TD Bank 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Leading the way...

152nd Annual Report 2007

Over the last ve years, TD

power of TD’s diversied Canadian Wealth Management

A look at the nancial and

non-nancial indicators that

Table of contents

-

Page 1

Leading the way... 152nd Annual Report 2007 -

Page 2

...: TD Bank Financial Group Best-in-class Canadian retail operations Wholesale bank delivering high return on invested capital Focused U.S. growth strategy A Top 10 Bank in North America by Market Capitalization Over 4.5 million Online Banking Customers CDN $422.1 billion in Assets (October... -

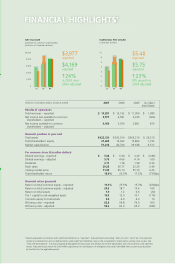

Page 3

... end Total assets Total shareholders' equity Market capitalization Per common share (Canadian dollars) Diluted earnings - reported Diluted earnings - adjusted Dividends Book value Closing market price Total shareholder return Financial ratios (percent) Return on total common equity - reported Return... -

Page 4

...great franchise businesses and has made us a top three dealer in Canada. TD Securities' client Shaw Communications also understands the value of forward thinking. They've been blazing trails for over 40 years. Delivering a Great Customer Experience TD Canada Trust's leading retail branch network is... -

Page 5

... most often this year by the investment community and TD employees. p11 Statement of Corporate Governance Practices Information about our corporate governance structure and our Board's responsibilities, members and committees. MORE ABOUT US p9 TD's Performance Indicators A look at the financial... -

Page 6

... in our people and company," says JR. "In the 40's, my dad banked with TD because they understood his business. I continued to bank with TD not only because they had confidence in the cable industry, but because they had confidence in us." 2 TD BANK FINANCIAL GROUP ANNUAL REPORT 2007 TDBFG Stories -

Page 7

...Banking Model At TD's core is a Canadian retail branch network built on best-in-class convenience and service. We have #1 or #2 market share in most retail products. That's why we keep significantly outgrowing our peers in both revenue and profits. Relentless Focus on the Customer Shareholder value... -

Page 8

... TD Securities continued to gain recognition as an industry leader through some high profile underwriting deals. They were also supported by a 20% increase in invested capital. All this momentum is helping solidify their position as a top 3 dealer in Canada. 4 TD BANK FINANCIAL GROUP ANNUAL REPORT... -

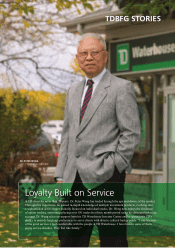

Page 9

... investment products, evolving into a sophisticated active trader. Initially focused on individual stocks, Dr. Wong now enjoys the challenge of option trading, sometimes placing over 150 trades in a three month period using his discount brokerage account. Dr. Wong relies on support from his TD... -

Page 10

...award for best customer service. We were also ranked highest in customer satisfaction among Canadian banks by J. D. Power and Associates. Serving Diverse Communities TD is committed to meeting the needs of our diverse customer base. Our network of multi-language ABMs, convenient branch locations in... -

Page 11

... have a bank that can outperform. That's exactly what TD has done. How do you know TD's strategy is working? Just look at what TD businesses consistently deliver. Our core franchise is a Canadian retail branch network built on convenience and service. In the last 5 years alone, TD Canada Trust has... -

Page 12

... Wholesale business, and you see the power of our franchise. This is an enormously exciting time for TD. We're facing a new frontier as we show the world we are quickly becoming a North American powerhouse. W. Edmund Clark President and Chief Executive Officer 8 TD BANK FINANCIAL GROUP ANNUAL... -

Page 13

... 1% of domestic pre-tax proï¬ts (ï¬ve year average) to charitable and not-for-proï¬t organizations Make positive contributions by: - Supporting employees' community involvement and fundraising efforts - Promoting children's health, literacy and education • 1.3% or $32.6 million, in donations... -

Page 14

... for having the Best Disclosure Policy in 2007. This year the Canadian Coalition for Good Governance also identified TD as having best practices in director and executive share ownership guidelines, director performance assessment, and relating company performance to executive compensation. These... -

Page 15

... Shareholders Shareholders' Auditor REPORT ELECT Corporate Governance Committee APPOINT Audit Committee Board of Directors APPOINT Management Resources Committee APPOINT Risk Committee Management TD BANK FINANCIAL GROUP ANNUAL REPORT 2007 Statement of Corporate Governance Practices 11 -

Page 16

...Director and Retired Vice Chairman Eastman Kodak Company Charleston, South Carolina William J. Ryan Chairman TD Banknorth Inc., Portland, Maine Helen K. Sinclair Chief Executive Ofï¬cer BankWorks Trading Inc., Toronto, Ontario John M. Thompson Chairman of the Board The Toronto-Dominion Bank Toronto... -

