Ross 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ross Stores, Inc.

2007 Annual Report

25 Years of Delivering Bargains

Table of contents

-

Page 1

Ross Stores, Inc. 2007 Annual Report 25 Years of Delivering Bargains -

Page 2

... per share data) 2007 20061 2005 Total Sales $ 5,975,212 $ 5,570,210 $ 4,944,179 Comparable Store Sales Increase (52-week basis) 1% 4% 6% Net Earnings $ 261,051 $ 241,634 $ 199,632 Diluted Earnings per Share $ 1.90 $ 1.70 $ 1.36 Return on Average Stockholders' Equity 28... -

Page 3

1 -

Page 4

... a 7% increase over the $5.6 billion for the 53 weeks ended February 3, 2007. Comparable store sales in 2007 grew 1% on top of a 4% gain in the prior year. Our strongest markets for same store sales gains were the Northwest and Texas, while Dresses, Home and Shoes were our top performing merchandise... -

Page 5

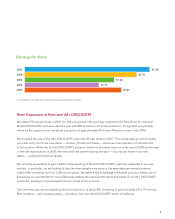

... Expansion at Ross and dd's DISCOUNTS We added 93 net new stores in 2007, for 12% unit growth. Net openings consisted of 67 Ross Dress for Less and 26 dd's DISCOUNTS, and we ended the year with 890 locations in 27 states and Guam. This growth was partially driven by the opportunistic real estate... -

Page 6

...and dividend programs. In 2007, we repurchased 6.9 million shares for an aggregate purchase price of $200 million, completing our two-year $400 million program. In January 2008, our Board of Directors approved a new two-year $600 million stock repurchase program. This represented a 50% increase over... -

Page 7

..., we plan to target new store growth in our most productive existing markets, with unit expansion of about 5% to 6% planned for 2009 and 2010. We believe this more moderate and focused growth will enhance new store productivity and proï¬tability and, along with our ongoing stock repurchase program... -

Page 8

... bargains on a wide array of name-brand fashions for the entire family and the home into our stores. At Ross Dress for Less, our merchandise is priced at 20% to 60% off regular prices at department and specialty stores. At dd's DISCOUNTS, our assortments are offered at 20% to 70% off regular... -

Page 9

7 -

Page 10

..., we deliver a constant ï¬,ow of new and exciting bargains to our stores, with product received three to six times a week. As an off-price retailer, the upside in more uncertain economies is our ability to take advantage of an abundance of terriï¬c name-brand fashions, like we are doing today. As... -

Page 11

9 -

Page 12

.... Ross has a history of returning cash to its stockholders and has repurchased stock every year since 1993, including $900 million in the last ï¬ve years. In addition, we recently announced that our Board of Directors approved a new two-year $600 million program, which is a 50% increase over... -

Page 13

11 -

Page 14

...net new Ross Dress for Less and 5 dd's DISCOUNTS stores. Total Store Locations: Alabama Arizona* California* Colorado Delaware Florida* Georgia 15 48 235 29 1 105 43 Guam Hawaii Idaho Louisiana Maryland Mississippi Montana 1 11 8 10 17 4 6 Nevada New Jersey New Mexico North Carolina Oklahoma Oregon... -

Page 15

10K Ross Stores, Inc. 2007 13 -

Page 16

... Financial Statements and Supplementary Data Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Signatures Index to Exhibits Certiï¬cations 16 28 30 40 44 64 70 71 75 Index to Other Information Directors and Ofï¬cers Corporate Data 78 Inside back... -

Page 17

... number 0-14678 Ross Stores, Inc. (Exact name of registrant as speciï¬ed in its charter) Delaware (State or other jurisdiction of incorporation or organization) 4440 Rosewood Drive, Pleasanton, California (Address of principal executive ofï¬ces) Registrant's telephone number, including area code... -

Page 18

... expectations of the off-price customer. • Manage real estate growth to compete effectively across all our markets. The original Ross Stores, Inc. was incorporated in California in 1957. In August 1982, the Company was purchased by some of our then and current directors and stockholders. In June... -

Page 19

... use a number of methods that enable us to offer our customers brand-name and fashion merchandise at strong everyday discounts relative to department and specialty stores for Ross and moderate department and discount stores for dd's DISCOUNTS. By purchasing later in the merchandise buying cycle... -

