Southwest Airlines 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

cost structure, both including and excluding fuel. Nevertheless, we will not stand still and have intensity in our

efforts to protect our Low-Cost Leadership and nancial strength. In addition, we are not letting up on our

ongoing efforts to grow revenues and initiatives to continue delivering a topnotch Customer Experience

that woos new Customers and keeps loyal Customers coming back.

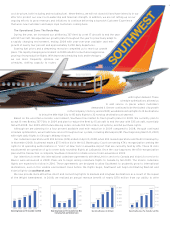

The Operational Zone: The Route Map

During the year, we increased our all–Boeing 737 eet by a net 17 aircraft to end the year

with 537 aircraft. We adjusted our growth plans throughout the year to proactively adapt to

a rapidly changing environment, ending 2008 with year-over-year available seat mile

growth of nearly four percent and approximately 3,200 daily departures.

Soaring fuel prices and a deepening recession compelled us to reset our growth

plans. The rapidly changing environment in 2008 called for a much more aggressive

pruning of nonproductive ights. With improved scheduling tools and techniques,

we can more frequently optimize our

schedules, shifting capacity to routes

with higher demand. These

schedule optimizations allowed us

to add service in places where Customers

demanded it. Denver continued to be the fastest city growth

in the Company’s history, and in 2008, we added nonstop ights to 13 destinations

to bring the Mile High City to 115 daily ights to 32 nonstop destinations at yearend.

Based on the uncertain economic environment, Southwest has halted its eet growth plans for 2009. We currently plan to

accept 13 new Boeing 737-700s in 2009 and plan to reduce the eet by 15 aircraft to end the year with 535 aircraft, essentially

at with 2008. Our 2009–2014 future Boeing orders include 104 rm orders, 62 options, and 54 purchase rights.

Although we are planning for a four percent available seat mile reduction in 2009 compared to 2008, through continued

schedule optimization, we will add new service throughout our system, including Minneapolis/St. Paul beginning March 8, 2009,

with eight daily ights to Chicago’s Midway Airport.

Our codeshare operations with ATA Airlines (ATA) ended on April 3, 2008, when ATA ceased operations and led for bankruptcy.

In November 2008, Southwest made a $7.5 million bid in the U.S. Bankruptcy Court overseeing ATA’s reorganization seeking the

rights to 14 operating authorizations or “slots” at New York’s LaGuardia Airport that are currently held by ATA. These 14 slots

would permit an operation of up to seven daily roundtrip ights at LaGuardia. Once the court approves the ATA reorganization

plan and the transaction is complete, Southwest intends to initiate service from LaGuardia in 2009.

Our intentions to enter into international codeshare agreements with WestJet for service to Canada and Volaris for service to

Mexico were announced in 2008. Plans are to begin selling codeshare ights to Canada by fall 2009. The Volaris codeshare

ights are expected to follow in 2010. These agreements are designed to allow Southwest to prudently grow to international

destinations, even in this volatile environment. Even before the ights begin, Southwest will begin distributing WestJet and

Volaris ights via southwest.com.

We now provide more attractive direct and connecting flights to medium and longhaul destinations as a result of the repeal

of the Wright Amendment. In 2008, we realized an annual revenue benefit of nearly $170 million from our ability to offer

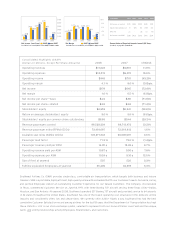

$11,023

20082004 2005 2006 2007

Operating Revenues (in millions)

$9,086

$9,861

$6,530

$7,584

$11,000

$10,000

$9,000

$8,000

$7,000

$6,000

20082004 2005 2006 2007

Operating Revenues Per Available Seat Mile

9.81¢

10.67¢

9.90¢

8.50¢

8.90¢

11.0¢

10.5¢

10.0¢

9.5¢

9.0¢

8.5¢

9.10¢

7.97¢ 8.05¢

8.80¢

20082004 2005 2006 2007

Operating Expenses Per Available Seat Mile

10.24¢

11¢

10¢

9¢

8¢

7¢

9

20082004 2005 2006 2007

Operating Expenses Per Available Seat Mile

Excluding Fuel and Related Taxes

6.40¢

6.54¢

6.34¢ 6.34¢

6.64¢ 6.7¢

6.6¢

6.5¢

6.4¢

6.3¢