Page 17

...Expenses Taxes Quarterly Financial Information BUSINESS SEGMENT ANALYSIS Balance Sheet Review Credit Portfolio Quality Capital Position Off-balance Sheet Arrangements Financial Instruments RISK FACTORS AND MANAGEMENT 24 28 32 36 39 42 Business Focus Canadian Personal and Commercial Banking Wealth... -

Page 18

... banking products and services. The Bank's operations and activities are organized around operating groups: Canadian Personal and Commercial Banking; Wealth Management; U.S. Personal and Commercial Banking; and Wholesale Banking. HOW THE BANK REPORTS The Bank prepares its financial statements... -

Page 19

... charge in TD Banknorth Wholesale Banking restructuring charge Change in fair value of credit default swaps hedging the corporate loan book12 General allowance release Non-core portfolio loan loss recoveries (sectoral related) Loss on structured derivative portfolios Tax charges related to... -

Page 20

...the Bank Reports" section. TABLE 4 RECONCILIATION OF ECONOMIC PROFIT, RETURN ON INVESTED CAPITAL AND ADJUSTED NET INCOME 2007 2006 2005 (millions of Canadian dollars) Average common equity Average cumulative goodwill/intangible assets amortized, net of income taxes Average invested capital Rate... -

Page 21

...33 per TD Banknorth share for a total cash consideration of $3.7 billion (US$3.3 billion). The acquisition has been accounted for by the purchase method. On closing, TD Banknorth became a wholly-owned subsidiary of the Bank and TD Banknorth's shares were delisted from the New York Stock Exchange. As... -

Page 22

... rate Average balance 1 (millions of Canadian dollars) 2006 Interest Average rate Average balance Interest 2005 Average rate Earning assets Deposits with banks Securities Trading Non-trading Investment Total securities Securities purchased under reverse repurchase agreements Loans Mortgages... -

Page 23

... 2005 % change (millions of Canadian dollars) Investment and securities services: Discount brokerage Securities and full service brokerage Mutual funds Credit fees Net securities gains Trading income (loss) Income from financial instruments designated as trading under the fair value option Service... -

Page 24

...'s mutual funds and higher sales force compensation in advice-based businesses. The decrease in expenses in the Wholesale Banking business was mainly due to lower expenses related to the exit of certain structured product businesses. NON-INTEREST EXPENSES (millions of Canadian dollars) EFFICIENCY... -

Page 25

.... TD reports its investments in TD Ameritrade using the equity method of accounting; tax expense of $173 million for the year is not part of the tax rate reconciliation. TA B L E 10 TAXES 2007 2006 2005 (millions of Canadian dollars) Income taxes at Canadian statutory income tax rate Increase... -

Page 26

... gain on Ameritrade transaction, net of costs Balance sheet restructuring charge in TD Banknorth Wholesale Banking restructuring charge Change in fair value of credit default swaps hedging the corporate loan book Tax charges related to reorganizations Other tax items Loss on structured derivative... -

Page 27

... in TD Banknorth Wholesale Banking restructuring charge TD Banknorth restructuring, privatization and merger-related charges Change in fair value of credit default swaps hedging the corporate loan book Other tax items Initial set up of specific allowance for credit card and overdraft loans General... -

Page 28

... and a network of 1,070 branches located across Canada. TD Commercial Banking serves the needs of medium-sized Canadian businesses, customizing a broad range of products and services to meet their financing, investment, cash management, international trade and day-today banking needs. Under the TD... -

Page 29

...Personal and Commercial Banking accounts for the transactions as though they are financing arrangements. Accordingly, the interest income earned on the assets sold net of the funding costs incurred by the purchaser trusts is recorded in net interest income and the provision for credit losses related... -

Page 30

... loss on the acquisition of Hudson by TD Banknorth Wholesale Banking restructuring charge Balance sheet restructuring charge in TD Banknorth TD Banknorth restructuring, privatization and merger-related charges Change in fair value of credit default swaps hedging the corporate loan book Other tax... -

Page 31

... Canadian economy was consumer spending, which was supported by 30-year low unemployment rates, strong gains in wages and gains in home equity due to further price appreciation. On the corporate side, profits as a share of the national economy were near record highs, while the high Canadian dollar... -

Page 32

... the U.S.). Under the TD Canada Trust brand, the retail operations provide a full range of financial products and services to approximately 11 million personal and small business customers. $2,253 (millions of Canadian dollars) 51.6% (percent) NET INCOME EFFICIENCY RATIO $2,500 60% 2,000... -

Page 33

... that include furthering customer service, our leading position in branch hours and continuing to lead the industry in new branch openings. Maintained #1 market share position in personal deposits and personal loans (including cards). Gained market share in Business Banking and Insurance. Achieved... -