Page 20

... organized, attractive, easy-to-shop, in-store environments at both Ross and dd's DISCOUNTS, which allow customers to shop at their own pace. Our stores are designed for customer convenience in their merchandise presentation, dressing rooms, checkout and merchandise return areas. Each store's sales... -

Page 21

... prices. This strategy reflects our belief that television is the most efficient and cost-effective medium for communicating everyday savings on a wide selection of brand-name bargains for both the family and home. Advertising for dd's DISCOUNTS is primarily focused on new store grand openings... -

Page 22

..., offering a well-balanced assortment appealing to our target customer, and consistently providing store environments that are convenient and easy to shop. To execute this concept, we have invested in our buying organization and developed a merchandise allocation system to distribute product based... -

Page 23

...name merchandise at desirable discounts that could impact our ability to purchase product and continue to offer customers a wide assortment of merchandise at competitive prices. • Potential disruptions in the supply chain that could impact our ability to deliver product to our stores in a timely... -

Page 24

... located in California, Florida, Texas, and Arizona. During ï¬scal 2007, no one store accounted for more than 1% of our sales. We carry earthquake insurance for business interruption, inventory and personal property to mitigate our risk on our corporate headquarters, distribution centers, buying... -

Page 25

...3, 2007, all 26 dd's DISCOUNTS stores were in California. State/Territory Alabama Arizona California Colorado Delaware Florida Georgia Guam Hawaii Idaho Louisiana Maryland Mississippi Montana Nevada New Jersey New Mexico North Carolina Oklahoma Oregon Pennsylvania South Carolina Tennessee Texas Utah... -

Page 26

... The lease term for the New York ofï¬ce contains a renewal provision. Item 3. Legal Proceedings. We are party to various litigation matters related to customers, vendors, and employees, including class action lawsuits alleging misclassiï¬cation of assistant store managers and missed meal and rest... -

Page 27

... has served as Executive Vice President, Merchandising since October 2005. She joined the Company as Senior Vice President and General Merchandise Manager, Home in January 2005. In December 2006, she was given additional responsibility for the Home business at both Ross and dd's DISCOUNTS. Prior to... -

Page 28

... January 2008 our Board of Directors approved a new two-year $600 million stock repurchase program for ï¬scal 2008 and 2009. 2 See Note H to Notes to Consolidated Financial Statements for equity compensation plan information. The information under Item 12 of this Annual Report on Form 10-K under... -

Page 29

... invested on 1/31/03 in stock or index including reinvestment of dividends. Fiscal year ending January 31. Indexes calculated on month-end basis. Indexed Returns for Years Ending Base Period January 2003 January 2004 January 2005 January 2006 January 2007 January 2008 Company / Index Ross Stores... -

Page 30

... owned corporate headquarters in Newark, California. For the year ended January 31, 2004, the Company reclassiï¬ed $14.2 million of bonus expense that relates to personnel in the merchandising and distribution organizations from selling, general and administrative expense to cost of goods sold. 28 -

Page 31

... Return on average stockholders' equity Book value per common share outstanding at year-end Operating Statistics Number of stores opened Number of stores closed Number of stores at year-end Comparable store sales increase (decrease) (52-week basis) Sales per square foot of selling space2 (52-week... -

Page 32

... At the end of ï¬scal 2007, there were 838 Ross Dress for Less ("Ross") locations in 27 states and Guam, and 52 dd's DISCOUNTS stores in four states. Ross offers ï¬rst-quality, in-season, name-brand and designer apparel, accessories, footwear and home fashions at everyday savings of 20% to 60% off... -

Page 33

... prior year due to the opening of 63 net new stores during 2006, and a 4% increase in sales from comparable stores. Our sales mix for Ross is shown below for ï¬scal 2007, 2006 and 2005: 2007 Ladies Home accents and bed and bath Men's Fine jewelry, accessories, lingerie and fragrances Shoes Children... -

Page 34

... in future years. Selling, general and administrative expenses. For ï¬scal 2007, selling, general and administrative expenses ("SG&A") increased $72.9 million compared to the prior year, mainly due to increased store operating costs reflecting the opening of 93 net new stores during the year. SG... -

Page 35

...our stock repurchase program. Financial Condition Liquidity and Capital Resources Our primary sources of funds for our business activities are cash flows from operations and short-term trade credit. Our primary ongoing cash requirements are for seasonal and new store merchandise inventory purchases... -

