Rayovac 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

working well. The Rayovac brand has returned to its historical value proposi-

tion by communicating to consumers a “Power Challenge,” emphasizing that

Rayovac batteries last as long as the leading premium battery brands, while

costing less. To support this value message, three-time NFL MVP Brett Favre

has signed on as the personality behind Rayovac in print and TV advertising.

Customer response has been positive. Over the past year, the North American

battery business has shown steady sequential improvement and, in the fourth

quarter of fi scal year 2006, helped to deliver a sales increase in our global

battery business – the fi rst in fi ve quarters. Our Latin American business,

where the Rayovac brand enjoys a strong number one market position, also

was an important contributor to this improved performance.

Europe remains the real challenge for us in the battery category. On the pri-

vate-label side, pricing pressures, combined with increased raw material costs,

have mandated aggressive reductions in our European cost structure, primar-

ily through shifting manufacturing to China. On the branded battery side,

there has been a shift away from our historical stronghold of specialty retail

stores and toward large discount merchants. Accordingly, we are shifting the

focus of our sales force toward this market segment. Though we are optimistic

that these production and marketing initiatives will stabilize our European

battery operations, both will require further time, resources and effort.

MIXED RESULTS FROM DIVERSIFIED PRODUCT PORTFOLIO

In the shaving and grooming and personal care categories, Remington con-

tinues to be an overall success story for Spectrum. Although fi scal year 2006

shaving and grooming product sales underperformed, our personal care cat-

egory showed very strong sales growth of 6 percent worldwide. And in the

three years since we acquired the brand, total Remington sales have grown

Over the past year, the North American

battery business has shown steady

sequential improvement and, in the

fourth quarter of fi scal year 2006,

helped to deliver a sales increase in our

global battery business – the fi rst in

fi ve quarters.

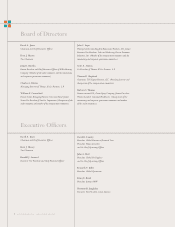

Financial Highlights

(in millions, except per share amounts)

2006 2005 2004 2003 2002

Net sales $2,551.8 $2,307.2 $1,417.2 $922.1 $572.7

Net (loss) income (434.0) 46.8 55.8 15.5 29.2

Diluted (loss) earnings per share (8.77) 1.03 1.61 0.48 0.90

Diluted earnings per share, as adjusted 0.41 1.99 1.83 1.27 1.16

Note: see page 9 for reconciliation to U.S. GAAP fi nancial results

SPECTRUM BRANDS | 2006 ANNUAL REPORT 3