Westjet 1999 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1999 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

WestJet’s business plan and low-fare,

controlled cost model for market

stimulation. WestJet’s available seats in

the marketplace increased by 40% over

1998 and that added capacity was more

than absorbed by the travelling public

as demonstrated by an increase in load

factor from 71.6% in 1998 to 72.3% in

1999. WestJet continued to deliver a

quality product at an affordable price,

including added frequency, an

improved schedule, the expanded

choice of destinations, the operational

quality in terms of on-time

performance, and the efficiency and

ease of making a reservation and

checking-in. A key to the 1999

financial success was the friendliness

and positive attitude displayed by the

people of WestJet and their constant

attention to creativity and improved

productivity.

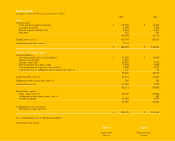

Results of Operations

Net earnings for 1999 were $15.8

million, a 143% increase over 1998’s

$6.5 million due to growing revenues

and stable costs which resulted in

improved margins on much larger

revenues. The corporation’s 1999

earnings from operations of $30.5

million - or 15% of revenues -

compared favorably with 1998’s

margin of $13.1 million or 10% of the

airline’s total annual revenues. Earnings

before interest, income taxes,

depreciation, and aircraft rent

(EBITDAR) was $41.4 million in

1999, a 111% increase over 1998’s

$19.6 million. The EBITDAR margin

improved from 1998’s 15.6% to 20.3%

in 1999.

These earnings numbers are after

deduction of the employee profit share

provision. WestJet’s earnings before

income taxes and profit share provision

were $37.1 million or 18% of revenues

in 1999, compared with $14.8 million

or 12% of revenues in the previous year.

Profit sharing is based on the

corporation’s pre-tax margin and will

result in a $6.6 million distribution to

eligible employees for 1999 as

compared with a $1.7 million profit

share for 1998. This 288% increase is in

part due to the growth in size of the

airline, its revenues and employee base,

but is also attributable to the

incremental nature of the plan’s

formula. As WestJet’s operating

margins improve so does the

percentage of profit share, subject to a

cap. This plan is an integral part of

WestJet’s compensation program,

which further aligns the interests of its

people with those of its shareholders

and is designed to encourage

exceptional performance.

WestJet’s financial performance

resulted in fully diluted earnings per

share growth from 28 cents in 1998 to

58 cents in 1999. Cash provided by

operations amounted to $47.8 million,

exactly double the amount generated

in 1998.

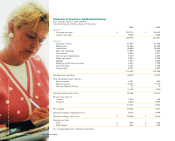

Revenues

WestJet’s growth in 1999 can best

be measured by capacity or available

seat miles, and the success of that

growth is best reflected by the number

of passengers in those seats and the

corresponding revenue yield. Available

seat miles increased 40% from 893

million in 1998 to 1.25 billion in 1999,

while revenue passenger miles increased

at a faster pace, with a 41% change from

639 million in 1998 to 903 million

in 1999.

Yield or revenue per revenue

passenger mile increased 15% from

19.6 cents in 1998 to 22.5 cents in

1999, while total revenues increased by

62% over 1998 to $204 million. The

airline continues to focus on scheduled

service and as in 1998, with 95% of its

total revenue being derived from

domestic operations. WestJet also has a

number of contracts with major

Canadian tour companies for off-peak

hour charters flying to southwestern

USA destinations, providing improved

aircraft utilization and a positive

revenue stream on incremental

operating costs. Income from cargo

operations remains insignificant but

again, provides incremental revenues

for carrying small packages and

envelopes. Charter, cargo, and other

revenues derived from guest service

fees amounted to $9.9 million in 1999,

a 45% increase over the previous year,

and a consistent 5% of total revenues of

the corporation.

WestJet Airlines 1999 Annual Report