Ross 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Strong Cash Flows Fund Growth and Enhance Stockholder Returns

Operating cash flows in 2007 continued to provide the necessary resources to fund new store growth and

infrastructure improvements. We invested a total of about $236 million in capital including $110 million to open new

stores and about $60 million for our distribution network. We ended the year with $264 million in cash and short-term

investments and $150 million in long-term debt.

We also continued to return cash to stockholders through our stock repurchase and dividend programs. In 2007,

we repurchased 6.9 million shares for an aggregate purchase price of $200 million, completing our two-year

$400 million program.

In January 2008, our Board of Directors approved a new two-year $600 million stock repurchase program. This

represented a 50% increase over our prior program, reflecting our confidence in the long-term prospects of our

business. At the same time, our Board authorized a 27% increase in the quarterly cash dividend to $.095 per share, our

14th consecutive annual dividend increase.

Outlook for 2008 and Beyond

We believe that our value-focused business strategies will continue to enhance our ability to deliver respectable sales

and earnings growth in the coming year. Because we buy closer to need, we can operate with leaner inventory

levels which increases our ability to take advantage of great close-out opportunities. As an off-price retailer, the

upside for us in more difficult environments is our ability to take advantage of an abundance of great bargains in the

marketplace like we are doing today. As a result, we have been able to manage successfully through both healthy

and challenging economic climates, because bargains are always in style. For this reason, we usually experience less

volatility in our financial results than a comparable full-price retailer.

From 2008 through 2010, we will be gradually rolling out the next phase of micro-merchandising, consisting of

new systems enhancements and related process changes. We believe that over time, this initiative will lead to

improvements in sales and profitability by enhancing our ability to plan, buy and allocate product at a more local, or

even store, level.

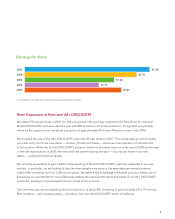

Return on Average Stockholders’ Equity

2003 2004 2005 2006 2007

33%

22% 25% 28% 28%