Vtech 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 VTech Holdings Ltd Annual Report 2011

Letter to Shareholders

“I am pleased to report that VTech

continued to implement its growth strategy

in the financial year 2011, which enabled us

to achieve record revenue.”

Dear Shareholders,

I am pleased to report that VTech continued to implement

its growth strategy in the financial year 2011, which

enabled us to achieve record revenue.

In telecommunication (TEL) products, we maintained

our leadership position in the US and expanded our

presence in the rest of the world. In electronic learning

products (ELPs), we successfully launched two new

platform products in North America and parts of Europe,

which has laid an important foundation for future

growth. Contract manufacturing services (CMS) again

outperformed the global electronic manufacturing

services (EMS) market and delivered record revenue, as

we benefited from the recovery in the global economy.

Our superior performance as a supplier also allowed us to

gain new customers and additional business from existing

customers in all regions.

Despite the solid growth in revenue, the profitability of

the Group was affected by a significant increase in the

cost of materials and labour. This was compounded with

the appreciation of the Renminbi, higher promotional

costs for new ELP launches and a change in product

mix. These challenges notwithstanding, their impacts

have been alleviated through operational efficiency

gains, product design optimisation and other cost

control measures.

Results and Dividend

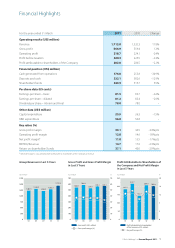

Group revenue for the year ended 31 March 2011 rose

by 11.8% over the previous financial year to US$1,712.8

million. Profit attributable to shareholders of the Company

declined by 2.2% to US$202.0 million. The decline in profit

was mainly attributable to the decrease in gross margin,

as we faced higher costs of materials, rising labour costs,

Renminbi appreciation, increased promotional expenses

and a change in product mix during the financial year.