Western Digital 1995 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1995 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

T C all its fiscal 1995 goals for

financial performance, and led its industry in the key measurements we

consider most important for a manufacturing company in a brutally com-

petitive industry.

We maintained our high-velocity employment of assets, and led in the

turnover of inventory, operating assets and total assets. Our finished goods

inventory of hard drives, for example, was equal to three days’production at

year’s end. Our cash conversion cycle, which measures the elapsed time from

the outlay of cash for inventories to the receipt of cash, was reduced fur-

ther to 19 days.

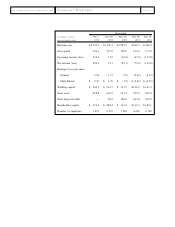

Reflecting our “virtual vertical integration” manufacturing strategy,

Western Digital produced $26 in sales per dollar of property, plant and

equipment last year, more than twice the average for our industry. The

Company also doubled the merchant hard drive industry’s averages with its

28 percent operating return on operating assets and with returns of 16 percent on total assets

and 32 percent on shareholders’equity.

Western Digital’s balance sheet, already the industry’s strongest, improved further as the

last of our long-term debt was extinguished. Especially satisfying was the growth of our cash

position to $308 million, and the 64 percent growth in shareholders’equity to a record $473

million.

Last year’s $55 million in capital expenditures was directed mainly to the expansion of

hard drive media production and to the retooling of our Malaysian facility into a drive

manufacturing site. This year, spending will be increased to about $125 million as we expand

the Singapore manufacturing operation, increase the size of the Malaysian facility, and make

preparations for high-performance drive production.

Western Digital’s financial disciplines have enabled the Company to grow rapidly and

profitably. We will continue to adhere to them as we extend the Western Digital record of proven

performance.

Asset Management Leadership .

D. Scott Mercer

Average Operating

Asset Turns

D. Scott Mercer,

Ex ecutive Vice President, Chief Financial and Administrative Officer