Royal Caribbean Cruise Lines 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to certain limitations, the purchase price for each share of com-

mon stock is equal to 90% of the average of the market prices

of the common stock as reported on the New York Stock

Exchange on the first business day of the purchase period and

the last business day of each month of the purchase period.

Shares of common stock of 21,280, 25,649 and 33,395 were

issued under the ESPP at a weighted-average price of $19.56,

$17.34 and $17.69 during 2003, 2002 and 2001, respectively.

Under an executive compensation program approved in 1994, we

will award to a trust 10,086 shares of common stock per quarter,

up to a maximum of 806,880 shares. We issued 40,344 shares

each year under the program during 2003, 2002 and 2001.

Compensation expense related to our “Taking Stock in

Employees” program, which was discontinued effective

December 31, 2001, was $1.6 million in 2001. Under the plan,

employees were awarded five shares of our stock, or the cash

equivalent, at the end of each year of employment.

We have three Employee Stock Option Plans which provide for

awards to our officers, directors and key employees of options

to purchase shares of our common stock. During 2001, two of

the Employee Stock Option Plans were amended to increase

the number of shares reserved for issuance by a total of

13,000,000 shares of common stock between the two plans.

During 2003, one of the Employee Stock Option Plans was

amended to provide for the issuance of restricted stock and

restricted stock units. Each recipient of the restricted stock

units is entitled to receive shares of common stock in accor-

dance with a five-year vesting schedule. Generally, the shares

are forfeited if the recipient ceases to be a director or employ-

ee before the shares vest. We awarded 14,025 restricted stock

units in 2003. Options are granted at a price not less than the

fair value of the shares on the date of grant. Options expire not

later than ten years after the date of grant and generally become

exercisable in full over three or five years after the grant date.

