Ross 2010 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2010 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14

We are subject to operating risks as we attempt to execute on our merchandising and growth strategies.

The continued success of our business depends, in part, upon our ability to increase sales at our existing store locations, to open

new stores, and to operate stores on a profi table basis. Our existing strategies and store expansion programs may not result

in a continuation of our anticipated revenue or profi t growth. In executing our off-price retail strategies and working to improve

effi ciencies, expand our store network, and reduce our costs, we face a number of operational risks, including:

• Our ability to attract and retain personnel with the retail talent necessary to execute our strategies.

• Our ability to effectively operate our various supply chain, core merchandising, and other information systems.

• Our ability to improve our merchandising capabilities through implementation of new processes and systems enhancements.

• Our ability to improve new store sales and profi tability, especially in newer regions and markets.

• Our ability to achieve and maintain targeted levels of productivity and effi ciency in our distribution centers.

• Our ability to lease or acquire acceptable new store sites with favorable demographics and long-term fi nancial returns.

• Our ability to identify and to successfully enter new geographic markets.

• Our ability to achieve planned gross margins by effectively managing inventories, markdowns, and shrink.

• Our ability to effectively manage all operating costs of the business, the largest of which are payroll and benefi t costs for store

and distribution center employees.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable.

ITEM 2. PROPERTIES.

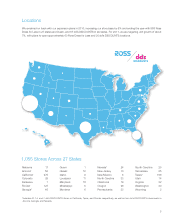

At January 29, 2011, we operated a total of 1,055 stores, of which 988 were Ross locations in 27 states and Guam and 67 were

dd’s DISCOUNTS stores in six states. All stores are leased, with the exception of two locations which we own.

During fi scal 2010, we opened 41 new Ross stores and closed six existing stores. The average approximate Ross store size is

29,600 square feet.

During fi scal 2010, we opened 15 new dd’s DISCOUNTS stores. The average approximate dd’s DISCOUNTS store size is 22,700

square feet.

During fi scal 2010, no one store accounted for more than 1% of our sales.

We carry earthquake insurance to help mitigate the risk of fi nancial loss due to an earthquake.

Our real estate strategy in 2011 is to open stores in states where we currently operate to increase our market penetration and to

reduce overhead and advertising expenses as a percentage of sales in each market. We also expect to enter new states for both

Ross and dd’s DISCOUNTS in 2011. Important considerations in evaluating a new store location in both new and existing markets

are the availability and quality of potential sites, demographic characteristics, competition, and population density of the local

trade area. In addition, we continue to consider opportunistic real estate acquisitions.