Westjet 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6. Share capital cont:

(e) Employee share purchase plan:

Under the terms of the Employee Share Purchase Plan, employees may

contribute up to a maximum of 20% of their gross pay and acquire common

shares of the Corporation at the current fair market value of such shares.

The Corporation matches the employee contributions and shares may be

withdrawn from the Plan after being held in trust for one year. Employees

may offer to sell common shares at any time to the Corporation for 50% of

the then current market price.

As at December 31, 1998, $209,000 was held in Trust representing

employee and employer contributions under the Plan and the Company had

an obligation to issue 52,331 common shares at $4.00 per share. After July,

1999, the Corporation has not issued the shares from Treasury but

purchased these shares off of the open market.

(f) Due from shareholder:

The advance to purchase common shares of the Corporation consists of

promissory notes of $575,000 as at December 31, 1999 due from a

shareholder who is an officer of the Corporation. The amount repayable on

or before March 31, 2000 is $275,000 and on or before May 31, 2000 is

$300,000.

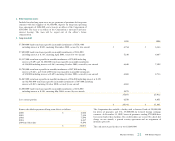

7. Income taxes:

Income taxes vary upon the amount that would be computed by applying the

basic Federal and Provincial tax rate of 45% to earnings before taxes as follows:

1999 1998

Expected income tax provision $ 13,207 $ 5,544

Add (deduct):

Non-deductible expenses 55 35

Capital taxes 264 335

Other (10) -

$ 13,516 $ 5,914

8. Commitments:

(a) Employee profit share:

The Corporation has an employee profit sharing plan whereby eligible

employees will participate in the pre-tax operating income of the Corporation.

The profit share ranges from a minimum of 10% to a maximum of 20% of

earnings before employee profit share and income taxes. The amounts paid

under the plan are subject to approval by the Board of Directors.

(b) Building lease:

The Corporation entered into a 10 year lease agreement for additional

office space. The building, which is expected to be ready for occupancy by

September 2000, will result in the consolidation of all head office,

administration and accounting functions. The aggregate payments under

this lease agreement were included in the Corporation’s commitments as at

December 31, 1999 (see note 5).

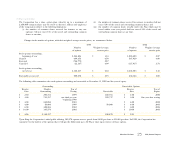

(c) Hushkit requirements:

In accordance with Canadian Aviation Regulations (C.A.R.s) requirements,

the Corporation is required to install hushkits on its aircraft fleet in order to

conform to noise emission standards. The C.A.R.s requirement to hushkit

Boeing 737 aircraft is as follows:

Percentage of

fleet to be hushkitted

(rounded down)

December 31, 1999 75%

October 1, 2001 85%

April 1, 2002 100%

As at December 31, 1999, the Corporation had 11 of its 15 operational

aircraft equipped with hushkits and was in compliance with C.A.R.'s

requirements.

26

WestJet Airlines 1999 Annual Report