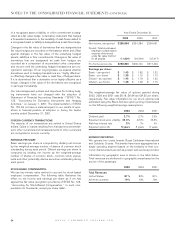

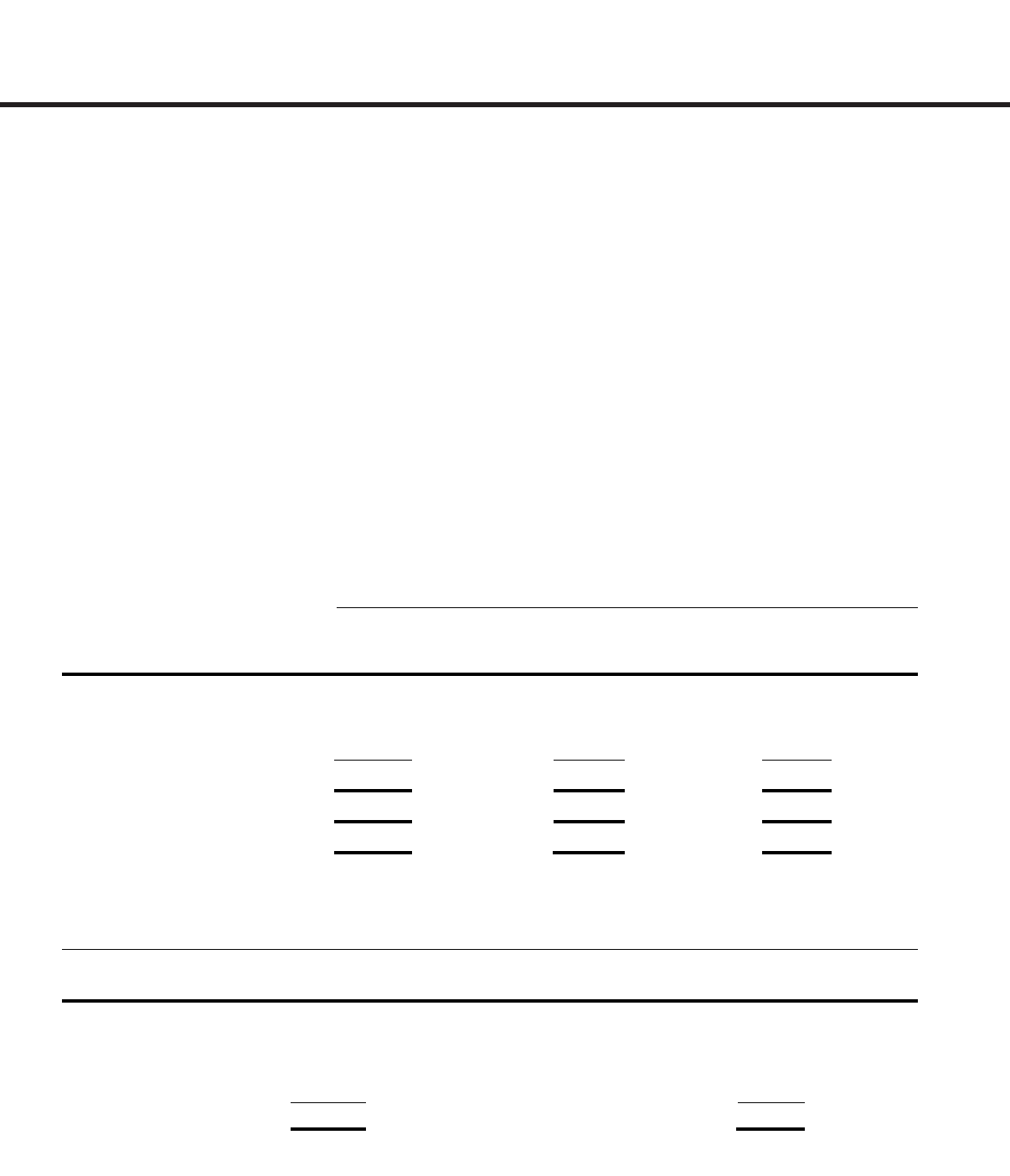

Stock option activity and information about stock options out-

standing are summarized in the following tables:

ROYAL CARIBBEAN CRUISES LTD.

28

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

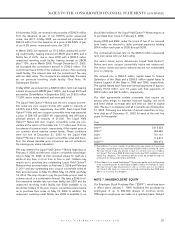

STOCK OPTION ACTIVITY

2003 2002 2001

Weighted– Weighted– Weighted–

Average Average Average

Number of Exercise Number of Exercise Number of Exercise

Options Price Options Price Options Price

Outstanding options at January 1 15,234,577 $21.63 17,022,241 $21.49 11,291,784 $27.17

Granted 536,991 $25.59 617,600 $20.89 6,525,775 $12.41

Exercised (3,064,355) $14.89 (599,122) $11.10 (104,526) $13.22

Canceled (712,691) $25.72 (1,806,142) $23.61 (690,792) $29.84

Outstanding options at December 31 11,994,522 $23.28 15,234,577 $21.63 17,022,241 $21.49

Exercisable options at December 31 7,949,284 $23.53 7,890,128 $21.82 4,679,421 $20.79

Available for future grants at December 31 6,793,185 6,744,505 5,871,763

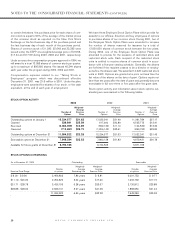

STOCK OPTIONS OUTSTANDING

As of December 31, 2003

Outstanding Exercisable

Weighted– Weighted– Weighted–

Number Average Average Number Average

Exercise Price Range of options Remaining Life Exercise Price of options Exercise Price

$ 9.00 - $ 9.90 3,466,803 7.86 years $ 9.81 2,001,753 $ 9.77

$11.19 - $20.30 2,254,822 5.64 years $17.90 1,932,769 $17.72

$21.71 - $28.78 3,426,156 6.28 years $25.67 2,130,812 $25.88

$28.88 - $48.00 2,846,741 5.97 years $41.08 1,883,950 $41.44

11,994,522 6.54 years $23.28 7,949,284 $23.53