Page 36

... long-term capital investments. We own three distribution centers in Carlisle, Pennsylvania, Moreno Valley, California, and Fort Mill, South Carolina. In November 2005, we announced that our Board of Directors authorized a two-year stock repurchase program of up to $400 million for 2006 and 2007. We... -

Page 37

... covenants. Off-Balance Sheet Arrangements Operating leases. All but two of our store sites, one of our distribution centers, and our buying ofï¬ces and corporate headquarters are leased and, except for certain leasehold improvements and equipment, do not represent long-term capital investments. We... -

Page 38

... square foot distribution center in Perris, California. The land and building for this distribution center are ï¬nanced under a $70 million ten-year synthetic lease that expires in July 2013. Rent expense on this center is payable monthly at a ï¬xed annual rate of 5.8% on the lease balance of $70... -

Page 39

..., South Carolina distribution center and paid cash in the amount of $87.3 million to acquire the facility from the lessor. We estimated the fair value of the components of the facility and the related equipment using various valuation techniques, including appraisals, market prices, and cost data... -

Page 40

... be required. Stock-based compensation. We account for stock-based compensation under the provisions of SFAS No. 123(R). The determination of the fair value of stock options and Employee Stock Purchase Plan ("ESPP") shares, using the Black-Scholes model, is affected by our stock price as well as... -

Page 41

... 2007, and information we provide in our Annual Report to Stockholders, press releases, telephonic reports and other investor communications including on our website, may contain a number of forwardlooking statements regarding, without limitation, planned store growth, new markets, expected sales... -

Page 42

... of Earnings Year ended February 2, 2008 Year ended February 3, 2007 Year ended January 28, 2006 ($000, except per share data) Sales Costs and Expenses Cost of goods sold Selling, general and administrative Interest income, net Total costs and expenses Earnings before taxes Provision for taxes on... -

Page 43

... ($000, except share data) February 2, 2008 February 3, 2007 Assets Current Assets Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventory Prepaid expenses and other Deferred income taxes Total current assets Property and Equipment Land and buildings Fixtures and... -

Page 44

...: Net earnings Unrealized investment loss Total comprehensive income Common stock issued under stock plans, net of shares used for tax withholding Tax beneï¬t from equity issuance Stock based compensation Common stock repurchased Dividends declared Balance at February 3, 2007 Comprehensive income... -

Page 45

... taxes Tax beneï¬t from equity issuance Excess tax beneï¬ts from stock-based compensation Change in assets and liabilities: Merchandise inventory Other current assets, net Accounts payable Other current liabilities Other long-term, net Net cash provided by operating activities Cash Flows Used... -

Page 46

... items, linens and other home-related merchandise. At the end of ï¬scal 2007, there were 838 Ross Dress for Less® ("Ross") locations in 27 states and Guam and 52 dd's DISCOUNTS® stores in four states, which are supported by four distribution centers. The Company's headquarters, two distribution... -

Page 47

...Mill, South Carolina distribution center and paid cash in the amount of $87.3 million to acquire the facility from the lessor. The Company estimated the fair value of the components of the facility and the related equipment using various valuation techniques, including appraisals, market prices, and... -

Page 48

... value. Revenue recognition. The Company recognizes revenue at the point of sale, net of actual returns, and maintains an allowance for estimated future returns. Sales of gift cards are deferred until they are redeemed for the purchase of Company merchandise. Sales tax collected is not recognized as... -

Page 49

...based upon the grant date fair value of all stock-based awards, typically over the vesting period. See Note C for more information on the Company's stock-based compensation plans. Taxes on earnings. SFAS No. 109, "Accounting for Income Taxes," requires income taxes to be accounted for under an asset... -

Page 50

...90 141,883 1.70 146,532 1.36 $ $ $ $ $ $ Segment reporting. The Company has one reportable operating segment. The Company's operations include only activities related to off-price retailing in stores throughout the United States and, therefore, comprise only one segment. Comprehensive income... -

Page 51

... cost and fair value of the Company's available-for-sale securities as of February 3, 2007 were: Amortized cost Unrealized gains Unrealized losses ($000) Fair value Short-term Long-term Auction-rate securities Asset-backed securities Corporate securities U.S. Government and agency securities... -

Page 52

... options and ESPP purchase rights, using the Black-Scholes model, is affected by the Company's stock price as well as assumptions as to the Company's expected stock price volatility over the term of the awards, actual and projected employee stock option exercise behavior, the risk-free interest rate... -

