Tesco 1999 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1999 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC ANNUAL REPORT 1999 11

Pension fund

The assets of the pension funds, established for the benefit of

the Group’s employees, are held separately from those of the

Group. Both the Tesco PLC Pension Scheme and the Tesco

PLC Money Purchase Pension Scheme are managed by a trustee

company. Its board comprises three executive directors, two

senior managers and four members appointed from staff and

pensioners. Management of the assets of the Tesco PLC Pension

Scheme is delegated to a number of independent fund

managers. Contributions to the Tesco PLC Money Purchase

Pension Scheme are paid into insurance policies administered

by the Equitable Life Assurance Society. There is no self-

investment in Tesco shares or property occupied by the Tesco

Group. Details of pension commitments are set out in note 26

to the financial statements on page 37.

Statement of compliance with the Code Provisions in the

Combined Code

Throughout the year ended 27 February 1999, the company

has been in compliance with all the Code Provisions set out in

Section 1 of the Combined Code on Corporate Governance,

except as detailed below.

Following the issuance of the Combined Code, the company

resolved in September 1998 that Mr G F Pimlott held the

position of senior independent non-executive director with

effect from 19 October 1998, as in accordance with

Code provision A.2.1.

With regard to Code provision B.1.7 on the length of directors’

service agreements, the Remuneration Committee considers

that the current length of two years is both appropriate and

necessary although it reviews the matter every year.

With regard to Code provision C.2.1, the company always

counts proxy votes but has not hitherto announced the proxy

votes lodged on each resolution although the company will

adopt this procedure with effect from the Annual General

Meeting on 4 June 1999.

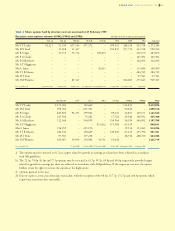

Board Committee membership Nominations Committee Remuneration Committee Audit Committee

Independent directors

Mr J A Gardiner * * *

Mr G F Pimlott * * *

Mr J W Melbourn * * *

Baroness O’Cathain * *

Mr C L Allen (a) **

Dr H Einsmann (b)

Executive directors

Mr T P Leahy *

a) Appointed to the Board on 19 February 1999

b) Appointed to the Board on 1 April 1999