Royal Caribbean Cruise Lines 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

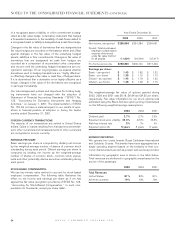

Year Ended December 31, 2002 Compared to

Year Ended December 31, 2001

REVENUES

Passenger ticket revenues increased 6.7% to $2.6 billion com-

pared to $2.4 billion in 2001. The increase in passenger ticket

revenues was primarily due to a 15.0% increase in capacity,

partially offset by a lower percentage of passengers who chose

to book their air passage through us and lower cruise ticket

prices. The increase in capacity was associated with the full

year effect of the additions of

Infinity

,

Radiance of the Seas

,

Summit

and

Adventure of the Seas

and the deliveries of

Constellation

,

Brilliance of the Seas

and

Navigator of the Seas

in 2002. The increase in capacity was partially offset by the

transfer of

Viking Serenade

to Island Cruises, our joint venture

with First Choice Holidays PLC in 2002. Lower cruise ticket

prices were attributed to the events of September 11, 2001, a

general softness in the United States economy and an

increase in industry capacity. Occupancy for 2002 was 104.5%

compared to 101.8% in 2001.

Onboard and other revenues increased 17.7% to $0.8 billion in

2002 compared to $0.7 billion in 2001. The increase was mainly

attributable to a 20.7% increase in shipboard revenues resulting

primarily from an increase in capacity. Included in onboard and

other revenues were concession revenues of $162.0 million and

$131.6 million in 2002 and 2001, respectively.

Gross Yields and Net Yields for 2002 decreased 5.1% and

0.7%, respectively, compared to 2001, primarily due to lower

cruise ticket prices. In addition, the decline in Gross Yields was

also due to a lower percentage of passengers who chose to

book their air passage through us.

EXPENSES

Operating expenses increased 9.2% to $2.1 billion in 2002

compared to $1.9 billion in 2001. Included in other operating

expenses in 2002 was a charge of $20.0 million recorded in

connection with a litigation settlement. (See Note 12.

Commitments and Contingencies.) Operating expenses per

Available Passenger Cruise Day in 2002 decreased 5.0% com-

pared to 2001. The decline on a per Available Passenger

Cruise Day basis was associated with fewer passengers pur-

chasing air passage through us and lower commissions result-

ing from reduced cruise ticket prices.

Marketing, selling and administrative expenses decreased 5.1%

to $431.1 million in 2002 compared to $454.1 million in 2001.

Marketing, selling and administrative expenses as a percentage

of revenues were 12.6% and 14.4% in 2002 and 2001, respec-

tively. Included in 2001 were charges associated with business

decisions taken subsequent to the events of September 11,

2001 involving itinerary changes, office closures and severance

costs related to a reduction in force. On a per Available

Passenger Cruise Day basis, marketing, selling and administra-

tive expenses in 2002 decreased 17.5% from 2001 primarily due

to economies of scale and cost reduction initiatives.

Net Cruise Costs per Available Passenger Cruise Day

decreased 2.2% in 2002 compared to 2001. The decrease in

2002 was primarily due to cost reduction initiatives subsequent

to the events of September 11, 2001.

Depreciation and amortization expenses increased 12.6% to

$339.1 million in 2002 from $301.2 million in 2001. The

increase was primarily due to incremental depreciation associ-

ated with the addition of new ships, partially offset by the elim-

ination of $10.4 million of goodwill amortization in 2002. (See

Note 2. Summary of Significant Accounting Policies.)

OTHER INCOME (EXPENSE)

Gross interest expense, was $290.3 million in 2002, essential-

ly unchanged from 2001. The increase in the average debt level

associated with our fleet expansion program was offset by a

decrease in interest rates. Capitalized interest decreased to

$23.4 million in 2002 from $37.0 million in 2001 due to a lower

average level of investment in ships under construction and

lower interest rates.

Included in other income (expense) in 2002 was $33.0 million

of net proceeds received in connection with the termination of

the P&O Princess merger agreement. Also included in other

income (expense) in 2002 and 2001 was $12.3 million and $7.2

million, respectively, of compensation from shipyards related to

the late delivery of ships.

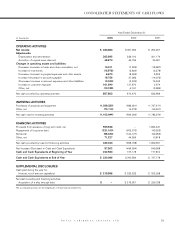

LIQUIDITY AND CAPITAL RESOURCES

SOURCES AND USES OF CASH

Net cash provided by operating activities was $857.8 million in

2003 compared to $870.5 million in 2002 and $633.7 million in

2001. The change in each year was primarily due to the timing

of cash receipts related to customer deposits and fluctuations

in net income.

During the year ended December 31, 2003, our capital expen-

ditures were approximately $1.0 billion compared to approxi-

mately $1.0 billion in 2002 and $2.1 billion in 2001. Capital

expenditures were primarily related to the deliveries of

Serenade of the Seas

and

Mariner of the Seas

in 2003;

Constellation

and

Navigator of the Seas

in 2002; and

Infinity

,

Radiance of the Seas

,

Summit

and

Adventure of the Seas

in

2001, as well as progress payments for ships under construc-

tion in all years.

Capitalized interest decreased to $15.9 million in 2003 from

$23.4 million in 2002 and $37.0 million in 2001 due to a lower

average level of investment in ships under construction and

lower interest rates.

ROYAL CARIBBEAN CRUISES LTD.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS (CONTINUED)