Suzuki 1999 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1999 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

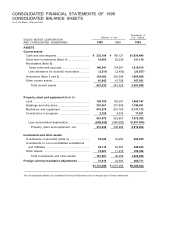

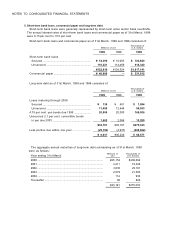

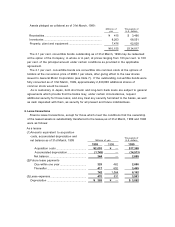

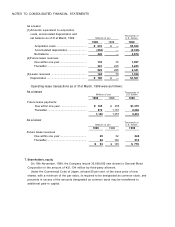

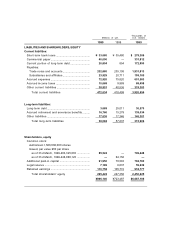

Assets pledged as collateral as of 31st March, 1999:

Millions of Thousands of

yen U.S. dollars

Receivables ........................................................................... ¥ 415 $ 3,466

Inventories ............................................................................ 8,263 68,551

Property, plant and equipment ........................................... 7,476 62,020

¥16,155 $134,017

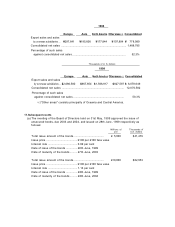

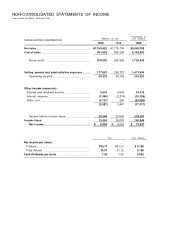

The 2.1 per cent. convertible bonds outstanding as of 31st March, 1999 may be redeemed

at the option of the Company, in whole or in part, at prices ranging from 103 per cent. to 100

per cent. of the principal amount under certain conditions as provided in the applicable

agreement.

The 2.1 per cent. convertible bonds are convertible into common stock at the options of

holders at the conversion price of ¥609.1 per share, after giving effect to the new shares

issued to General Motor Corporation (see Note 7). If the outstanding convertible bonds were

fully converted as of 31st March, 1999, approximately 2,630,000 additional shares of

common stock would be issued.

As is customary in Japan, both short-term and long-term bank loans are subject to general

agreements which provide that the banks may, under certain circumstances, request

additional security for those loans, and may treat any security furnished to the banks, as well

as cash deposited with them, as security for all present and future indebtedness.

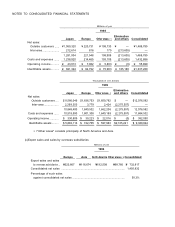

6. Lease transactions

Finance lease transactions, except for those which meet the conditions that the ownership

of the leased assets is substantially transferred to the lessee,as of 31st March, 1999 and 1998

were as follows:

As a lessee

(1)Amounts equivalent to acquisition

costs, accumulated depreciation and

net balance as of 31st March, 1999

1999 1998 1999

Acquisition costs ........................................ ¥2,093 ¥ — $17,368

Accumulated depreciation......................... (1,749) — (14,513)

Net balance ................................................. 344 — 2,855

(2)Future lease payments

Due within one year ................................... 325 462 2,696

Thereafter.................................................... 417 602 3,465

742 1,064 6,162

(3)Lease expenses ............................................... 470 531 3,901

Depreciation .................................................... ¥ 369 ¥ — $ 3,062

Thousands of

Millions of yen U.S. dollars