Page 53

... 3.5 33.7% 3.9% 0.7% Employee Stock Purchase Plan Expected life from grant date (years) Expected volatility Risk-free interest rate Dividend yield 2007 1.0 26.4% 5.0% 0.9% 2006 1.0 26.7% 4.5% 0.8% 2005 1.0 32.9% 4.5% 0.8% Total stock-based compensation recognized in the Company's consolidated... -

Page 54

... in 2002 to ï¬nance equipment and information systems for the Company's Perris, California distribution center. Senior Notes. In October 2006, the Company entered into a Note Purchase Agreement with various institutional investors for $150 million of unsecured senior notes. The notes were issued... -

Page 55

... additional rent based on a percentage of sales. The Company has lease arrangements for certain equipment in its stores for its point-of-sale ("POS") hardware and software systems. These leases are accounted for as operating leases for ï¬nancial reporting purposes. The initial terms of these leases... -

Page 56

...590) $ 128,710 Deferred Federal State (9,263) (1,436) (10,699) Total $ 164,069 In ï¬scal 2007, 2006 and 2005, the Company realized tax beneï¬ts of $6.5 million, $12.1 million and $21.9 million, respectively, related to employee equity programs that were credited to additional paid-in capital... -

Page 57

...are as follows: 2006 35% 4% 39% 2005 35% 4% 39% ($000) 2007 2006 Deferred Tax Assets Deferred compensation Deferred rent Employee beneï¬ts Accrued liabilities California franchise taxes Stock-based compensation Other $ 29,163 9,755 7,474 20,999 3,976 7,991 3,950 83,308 $ 28,813 8,742 7,307... -

Page 58

... Service under the statute of limitations for ï¬scal years 2005 through 2007. The Company's state income tax returns are open to audit under the statute of limitations for ï¬scal years 2003 through 2007. Certain state tax returns are currently under audit by state tax authorities. The Company... -

Page 59

... (in millions) Average repurchase price Repurchased (in millions) Fiscal Year 2007 2006 2005 6.9 7.1 6.4 $ $ $ 29.10 28.17 27.26 $ $ $ 200.0 200.0 175.0 In January 2008, the Company's Board of Directors approved a new two-year $600 million stock repurchase program for ï¬scal 2008 and 2009... -

Page 60

... of stock options to each non-employee director at pre-established times and at a predetermined value. To date, the Company has granted stock options, restricted stock shares, and performance awards under the 2004 Plan. Stock options are granted at exercise prices not less than the fair market value... -

Page 61

...ï¬ed remaining service period, generally two years. The Company recognized $0.6 million of expense related to performance share awards in ï¬scal 2007. Employee Stock Purchase Plan. Under the Employee Stock Purchase Plan, eligible full-time employees participating in the annual offering period can... -

Page 62

... has been named in class action lawsuits regarding wage and hour claims. In February 2007 the Orange County Superior Court approved a settlement of the cases involving whether the Company's assistant store managers in California were correctly classiï¬ed as exempt under California Wage Orders. The... -

Page 63

... is presented in the tables below. Year ended February 2, 2008: Quarter ended May 5, 2007 Quarter ended August 4, 2007 Quarter ended November 3, 2007 Quarter ended February 2, 2008 ($000, except per share data) Sales Cost of goods sold Selling, general and administrative Interest (income) expense... -

Page 64

....03 24.35 $ $ $ .060 31.00 22.12 $ $ $ .1352 33.63 28.56 Fiscal 2006 was a 53-week year. Includes $.06 per share dividend declared in November 2006 and $.075 dividend declared in January 2007. Ross Stores, Inc. common stock trades on The NASDAQ Global Select Market® under the symbol ROST. 62 -

Page 65

This page intentionally left blank. 63 -

Page 66

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Board of Directors and Stockholders Ross Stores, Inc. Pleasanton, California We have audited the accompanying consolidated balance sheets of Ross Stores, Inc. and subsidiaries (the "Company") as of February 2, 2008 and February 3, 2007, and ... -

Page 67

... position of Ross Stores, Inc. and subsidiaries as of February 2, 2008 and February 3, 2007, and the results of their operations and their cash flows for each of the three years in the period ended February 2, 2008, in conformity with accounting principles generally accepted in the United States of... -

Page 68

...stated in their report, dated March 27, 2008, which is included in Item 8 in this Annual Report on Form 10-K. Because of its inherent limitations, internal control over ï¬nancial reporting may not prevent or detect misstatements. It should be noted that any system of controls, however well designed... -

