Washington Post 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

earnings (all Post shareholders should be aware that the company pays no attention to re-

ported quarterly results). Kaplan CEO Jonathan Grayer has been running Kaplan since it

was 3.6% of its present size. He and his team, led by Kaplan president Andy Rosen and

Kaplan Test Prep CEO John Polstein (also there since those early days), have quite a

record. Through acquisitions, we’ve added and grown businesses that now contribute more

than 80% of Kaplan’s revenues today. Through smart management, we’ve stayed on top

in the test prep business and expanded successfully into other very attractive businesses.

It takes enormous numbers of excellent, highly motivated managers to run these busi-

nesses. Kaplan’s team is amazing, and we’re growing at a rate that should provide lots

of opportunity.

I’m sometimes asked if Kaplan is a counter-cyclical business. The company contains

both cyclical and counter-cyclical elements. (We were making $20 million from a real es-

tate training business two years ago; it will be a long time before we see that profit level

again.) Both higher education and test prep should be somewhat better in tough times.

Kaplan can’t continue to grow at the rates we saw since 1994 (and almost certainly won’t

grow at 21% this year). But it still feels early in the Kaplan story.

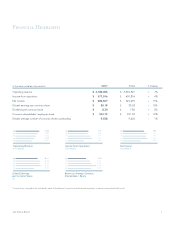

Cable ONE had another excellent year; 2008 looks quite promising as well.

The introduction of telephony in Cable ONE’s smaller-city markets (that’s all our markets)

went well. As customers buy high-speed data, telephone or DVR service from Cable ONE,

the combination seems to reinforce the appeal of all Cable ONE’s products. Month after

month, basic subscriber numbers performed well. The result was a gain in operating income

despite a $10 million insurance recovery in 2006 and no basic video rate increase in 2007

(we have already implemented a basic video rate increase for 2008).

Customers love Cable ONE’s high-speed data service (almost 50% of basic customers

now take it), and growth remains strong.

The whole Cable ONE team is remarkable, but our managers would give CEO Tom

Might most of the credit for our strategic success.

The Washington Post Company

6