Union Pacific 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Union Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

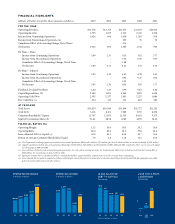

OPERATING REVENUES

In millions of dollars

OPERATING INCOME

In millions of dollars

LEASE ADJUSTED

DEBT TO CAPITAL*

Percentage

2005 STOCK PRICE

COMPARISON

Percentage

2,018

2,253

1,295

1,795

10,830

11,159

11,551

12,215

13,578 55.0

51.7

44.8 45.1 43.6

-1

+3

+20

2,133

Dow S&P

500

UNP

*Refer to footnote (e) above

01 01 01 02 03 04 0502 03 04 0502 03 04 05

financial HigHligHts

Millions of Dollars, Except Per Share Amounts and Ratios 2005 2004 2003 2002 2001

for tHe Year

Operating Revenues $13,578 $12,215 $11,551 $11,159 $10,830

Operating Income 1,795 1,295 2,133 2,253 2,018

Income from Continuing Operations 1,026 604 1,056 1,265 934

Income from Discontinued Operations (a) - - 255 76 32

Cumulative Effect of Accounting Change, Net of Taxes - - 274 - -

Net Income 1,026 604 1,585 1,341 966

Per Share

—

Basic:

Income from Continuing Operations 3.89 2.33 4.15 5.02 3.77

Income from Discontinued Operations - - 1.00 0.30 0.13

Cumulative Effect of Accounting Change, Net of Taxes - - 1.08 - -

Net Income 3.89 2.33 6.23 5.32 3.90

Per Share

—

Diluted:

Income from Continuing Operations 3.85 2.30 4.07 4.78 3.65

Income from Discontinued Operations - - 0.95 0.27 0.12

Cumulative Effect of Accounting Change, Net of Taxes - - 1.02 - -

Net Income 3.85 2.30 6.04 5.05 3.77

Dividends Declared Per Share 1.20 1.20 0.99 0.83 0.80

Capital Expenditures (b) 2,169 1,876 1,940 1,820 1,696

Operating Cash Flow 2,595 2,257 2,443 2,237 1,886

Free Cash Flow (c) 234 215 712 662 285

at Year-end

Total Assets $35,620 $34,596 $33,496 $32,772 $31,552

Total Debt 7,416 8,131 7,989 7,703 8,078

Common Shareholders’ Equity 13,707 12,655 12,354 10,651 9,575

Equity Per Common Share (d) 51.41 48.58 47.85 41.99 38.26

financial ratios (%)

Operating Margin 13.2 10.6 18.5 20.2 18.6

Operating Ratio 86.8 89.4 81.5 79.8 81.4

Lease Adjusted Debt to Capital (e) 43.6 45.1 44.8 51.7 55.0

Return on Average Common Shareholders’ Equity 7.8 4.8 13.8 13.3 10.6

(a) The Corporation’s trucking segment is presented as discontinued operations. 2003 results include a $211 million gain on sale, which includes an income tax benefit of $126 million.

(b) Capital expenditures include non-cash capital lease financings of $188 million, $126 million, and $124 million in 2003, 2002 and 2001, respectively. There were no non-cash capital

lease financings in 2005 and 2004.

(c) Free cash flow is defined as cash provided by operating activities, less cash used in investing activities, less dividends paid. 2003 results exclude proceeds from the Overnite IPO of

$620 million. See reconciliation in Item 7 of Form 10-K.

(d) Equity per common share is calculated as follows: common shareholders’ equity divided by common shares issued less treasury shares outstanding.

(e) Lease adjusted debt to capital is computed as follows: total debt plus convertible preferred securities plus net present value of leases divided by total debt plus equity plus convertible

preferred securities plus net present value of leases.

Union Pacific