Page 69

... Board of Directors has adopted a Code of Ethics for Senior Financial Ofï¬cers that applies to the Company's Chief Executive Ofï¬cer, Chief Administrative Ofï¬cer, Chief Operations Ofï¬cer, Chief Financial Ofï¬cer, Vice President Controller, Vice President Finance and Treasurer, Vice President... -

Page 70

...Certain Transactions." Item 14. Principal Accountant Fees and Services. Information concerning principal accountant fees and services will appear in the Proxy Statement in the Ross Stores, Inc. Board of Directors Audit Committee Report under the caption "Summary of Audit, Audit-Related, Tax and All... -

Page 71

...' Equity for the years ended February 2, 2008, February 3, 2007 and January 28, 2006. Consolidated Statements of Cash Flows for the years ended February 2, 2008, February 3, 2007 and January 28, 2006. Notes to Consolidated Financial Statements. Report of Independent Registered Public Accounting Firm... -

Page 72

... 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized. ROSS STORES, INC. (Registrant) Date: April 1, 2008 By: /s/Michael Balmuth Michael Balmuth Vice Chairman, President and Chief Executive Ofï¬cer Pursuant to the requirements of... -

Page 73

... Stores, Inc. for its quarter ended July 30, 1994. Note Purchase Agreement dated October 17, 2006 incorporated by reference to Exhibit 10.2 to the Form 10-Q ï¬led by Ross Stores, Inc. for its quarter ended October 28, 2006. Lease dated July 23, 2003 of Certain Property located in Perris, California... -

Page 74

... for Non-Employee Directors for options granted pursuant to Ross Stores, Inc. 2004 Equity Incentive Plan, incorporated by reference to Exhibit 10.3 to the Form 10-Q ï¬led by Ross Stores, Inc. for its quarter ended July 30, 2005. Form of Indemnity Agreement between Ross Stores, Inc. and Executive Of... -

Page 75

... by Ross Stores, Inc. for its quarter ended November 3, 2007. Form of Executive Employment Agreement between Ross Stores, Inc. and Executive Vice Presidents or Senior Vice Presidents, incorporated by reference to Exhibit 10.35 to the Form 10-K ï¬led by Ross Stores, Inc. for its ï¬scal year ended... -

Page 76

... Procurement, Inc. Ross Merchandising, Inc. Ross Dress for Less, Inc. Retail Assurance Group, Ltd. Domiciled Delaware Delaware Virginia Bermuda Date of Incorporation January 12, 2004 November 22, 2004 January 14, 2004 October 15, 1991 EXHIBIT 23 Consent of Independent Registered Public Accounting... -

Page 77

...Chief Executive Ofï¬cer Pursuant to Sarbanes-Oxley Act Section 302(a) I, Michael Balmuth, certify that: 1. I have reviewed this annual report on Form 10-K of Ross Stores, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material... -

Page 78

... material, that involves management or other employees who have a signiï¬cant role in the registrant's internal control over ï¬nancial reporting. Date: April 1, 2008 /s/J. Call John G. Call Senior Vice President, Chief Financial Ofï¬cer, Principal Accounting Ofï¬cer and Corporate Secretary 76 -

Page 79

...In connection with the Annual Report of Ross Stores, Inc. (the "Company") on Form 10-K for the year ended February 2, 2008 as ï¬led with the Securities and Exchange Commission on the date hereof (the "Report"), I, Michael Balmuth, as Chief Executive Ofï¬cer of the Company, hereby certify, pursuant... -

Page 80

...ï¬cer and Corporate Secretary Ken Caruana Senior Vice President Strategy, Marketing, Store Planning and Allocation Mark LeHocky Senior Vice President and General Counsel Terri Mann Senior Vice President and General Merchandise Manager D. Jane Marvin Senior Vice President Human Resources Carl Matteo... -

Page 81

... DATA Corporate Headquarters Ross Stores, Inc. 4440 Rosewood Drive Pleasanton, California 94588-3050 (925) 965-4400 Corporate Website: www.rossstores.com New York Buying Ofï¬ce Ross Stores, Inc. 1372 Broadway, 10th Floor New York, New York 10018 (212) 819-3100 Los Angeles Buying Ofï¬ce Ross Stores... -

Page 82

Ross Stores, Inc. 4440 Rosewood Drive Pleasanton, CA 94588-3050 (925) 965-4400 www.rossstores.com