Page 34

... average. Customer retention remained very strong. • • Merchant services offers point-of-sale settlement solutions for debit and credit card transactions, supporting over 100,000 business locations across Canada. In 2007, TD Canada Trust completed Canada's first interact debit card transaction... -

Page 35

... will benefit from the increased leadership position in branch hours and new branch and marketing investments, as well as improved customer cross-sell and productivity improvements. PCL rates as a function of loan volumes are expected to reflect evolving conditions in the Canadian economy. Expense... -

Page 36

... 2 3 Assets under management: Assets owned by customers, managed by the Bank, where the Bank makes investment selections on behalf of the client (in accordance with an investment policy). In addition to the TD family of mutual funds, the Bank manages assets on behalf of individuals, pension funds... -

Page 37

... Canadian banks continue to compete actively in the mutual fund industry by leveraging their distribution networks. • In Canada, TD Waterhouse's strategic leadership in reducing prices in its discount brokerage operation has changed the competitive landscape, as many bank-owned discount businesses... -

Page 38

... 2005 (millions of Canadian dollars) Canadian Wealth TD Ameritrade / TD Waterhouse U.S.A. Net income $ 501 261 $ 762 $ 410 180 $ 590 $ 324 108 $ 432 KEY PRODUCT GROUPS TD Waterhouse Discount Brokerage • A leader in self-directed investing, serving customers in Canada and the United Kingdom... -

Page 39

...be supportive to investment inflows in the coming year. Economic uncertainly may encourage a temporary shift towards more defensive financial asset holdings. An aging population should continue to work in favour of financial planning and wealth management. TD BANK FINANCIAL GROUP ANNUAL REPORT 2007... -

Page 40

...Operating under the TD Banknorth brand name, U.S. Personal and Commercial Banking offers a full range of banking services and products, including commercial, consumer, wealth management and insurance agency services. $320 (millions of Canadian dollars) 62.7% (percent) NET INCOME EFFICIENCY RATIO... -

Page 41

... a full array of deposit products to individuals, businesses and governments including, chequing, savings, money-market, term investment, merchant services and cash management products designed to meet the needs of the customer. • • • • • • Closed the acquisition of Interchange on... -

Page 42

...of Commercial Loans and Core Deposits, while keeping strong credit quality and competitive pricing. • Continue to deliver customer service that is above and beyond customer expectations. • Manage expenses to support positive operating leverage. • Improve efficiency by streamlining key business... -

Page 43

...06 07 0 05 06 07 Revenue evenue (millions of Canadian dollars) 2007 2006 2005 Corporate banking Investment banking and capital markets Equity investments Total $ 337 1,793 364 $ 287 1,617 367 $ 266 1,467 255 $ 2,494 $ 2,271 $ 1,988 TD BANK FINANCIAL GROUP ANNUAL REPORT 2007 Man ag em en... -

Page 44

... a wholesale bank that offers innovative solutions and ideas which span across products and regions. OVERALL BUSINESS STRATEGY • • • Solidify position as a top 3 dealer in Canada: - Protect the #1/#2 market share rankings in equity block and fixed-income trading. - Increase share of equity... -

Page 45

... $100 million related to loss on structured derivative portfolios and $29 million related to restructuring charge. KEY PRODUCT GROUPS Investment Banking and Capital Markets • Investment banking and capital markets revenue, which includes advisory, underwriting, trading, facilitation and execution... -

Page 46

...'s key businesses operate efficiently, reliably and in compliance with all applicable regulations. To accomplish this, corporate management endeavours to have the best people, processes and tools to support our businesses, customers, employees and shareholders. 42 TD BANK FINANCIAL GROUP ANNUAL... -

Page 47

... of automotive purchase financing and consumer installment loans. On January 24, 2006, the Bank closed the transaction involving the sale of its U.S. brokerage business, TD Waterhouse U.S.A. to Ameritrade Holding Corporation at a fair market value of $2.69 billion in exchange for a 32.5% ownership... -

Page 48

...of the new branch openings and an expanded sales force. The efficiency ratio for 2006 was 54.8%, a 150bps improvement over 2005. Wealth Management net income for 2006 was $590 million, compared with $432 million in 2005, an increase of 37% which came from the equity share in TD Ameritrade and growth... -

Page 49

... the $153 million loss in 2005, investment banking and capital markets revenue was flat year over year as strong trading revenue in foreign exchange and significant growth in equity commissions and merger and acquisitions revenue was offset by lower interest rate and credit trading and debt and... -

