Ross 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29%

25%

9%

12%

13%

12%

29% Ladies

25% Home Accents, Bed and Bath

13% Men’s

12% Accessories, Lingerie, Fine Jewelry, Fragrances

12% Shoes

9% Children’s

2

Our ongoing focus on bargains delivered another year of

record results for Ross Stores in 2010. This better-than-

expected fi nancial performance is even more noteworthy

considering it was on top of outstanding sales and earnings

gains in 2009.

2010 EPS Up 31% on Top of a 52% Gain in 2009

For the 52 weeks ended January 29, 2011, sales increased

9% to a record $7.9 billion, with same store sales up 5%

on top of a 6% gain in the prior year. Home, Dresses, and

Shoes were our top performing merchandise categories in

2010, with the Florida market posting the largest same store

sales gain.

Net earnings for the year grew 25% to a record $554.8

million, up from $442.8 million in 2009. Earnings per share

rose to $4.63, compared to $3.54 in the prior year. This

represented an exceptional gain of 31% on top of a 52%

increase in 2009. Operating margin in 2010 grew to a record

11.5%, up 140 basis points on top of a 250 basis point gain

in 2009. The main drivers of this signifi cant improvement

in profi tability were higher gross margin and increased

leverage on operating expenses from the healthy gain in

same store sales.

Strong Inventory Management Continues

to Drive Higher Margins

As we ended 2010, average in-store inventories were down

about 10% on top of double-digit declines in the prior two

years. We believe opportunities exist to further reduce in-

store inventories in 2011, with average store levels targeted

to be down in the mid-single-digit percentage range

compared to 2010.

Operating our business on lower inventory levels has

increased the percentage of fresh and exciting merchandise

our customers see when they shop our stores. By exceeding

our sales targets with leaner inventories, we also realized

signifi cantly faster turns in 2010, which resulted in lower

markdowns as a percent of sales and another year of record

merchandise gross margin.

The systems investments and new planning and allocation

processes we rolled out in 2009 continue to help us do a

better job of getting the right merchandise to the right store at

the right time. This is an iterative process that should enable

us to build on our successes and continue to enhance sales

productivity and profi tability going forward. We believe that

planning and allocating at a much more detailed level is

more important than ever, especially with less inventory in

our stores.

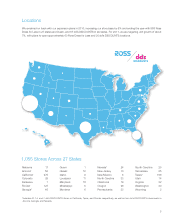

Expansion Accelerates at dd’s DISCOUNTS

During 2010, dd’s DISCOUNTS store growth accelerated

as we added 15 locations and entered two new states —

Nevada and Georgia. In addition, comparable stores at

dd’s DISCOUNTS posted respectable sales gains on top

of exceedingly strong increases in 2009. Like Ross, dd’s

DISCOUNTS has benefi ted from our ability to deliver a

faster fl ow of fresh and exciting product to our stores, while

operating on lower inventory levels. As a result, merchandise

gross margin in 2010 grew signifi cantly on top of record

levels in 2009.

To Our Stockholders