHJPHQWV,Q1RWHFRUSRUDWHJRRGZLOOKDVEHHQDOORFDWHGWRthe respective market segments as required by SFAS No.

142 for impairment testing.

Corporate and Unallocated operating income principally includes corporate investment gains and losses, certain

derivative gains and losses, insurance-related gains and losses, certain litigation expenses, corporate restructuring

program charges and other miscellaneous items. Because this category includes a variety of miscellaneous items, it is

subject to fluctuation on a quarterly and annual basis.

Refer to Note 2 and Note 4 for discussion of items that significantly impact business segment reported results. The most

significant items impacting 2006 results are the net gain on sale of portions of WKHSKDUPDFHXWLFDOVEXVLQHVVZLWKLQWKH

Health Care segment) and restructuring and other actions.