Page 50

... market movements, proprietary trading strategies and the impact of the strengthening Canadian dollar during the year Securities purchased under resale agreements declined by $3.3 billion, down 11% from 2006, reflecting reduced balances in Wholesale Banking. Loans (net of allowance for credit losses... -

Page 51

GROUP FINANCIAL CONDITION LOAN PORTFOLIO Overall in 2007, the Bank's credit quality remained stable due to strong Canadian market conditions, established business and risk management strategies and a continuing low interest rate environment. The Bank experienced a relatively low level of new ... -

Page 52

...1.8 100.0% 1 (millions of Canadian dollars, except percentage amounts) Canada Residential mortgages Consumer installment and other personal Total residential and personal Real estate development Commercial and industrial Residential Retail Real estate services Total real estate Agriculture Apparel... -

Page 53

...NET OF ALLOWANCE FOR CREDIT LOSSES BY LOCATION OF ULTIMATE RISK Percentage of total 2007 2006 2005 2007 2006 2005 (millions of Canadian dollars, except percentage amounts) Canada Atlantic Québec Ontario Prairies British Columbia Total Canada United States Other International United Kingdom Europe... -

Page 54

...loans Total business and government Total Canada United States Residential mortgages Consumer installment and other personal Total residential and personal Real estate development Commercial and industrial Residential Shopping Centres Real Estate Services...50 TD BANK FINANCIAL GROUP ANNUAL REPORT ... -

Page 55

... and type of security. Specific allowances for credit losses are established to reduce the book value of loans to estimated realizable amounts in the normal course of business. Specific allowances for the wholesale and commercial portfolios are borrower specific and reviewed quarterly. For... -

Page 56

... Total Canada United States Other International United Kingdom Australia Asia Total Other International General provision Total Provision for credit losses as a % of net average loans2 Canada Residential mortgages Personal Business and other Total Canada United States Other International General... -

Page 57

...PROVISIONS FOR CREDIT LOSSES BY INDUSTRY SECTOR 1 (millions of Canadian dollars, except percentage amounts) 2007 2006 2005 2007 Percentage of total 2006 2005 Canada Residential mortgages Consumer installment and other personal Total residential and personal Real estate development Commercial and... -

Page 58

... adverse economic or operational conditions, and investment capital that has been used to fund acquisitions or investments in fixed assets. The Bank uses internal models to determine how much riskbased capital is required for credit, market, trading, banking book interest rate, operational, business... -

Page 59

...$85 million from the dividend reinvestment plan; the Bank repurchased five million common shares at a cost of $356 million in 2007 through a normal course issuer bid; a subsidiary of the Bank issued US$500 million REIT preferred stock; and TD Mortgage Investment Corporation, a subsidiary of the Bank... -

Page 60

... Committee. The Committee is responsible for the review of structured transactions and complex credits with potentially significant reputational, legal, regulatory, accounting or tax risks, including transactions involving SPEs. 56 TD BANK FINANCIAL GROUP ANNUAL REPORT 2007 M a na ge me nt's D is... -

Page 61

... to the assets' full operational, financial and market risks. TA B L E 34 TOTAL OUTSTANDING EXPOSURES SECURITIZED BY THE BANK AS AN ORIGINATOR (millions of Canadian dollars) October 31, 2007 Residential mortgage loans Personal loans Credit card loans Commercial mortgage loans Total Securitized... -

Page 62

... Over 5 years Total 2006 Total (millions of Canadian dollars) Deposits1 Subordinated notes and debentures Operating lease commitments Capital lease commitments Capital trust securities Network service agreements Automated banking machines Contact centre technology Software licensing and equipment... -

Page 63

... The Bank's performance is impacted by the level of competition in the markets in which it operates. The Bank currently operates in a highly competitive industry. Customer retention can be influenced by many factors, such as the pricing of products or services, changes in customer service levels and... -

Page 64

...are exposed and assess the impact and likelihood of those risks. We respond by developing business and risk management strategies for our various business units taking into consideration the risks and business environment in which we operate. 60 TD BANK FINANCIAL GROUP ANNUAL REPORT 2007 M a na ge... -

Page 65

...owning and managing risk. • Set and implement policies consistent with enterprise-level policy. Executive Committees Business Performance Review Committee • Chaired by the President and Chief Executive Officer. • Reviews overall strategies and operating performance. Operational Risk Oversight... -

Page 66

... inter-company information flow. In addition to regular communication at the Chief Executive Officer level, monthly operating reviews of TD Ameritrade permit the Bank to examine and discuss their operating results and key risks. As well, certain functions, such as Internal Audit, Finance and... -

Page 67

... key risk parameters that are used in our credit risk models. Unanticipated economic or political changes in a foreign country could affect cross-border payments for goods and services, loans, dividends, trade-related finance, as well as repatriation of the Bank's capital in that country. The Bank... -

