Western Digital 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A total of 16.4 million Western Digital common shares were

repurchased during the scal year at a cost of $604 million under

the plan approved by the Board of Directors. In May 2012, we

announced an authorization to repurchase an additional $1.5 billion

of our stock. In September 2012, we announced the declaration of

a quarterly cash dividend of $.25 per share and the authorization of

an additional $1.5 billion under our share repurchase program.

We also repaid a total of $585 million of assumed debt from the

acquisition of HGST. At year’s end, Western Digital’s cash and cash

equivalents totaled $3.2 billion.

Hard drive industry shipments slipped to 599 million units

from the year-earlier 657 million, re ecting ood-related supply

constraints, continued sluggish consumer spending and market

shifts to devices such as smartphones and tablet computers. Our

approximately 45% share in this market exiting scal 2012 indicates

continued customer preference and satisfaction with our WD and

HGST subsidiaries as reliable providers of high-quality storage

solutions for local, cloud and networked environments.

It is already clear that customers understand and appreciate the

respective strengths of our WD and HGST subsidiaries. In the

months since HGST joined Western Digital, we have been able

to con rm the robustness and predictability of HGST’s business

operations, processes and controls. Nevertheless, we see many

opportunities for further improvement in the respective cost

structures of both our HGST and WD subsidiaries as newer areal

density platforms come into production and as the recovery from

ood related matters concludes.

Storage continues to be critical to the mass of digital content being

created and utilized in entertainment, in education, in commerce

and in communication, and which is growing at a terri c rate. We

believe the volume of petabytes stored will grow by about one-

third annually to calendar year 2016. That growth, and the need

to periodically refresh consumer and commercial information

technology systems, gives us great encouragement about the

future of the hard drive industry.

The industry’s mobile markets continue to demand that our

products be made smaller, thinner, lighter and quieter, with ever-

greater performance, reliability and environmental acceptability

— all at steadily reduced cost per unit of stored data. At the same

time, the growth in data creation and usage is driving increasing

demand for both high-capacity and high-performance drives in the

personal, private and public cloud infrastructure, which feeds these

mobile devices. These are challenges that t the demonstrated

capabilities of WD and HGST, both with decades-long experience

and reputations as reliable, preferred suppliers of storage solutions.

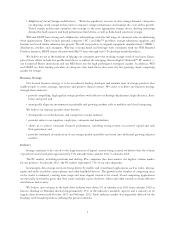

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

FY2008 FY2009 FY2010 FY2011 FY2012

$1,023

$595

$1,312

$2,334

NET CASH

Dollars in millions

$3,196

Net cash (cash and cash equivalents less

debt) ended the year at $1.0 billion, down

$2.2 billion from the end of scal 2011, as a

result of debt entered into for the $4.7 billion

acquisition of HGST.

$0

$400

$800

$1,200

$1,600

$2,000

$2,400

$2,800

$3,200

FY2008 FY2009 FY2010 FY2011 FY2012

$1,655

$3,067

$1,399 $1,305

$1,942

CASH FLOW FROM OPERATIONS

Dollars in millions

Strong pro tability and disciplined balance

sheet management produced robust cash

ows from operations of $3.1 billion during

scal 2012.

$0

$200

$400

$600

$800

FY2008 FY2009 FY2010 FY2011 FY2012

CAPITAL EXPENDITURES

Dollars in millions

$615 $519

$778 $717

$737

Capital expenditures were $717 million

during scal 2012 as Western Digital

recovered from the Thailand ooding and

continued to invest to support its future

growth.

$0

$200

$400

$600

$800

$1,000

$1,200

FY2008 FY2009 FY2010 FY2011 FY2012

$611 $703

$1,055

$464 $509

RESEARCH AND DEVELOPMENT SPENDING

Dollars in millions

Research and development continues to

increase as we invest in new products

and innovative technology to meet

customer needs.