Tecumseh Products 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Tecumseh Products annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

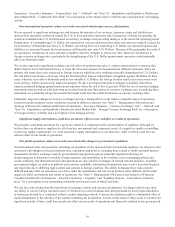

ITEM 6. SELECTED FINANCIAL DATA

The following is a summary of certain of our financial information. The Consolidated Statements of Operations for 2008 have

been restated to reflect the reclassification of the Electrical Components Group (with the exception of the Paris, Tennessee

operations), the Engine & Power Train Group, MP Pumps, and Manufacturing Data Systems, Inc. as discontinued operations.

Years Ended December 31,

(In millions, except share and per share data) 2012 2011 (c) 2010 (a)(c) 2009 (a)(c) 2008 (a)(b)(c)

Net sales................................................................................... $ 854.7 $ 864.4 $ 933.8 $ 735.9 $ 996.4

Cost of sales ..................................................................... (790.0)(826.5)(849.5)(687.6)(897.3)

Gross Profit.............................................................................. 64.7 37.9 84.3 48.3 99.1

Selling and administrative expenses ................................ (107.7)(108.1)(114.1)(125.2)(129.6)

Other income (expense), net............................................. 22.3 14.7 14.3 7.4 6.0

Impairments, restructuring charges, and other items ....... 40.6 (8.5)(50.3)(24.4)(43.8)

Operating income (loss) .......................................................... 19.9 (64.0)(65.8)(93.9)(68.3)

Interest expense ................................................................ (10.2)(10.5)(10.6)(10.8)(24.4)

Interest income ................................................................. 3.2 2.3 1.2 2.3 9.7

Income (loss) from continuing operations before taxes .......... 12.9 (72.2)(75.2)(102.4)(83.0)

Tax benefit........................................................................ 10.2 0.9 16.6 10.6 5.0

Income (loss) from continuing operations............................... 23.1 (71.3)(58.6)(91.8)(78.0)

(Loss) income from discontinued operations, net of tax.. (0.5)(1.9) 1.8 (1.6) 27.5

Net income (loss)..................................................................... $ 22.6 $ (73.2)$ (56.8)$ (93.4)$ (50.5)

Basic and diluted income (loss) per share:

Income (loss) from continuing operations ....................... $ 1.25 $ (3.86)$ (3.17)$ (4.97)$ (4.22)

(Loss) income from discontinued operations, net of tax.. (0.03)(0.10) 0.10 (0.09) 1.49

Net income (loss) per share ..................................................... $ 1.22 $ (3.96)$ (3.07)$ (5.06)$ (2.73)

Weighted average shares, basic and diluted (in thousands)..... 18,480 18,480 18,480 18,480 18,480

Cash dividends declared per share .......................................... $—$—$—$—$—

Cash and cash equivalents ....................................................... $ 55.3 $ 49.6 $ 65.9 $ 90.7 $ 113.1

Working capital........................................................................ $ 105.0 $ 107.4 $ 185.2 $ 149.8 $ 164.0

Property, plant and equipment, net.......................................... $ 157.0 $ 189.4 $ 234.9 $ 259.7 $ 253.7

Total assets............................................................................... $ 527.9 $ 563.7 $ 761.8 $ 767.1 $ 798.5

Long-term debt ........................................................................ $ 5.8 $ 4.8 $ 13.2 $ 8.0 $ 0.4

Stockholders’ equity................................................................ $ 258.4 $ 285.9 $ 434.9 $ 463.4 $ 477.4

Capital expenditures ................................................................ $ 13.8 $ 17.7 $ 9.2 $ 7.9 $ 8.0

Depreciation and amortization ................................................ $ 36.4 $ 40.5 $ 40.4 $ 45.2 $ 42.5

(a) Certain reclassifications have been made to prior results to conform to classifications used at December 31, 2011. These

classifications have no impact on net income.

(b) Adjusted from amounts reported in prior periods to reclassify our Paris, Tennessee operations from discontinued operations

to continuing operations to conform to current year consolidated statements of operations presentation. The reclassification

has the effect on income (loss) from continuing operations, net of tax, of $1.9 million, for the year ended December 31,

2008.

(c) In 2007, we issued a warrant to a lender to purchase 1,390,944 shares of our Class A Common Stock, at $6.05 per share,

which is equivalent to 7% of our fully diluted common stock (including both Class A and Class B shares). This warrant is

not included in diluted earnings per share, as the effect would be antidilutive. This warrant expired on April 9, 2012

without the purchase or issuance of additional shares.