Page 68

..., recommend changes to risk policies, review underwriting inventories, and review the usage of capital and assets in Wholesale Banking. HOW WE MANAGE MARKET RISK IN TRADING ACTIVITIES Managing market risk plays a key part in the assessment of any business strategy. We begin new trading operations or... -

Page 69

... using the market price and rate changes of the most recent 259 trading days. VaR is then computed as the threshold level that portfolio losses are not expected to exceed more than one out of every 100 trading days. The accompanying graph discloses daily VaR. Value-at-Risk (millions of Canadian... -

Page 70

... in foreign operations, and when our foreign currency assets are greater or less than our liabilities in that currency, they create a foreign currency open position. An adverse change in foreign exchange rates can impact our reported net income and equity, and also our capital ratios. Our objective... -

Page 71

...risk policy, but the major operating areas measure and manage liquidity risks as follows: •฀ The Treasury and Balance Sheet Management Department is responsible for consolidating and reporting the Bank's global liquidity risk position and for managing the Canadian Personal and Commercial Banking... -

Page 72

... value, operating efficiently and providing reliable, secure and convenient access to financial services. This involves ensuring we maintain an effective operational risk management framework of policies, processes, resources and internal controls for managing operational risk to acceptable levels... -

Page 73

...to address gaps. Based upon these attestations, the Chief Compliance Officer provides an annual LCM certification to the Audit Committee of the Board. Finally, while it is not possible to completely eliminate legal risk, the Legal Department also works closely with business units and other corporate... -

Page 74

... value of financial instruments, accounting for income taxes, accounting for securitizations and variable interest entities, the valuation of goodwill and other intangibles, accounting for pensions and post-retirement benefits, and contingent liabilities. 70 TD BANK FINANCIAL GROUP ANNUAL REPORT... -

Page 75

...3 to the Bank's Consolidated Financial Statements for additional disclosures regarding the Bank's allowance for credit losses. FAIR VALUE OF FINANCIAL INSTRUMENTS The fair value of publicly traded financial instruments is based on published market prices, adjusted for daily margin settlements, where... -

Page 76

... accounting policy impacts Canadian Personal and Commercial Banking, Wholesale Banking and the Corporate segment. VALUATION OF GOODWILL AND OTHER INTANGIBLES Under GAAP, goodwill is not amortized, but is instead assessed for impairment at the reporting unit level annually, and if an event or change... -

Page 77

...determined by management and are reviewed annually by the Bank's actuaries. These assumptions include the discount rate, the rate of compensation increase, the overall health care cost trend rate and the expected long-term rate of return on plan assets. The discount rate used to value liabilities is... -

Page 78

... STANDARDS AND POLICIES U.S. GAAP Defined Benefit Pension and Other Post-retirement Plans The Bank adopted the Financial Accounting Standards Board Statement No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans on October 31, 2007. Effective November 1, 2008... -

Page 79

...was performed under the supervision and with the participation of the Bank's management, including the Chief Executive Officer and Chief Financial Officer, of the effectiveness of the Bank's disclosure controls and procedures, as defined in the rules of the SEC and Canadian Securities Administrators... -

Page 80

...a well-defined division of responsibilities and accountability for performance, and the communication of policies and guidelines of business conduct throughout the Bank. Management has assessed the effectiveness of the Bank's internal control over financial reporting as at October 31, 2007 using the... -

Page 81

... an opinion on the Bank's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance... -

Page 82

... deposits with banks Securities (Note 2) Trading Designated as trading under the fair value option Available-for-sale Held-to-maturity Investment Securities purchased under reverse repurchase agreements Loans (Note 3) Residential mortgages Consumer installment and other personal Credit card Business... -

Page 83

... instruments designated as trading under the fair value option Service charges Loan securitizations (Note 4) Card services Insurance, net of claims (Note 18) Trust fees Other (Note 28e) Total revenue Provision for credit losses (Note 3) Non-interest expenses Salaries and employee benefits (Note... -

Page 84

... (millions of Canadian dollars) Net income Other comprehensive income (loss), net of income taxes Change in unrealized gains and (losses) on available-for-sale securities, net of hedging activites1 Reclassification to earnings in respect of available-for-sale securities2 Change in foreign currency... -

Page 85

... and equipment Securities purchased under reverse repurchase agreements TD Banknorth share repurchase program (Note 28) Acquisitions and dispositions less cash and cash equivalents acquired (Note 28) Net cash used in investing activities Effect of exchange rate changes on cash and cash equivalents... -

Page 86

... OF SIGNIFICANT ACCOUNTING POLICIES CASH AND CASH EQUIVALENTS Cash and cash equivalents consist of cash and amounts due from banks. These deposits are issued by investment grade financial institutions. REVENUE RECOGNITION Investment and securities services includes asset management, administration... -

