Ross 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

To Our Stockholders:

We celebrated a special milestone in 2007 — our 25th anniversary — with record

sales and earnings for the year. We believe that our ability to deliver compelling

bargains to customers allowed us to successfully navigate the challenging

economic climate. Our solid performance is a testament to the resilience of our

off-price business model.

Record Sales and Earnings

We generated sales of $6.0 billion for the 52 weeks ended February 2, 2008, a 7% increase over the $5.6 billion for the

53 weeks ended February 3, 2007. Comparable store sales in 2007 grew 1% on top of a 4% gain in the prior year. Our

strongest markets for same store sales gains were the Northwest and Texas, while Dresses, Home and Shoes were our top

performing merchandise categories.

We took steps to strengthen our overall merchandise assortments in 2007 by improving the fashion and brand content

across our core men’s and ladies’ businesses, while expanding the assortments in accessories as well as the home and

gift-giving categories. We saw some progress during the year and expect additional benefits in 2008.

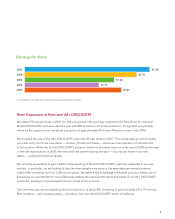

Net earnings in 2007 grew to $261.1 million, up from $241.6 million in the prior year. Earnings per share were $1.90,

compared to $1.70 in 2006, which included earnings equivalent to about $.07 per share from the 53rd week. On a

52-week comparable basis, our 2007 earnings per share increased a solid 17% from 2006.

Operating margin was 7.0% in 2007, up 5 basis points over fiscal 2006, which included approximately 20 basis points

of leverage related to the 53rd week. This improvement was driven primarily by better merchandise gross margin and

lower shrink and corporate expenses, partially offset by higher occupancy and store operating costs as a percent

of sales.

As we ended the year, consolidated inventories were down about 3%, while in-store inventories were down about

9% on an average store basis. We believe that leaner inventory levels contributed to faster inventory turns and lower

markdowns, while enhancing the flow of fresh and exciting name brand bargains to our stores — a key driver of

customer traffic. As we move into 2008, we will continue to focus on driving faster inventory turns with lower levels of

in-store inventory.