Vonage 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Vonage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

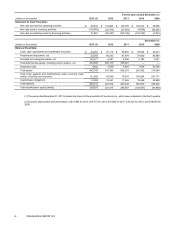

27 VONAGE ANNUAL REPORT 2013

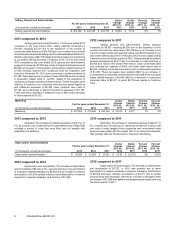

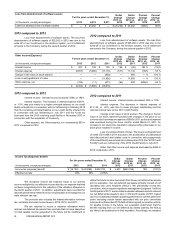

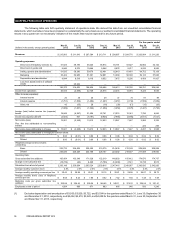

ITEM 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

You should read the following discussion together with “Selected

Financial Data” and our consolidated financial statements and the

related notes included elsewhere in this Annual Report on Form 10-K.

This discussion contains forward-looking statements, which involve

risks and uncertainties. Our actual results may differ materially from

those we currently anticipate as a result of many factors, including the

factors we describe under “Item 1A—Risk Factors,” and elsewhere in

this Annual Report on Form 10-K.

OVERVIEW

We are a leading provider of communications services

connecting people through cloud-connected devices worldwide. We rely

heavily on our network, which is a flexible, scalable Session Initiation

Protocol (SIP) based Voice over Internet Protocol, or VoIP, network. This

platform enables a user via a single “identity,” either a number or user

name, to access and utilize services and features regardless of how

they are connected to the Internet, including over 3G, 4G, Wi-Fi, Cable,

or DSL broadband networks. This technology enables delivery of voice,

messaging and video services globally on a variety of devices.

Since its inception, Vonage has used IP technology to disrupt

large existing markets by offering high-value, low cost communications

services. From its start-up roots, the Company has evolved into a leader

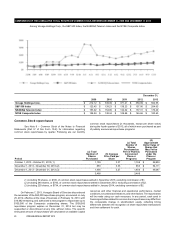

in the VoIP services market, with 2.5 million customer lines serving

residential and small and medium business customers. Customers

using our core Vonage landline replacement service are located in the

United States (94% of lines), Canada and the UK. Our mobile

applications serve customers around the world.

Key to the Company's evolution was its strategic, operational

and financial transformation, which was largely completed in 2012. This

transformation resulted in a dramatic swing to profitability enabled by

significant cost reductions, a meaningful lowering of customer

defections, and the successful restructuring our balance sheet. This

transformation positioned the Company to pursue our current growth

strategy.

Strategically, we shifted our primary focus in our domestic

markets to serving the rapidly growing but under-served ethnic

segments in the United States with international calling needs. We

improved the customer value proposition by being the first to deliver

flat-rate, unlimited calling to over 60 countries with the launch of our

Vonage World service, and we differentiated our service by providing

enhanced features, including our mobile Extensions service, at no extra

cost. These strategic shifts have resulted in new customers with a higher

average lifetime value and a better churn profile than those in the past.

Operationally, we lowered customer churn from highs of 3.6%

in July 2009 to 2.6% in 2012; we further lowered churn in 2013 to 2.5%.

Through three debt refinancings in December 2010, July 2011, and

February 2013, we lowered our interest rate from 20% to less than 4%,

saving over $40 million in annual interest expense.

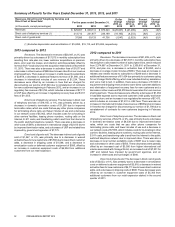

Our disciplined approach to cash management was

fundamental in enabling us to establish our share repurchase program

which was first instituted in August of 2012. We currently have a

$100,000 repurchase authorization in place to be completed by

December 31, 2014. As of December 31, 2013, we have repurchased

$50,653 or 16,954 shares of Vonage common stock. Since beginning

the first repurchase program, we have repurchased $83,971 or 31,390

shares of Vonage stock.

We believe our repurchase program reflects our balanced

approach to capital allocation as we invest for growth, both organically

and inorganically through acquisitions, and deliver value to shareholders

without compromising our ongoing operational needs.

In 2013 we made important progress against each of our

growth priorities. We launched the BasicTalk brand nationally, offering

compelling value to domestic callers. In the core Vonage branded

business, we continued to allocate marketing investments from mass-

reach vehicles like television to more ethnically-targeted and cost-

efficient, in-person selling channels. These initiatives combined to offset

the existing weakening in our premium domestic service, which reflects

broad market trends. As a result, for 2013, we delivered positive net

line additions for the first time since 2008. We grew the penetration rate

of our mobile Extension service, which extends our home phone product

to mobile phones, and we improved our standalone mobile app with

quality and feature enhancements, including video calling and video

voicemail. Early in 2013 we announced a joint venture to launch service

in Brazil and we expect to enter this market with a phased launch in the

second quarter of 2014. In late 2013 we acquired Vocalocity, a leading

provider of hosted VoIP services to small and medium businesses.

Recent Developments

Acquisition of Vocalocity. Pursuant to the Agreement and

Plan of Merger (the “Merger Agreement”) dated October 9, 2013, by

and among Vocalocity Inc. ("Vocalocity"), Vista Merger Corp., a

Delaware corporation and newly formed wholly-owned subsidiary of

Vonage (“Merger Sub”), Vonage and Shareholder Representative

Services, LLC (acting solely in its capacity as the Representative, the

“Representative”). Pursuant to the Merger Agreement, on November

15, 2013, Merger Sub merged with and into Vocalocity, and Vocalocity

became a wholly-owned subsidiary of Vonage (the “ Merger ”).

Vocalocity was acquired for $130,000 adjusted for $2,869 of

excess cash as of the closing date and the increase in value of the 7,983

shares of Vonage common stock from the signing date to the closing

date of $1,298, resulting in a total acquisition cost was $134,167. We

financed the transaction through $32,981 of cash and $75,000 from our

credit facility. The acquisition of Vocalocity immediately positions

Vonage as a leader in the SMB hosted VoIP market. SMB and SOHO

services will be offered under the Vonage Business Solutions brand.

Joint Venture in Brazil. We continue to make progress

building the foundation to deliver VoIP services through our joint venture

in Brazil. The joint venture has completed network testing, finalized

plans to host its billing platform, built out its management team, is

currently performing integrated production testing, and has established

and trained customer care centers. We are also implementing a change

to the ownership structure of our joint venture. In late 2013, our partner

was unable to meet its capital call obligations resulting in the delivery

of a notice to our partner in early 2014 that we would be exercising our

dilution rights. As a result, our ownership level in the joint venture is

expected to increase to more than 90%. Our joint venture partner

continues to contribute to implementation steps and progress building

the foundation to deliver VoIP services. We do not expect these funding

issues to increase risk to our planned market entry in the second quarter

of 2014.

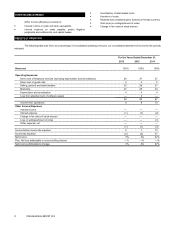

Trends in Our Industry and Key Operating Data A number

of trends in our industry have a significant effect on our results of

operations and are important to an understanding of our financial

statements.

Competitive landscape. We face intense competition from

traditional telephone companies, wireless companies, cable

companies, and alternative voice communication providers. Most

traditional wireline and wireless telephone service providers and cable

companies are substantially larger and better capitalized than we are

Table of Contents