Page 87

...facilitate a better understanding of the Bank's Consolidated Financial Statements, significant accounting policies are disclosed in the notes, where applicable, with related financial disclosures. A listing of all the notes is as follows: TD BANK FINANCIAL GROUP ANNUAL REPORT 2007 Fin anci al Resul... -

Page 88

... for Preferred Shares and Capital Trust Securities Share Capital Accumulated Other Comprehensive Income Stock-based Compensation Employee Future Benefits Trading-related Income Insurance Restructuring Costs Income Taxes Earnings Per Share Fair Value of Financial Instruments Interest Rate Risk... -

Page 89

... of the insurance reserve is based on a discount factor using a weighted average yield, with changes in the discount factor being recorded in the Consolidated Statement of Income. By designating the securities as trading under the fair value option, the unrealized gain or loss on the securities will... -

Page 90

... 50 78 Equity securities Preferred shares Common shares Total securities designated as trading under the fair value option Available-for-sale securities Government and government-insured securities Canada Mortgage-backed securities Provinces $ 4,636 2,253 6,889 - 6,889 Other debt securities Canadian... -

Page 91

...and government-insured securities Canada Mortgage-backed securities Provinces Other debt securities Canadian issuers U.S. Federal Government Other foreign governments Other issuers - - - - - Equity securities Preferred shares Common shares - - - Total investment securities Total securities 1 $ 22... -

Page 92

...772 Equity securities in the available-for-sale portfolio with a carrying value of $946 million do not have quoted market prices and are carried at cost. The fair value of these equity securities was $1,636 million and is disclosed in the table above. 88 TD BANK FINANCIAL GROUP ANNUAL REPORT 2007... -

Page 93

... Impaired Loans (millions of Canadian dollars) 2007 2006 2005 LOANS Loans (other than business and government loans designated as trading under the fair value option, described below) are recorded at amortized cost using the effective interest rate method, net of an allowance for credit losses and... -

Page 94

...For personal and small business loans and credit card loans, specific provisions are calculated using a formula taking into account recent loss experience. Specific provisions for credit card loans are recorded when account balances are 90 days in arrears. Credit card loans with payments 180 days in... -

Page 95

...future expected cash flows using management's best estimates of key assumptions - credit losses, New Securitization Activity (millions of Canadian dollars) Residential mortgage loans Personal loans Credit Commercial card mortgage loans loans prepayment rates, forward yield curves and discount rates... -

Page 96

... to reporting units that are either the operating business segment or the reporting unit below the segGoodwill by Segment (millions of Canadian dollars) 2007 Canadian Personal and Commercial Banking Wealth Management U.S. Personal and Commercial Banking Wholesale Banking Total Carrying value of... -

Page 97

...FINANCIAL TRANSACTIONS The Bank enters into structured transactions with VIEs to assist corporate clients in accessing cost efficient financing. Generally both the Bank and the client invest in such VIEs with the proceeds used to make loans to entities affiliated with the client. The Bank is not the... -

Page 98

... payable on a fixed date of maturity purchased by customers to earn interest over a fixed period. The terms are from one day to 10 years. Accrued interest on deposits, Deposits by Type (millions of Canadian dollars) 2007 Demand Notice Term Total 2006 Total Personal Banks Business and government... -

Page 99

..., Financial Instruments - Disclosure and Presentation, the Bank classifies preferred shares and capital trust securities, convertible into a variable number of the Bank's common shares at the holder's option, as liabilities for reporting purposes. TD BANK FINANCIAL GROUP ANNUAL REPORT 2007 Fin anci... -

Page 100

Liabilities (millions of Canadian dollars) 2007 2006 Preferred Shares Preferred shares issued by the Bank (thousands of shares): Class A - 16 Series I Class A - 14,000 Series M Class A - 8,000 Series N Preferred shares issued by TD Mortgage Investment Corporation (thousands of shares): 350 non-... -

Page 101

...of the closing price of such TD CaTS II on the last trading day immediately before the date fixed for purchase. The Bank has not issued any non-cumulative Class A redeemable First Preferred Shares, Series A2 as at October 31, 2007. Each TD CaTS II may be automatically exchanged into 40 noncumulative... -

Page 102

... of the plan, cash dividends on common shares are used to purchase additional common shares. At the option of the Bank, the common shares may be issued from the Bank's treasury at an average market price based on the last five trading days before the date of the dividend payment, with a discount of... -

Page 103

... common shares for the ESP in the open market. TD BANKNORTH As a result of the TD Banknorth privatization, 7.7 million TD Banknorth stock options were converted into 4.1 million TD Bank stock options using the exchange ratio set out in the merger agreement. The fair value of the converted options... -

Page 104

... on the plan's assets, compensation increases, retirement ages of employees and estimated health care costs. The discount rate used to value liabilities is based on long-term corporate AA bond yields as of the valuation date. The expense includes the cost of benefits for the current year's service... -

Page 105

... Bank's principal pension plan are managed utilizing a balanced approach with the primary objective of achieving a real rate of return of 3%. Accordingly, the allowable asset mix ranges are detailed in the following table: Asset Mix Security Acceptable range Equity Debt Alternative investments Cash... -

Page 106

... limited post-retirement benefit programs which provide TD Banknorth Plan Obligations and Assets (millions of Canadian dollars) medical coverage and life insurance benefits to a closed group of employees and directors who meet minimum age and service requirements. The plan assets and obligations... -

Page 107

...-pension post-retirement benefit plans are as follows: Plan Contributions (millions of Canadian dollars) 2007 2006 2005 Principal pension plan CT Defined Benefit Pension Plan TD Banknorth Defined Benefit Pension Plan Supplemental employee retirement plans Non-pension post-retirement benefit plans... -

Page 108

... Plan, $40 million to the TD Banknorth Defined Benefit Pension Plan, $12 million to the Bank's supplemental employee retirement plans and $12 million for the principal non-pension post-retirement benefit plans. Future contribution amounts may change upon the Bank's review of its contribution levels... -

Page 109

.... Future income tax assets and liabilities are determined based on the tax rates that are expected to apply Provision for (Benefit of) Income Taxes1 (millions of Canadian dollars) 2007 2006 2005 Provision for income taxes - Consolidated Statement of Income Current income taxes Future income taxes... -

Page 110

...net future tax asset which is reported in other assets is composed of: Net Future Tax Asset (millions of Canadian dollars) 2007 2006 Future income tax assets Allowance for credit losses Premises and equipment Deferred income Securities Goodwill Employee benefits Other Total future income tax assets... -

Page 111

... were originated and changes in the creditworthiness of individual borrowers. For fixed-rate performing loans, estimated fair value is determined by discounting the expected future cash flows related to these loans at market interest rates for loans with similar credit risks. The fair value of loans... -

Page 112

... (millions of Canadian dollars) Carrying Value 2007 Fair Value Carrying Value 2006 Fair Value Financial Assets Cash and due from banks Interest-bearing deposits with banks Securities Trading Designated as trading under the fair value option Available-for-sale Held-to-maturity Investment Securities... -

Page 113

...Loans designated as trading under the fair value option Other Total assets Liabilities and shareholders' equity Trading deposits Other deposits Effective yield Obligations related to securities sold short Obligations related to securities sold under repurchase agreements Effective yield Subordinated... -

Page 114

...credit spreads, commodity prices, equities or other financial measures. Such instruments include interest rate, foreign exchange, equity, commodity and credit derivative contracts. The Bank uses these instruments to manage the risks associated with its funding and investing strategies or for trading... -

Page 115

..., futures, swaps and options, such as precious metals and energy-related products in both over-the-counter and exchange markets. The Bank issues certain loan commitments to customers at a fixed price. These funding commitments are accounted for as derivatives if there is past practice of selling the... -

Page 116

... (millions of Canadian dollars) Average fair value for the year Positive Negative 1 2007 Year-end fair value Positive Negative 2006 Year-end fair value Positive Negative Derivative financial instruments held or issued for trading purposes: Interest rate contracts Futures Forward rate agreements... -

Page 117

...-RELATED RISKS Market Risk Derivative instruments, in the absence of any compensating upfront cash payments, generally have no market value at inception. They obtain value, positive or negative, as relevant interest rates, foreign exchange rates, equity, commodity or credit prices or indices change... -

Page 118

...the Bank's maximum derivative credit exposure. The credit equivalent amount is the sum of the current replacement cost and the potential future exposure, which is calculated by applying Credit Exposure of Derivative Financial Instruments (millions of Canadian dollars) factors supplied by the Office... -

Page 119

... make funds available for the financing needs of customers. The Bank's policy for requiring collateral security with respect to these contracts and the types of collateral security held is generally the same as for loans made by the Bank. Financial and performance standby letters of credit represent... -

Page 120

...Bank to make payments to a third party based on changes in an underlying interest rate, foreign exchange rate, equity or commodity instrument, index or other variable that is related to an asset, a liability or an equity security of the counterparty, are initially measured and recorded at fair value... -

Page 121

... Credit Risk Exposure (millions of Canadian dollars) 2007 2006 Cash and due from banks Interest-bearing deposits with banks Securities Trading Designated as trading under fair value option Available-for-sale Held-to-maturity Investment Securities purchased under reverse repurchase agreements Loans... -

Page 122

..., assets and liabilities generated by the businesses in that segment. Due to the complexity of the Bank, its management reporting model uses various estimates, assumptions, allocations and risk-based methodologies for funds transfer pricing, inter-segment revenue, income tax rates, capital, indirect... -

Page 123

... which the business is conducted and the location of the customer. (millions of Canadian dollars) Income before provision for income taxes, noncontrolling interests, net of tax & equity in net income of associated company 2007 Total revenue Net income Total assets Canada United States Other... -

Page 124

... Lillooet Limited (Lillooet), a company sponsored by Royal Bank of Canada, pursuant to which the Bank hedged the price risk related to 27 million shares of TD Ameritrade common stock. The number of shares hedged and the hedge price were determined based on market conditions over a specified hedging... -

Page 125

... Bank offers deferred share and other plans to non-employee directors, executives and certain other key employees. See Note 15, Stock-based Compensation, for more details. In the ordinary course of business, the Bank also provides various banking services to associated and other related corporations... -

Page 126

... Canada (millions of Canadian dollars) Canada Address of Head or Principal Office As at October 31, 2007 Carrying value of shares owned by the Bank CT Financial Assurance Company First Nations Bank of Canada (9%) Meloche Monnex Inc. Security National Insurance Company Primmum Insurance Company TD... -

Page 127

... International (millions of Canadian dollars) United States Address of Head or Principal Office As at October 31, 2007 Carrying value of shares owned by the Bank TD Discount Brokerage Acquisition LLC TD AMERITRADE Holding Corporation (7.47%) TD Discount Brokerage Holdings LLC TD AMERITRADE Holding... -

Page 128

... Review Condensed Consolidated Balance Sheet (millions of Canadian dollars) 1 2007 2006 2005 Assets Cash resources and other Securities Securities purchased under reverse repurchase agreements Loans (net of allowance for credit losses) Other Total Liabilities Deposits Other Subordinated... -

Page 129

... "items of note", net of tax, from reported results) and related terms are not defined terms under GAAP and therefore, may not be comparable to similar terms used by other issuers. For further explanation, see "How the Bank Reports" in the accompanying Management's Discussion and Analysis. Adjusted... -

Page 130

... Mutual Funds record keeping business Special Investment Real Estates Gains General Reserves Changes in fair value of credit default swaps hedging the corporate loan book General allowance release Non-core portfolio loan loss recoveries (sectoral related) Loss on structured derivative portfolios Tax... -

Page 131

... the number of employees on an average full-time equivalent basis. Prior to 2002, the number of employees is on an "as at" full-time equivalent basis. Includes retail bank outlets, private client centre branches, and estates and trusts branches. 127 TD BANK FINANCIAL GROUP ANNUAL REPORT 2007... -

Page 132

...asset-backed securities to investors to fund the purchase of loans. Swaps: Contracts that involve the exchange of fixed and floating interest rate payment obligations and currencies on a notional principal for a specified period of time. Total Market Return: The change in market price plus dividends... -

Page 133

... payments in U.S. funds by contacting the Bank's transfer agent. Dividends will be exchanged into U.S. funds at the Bank of Canada noon rate on the fifth business day after record date, or as otherwise advised by the Bank. Dividend information for 2008 is available at www.td.com under Investor... -

Page 134

... Fisher Office of the Ombudsman Finance Shared Services William R. Gazzard Compliance Phillip D. Ginn Technology Solutions Alan J. Jette Treasury and Balance Sheet Management Paul N. Langill Trading Risk CANADIAN PERSONAL AND COMMERCIAL BANKING Bernard T. Dorval Paul C. Douglas Group Head Business... -

Page 135

... J. Furlong Business Market Risk Management John Gisborne Credit Products Group Martine M. Irman Global Foreign Exchange and Money Markets Drew E. MacIntyre Investment Banking Patrick B. Meneley Investment Banking Bimal Morjaria Equity Derivatives Trading Brendan J. O'Halloran TD Securities USA... -

Page 136

... and benefit plan improvements, and enhancing our Employee Savings Plan - making it the best program in the industry. • We also invested more than $68 million in training and year by countless hours of volunteerism, pitching in for initiatives such as the Children's Miracle Network, the TD Canada... -

Page 137

...we are at TD. We invest in our businesses, people and in the communities where we live and work. That's why we also understand and support our customers' plans to build for tomorrow. Fostering Workplace Diversity At TD, diversity is about improving the value of the Bank for future generations. This... -

Page 138

... Group serves more than 14 million customers in four key businesses operating in a number of locations in key ï¬nancial centres around the globe: Canadian Personal and Commercial Banking, including TD Canada Trust; Wealth Management, including TD Waterhouse and an investment in TD Ameritrade...