Progressive 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

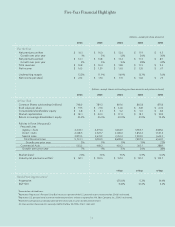

16 17

Our investment portfolio made a greater

contribution to our results this year with a

total return of 7.4%, up considerably from the

4.0% produced in 2005. Investment income

was up a healthy 21% for the year. Our com-

mon stock portfolio generated a return of

16.3%, largely tracking the general market.

We continued to maintain a high-quality, rel-

atively short-duration fixed-income portfolio

.

As the market price for risk declined during

the year, we further reduced our exposure,

ending the year with a weighted average

credit quality of AA+, up from AA at the end

of 2005. Fixed-income returns were strong

on an absolute basis at 5.9% and very strong

for the level of risk assumed.

Early in the year, shareholders approved

an authorization to increase the number of

shares outstanding and the Board of Direc-

tors subsequently approved a 4:1 stock split,

which was effective in May. Based on our

long-standing and continuing position on

capital management — to repurchase shares

when our capital balances, view of the future

and the stock’s price make it attractive —

we

repurchased 39.1 million shares during

the

year, or a little over 6% of the outstanding

balance at the start of the year. The average

repurchase price was just under $25, on a

split-adjusted basis.

We ended the year in a very strong cap-

ital position, with no constraints on any

business opportunities, and a debt-to-total

capital ratio below 15%. Our capital strategy

preference is to maximize operating lev-

erage (i.e.,ratio of net premiums written

to statutory surplus), while maintaining

relatively low financial leverage, and we

continue to expend considerable effort to

assess capital needs under a variety of

operating and external contingencies. We

believe we have opportunities to extend

our operating leverage and will continue to

manage our capital to that objective.

As part of our capital planning process, we

announced last year that we would introduce

a variable annual dividend based on our

Gainshare factor. During 2006, we published

the year-to-date Gainshare factor in our

monthly reporting to provide shareholders

some familiarity with the measure and its

relative volatility. We closed the year with a

factor of 1.18.

The Board of Directors has established

that the 2007 variable dividend will be based

on 20% of after-tax underwriting profit

multiplied by the companywide Gainshare

factor for 2007 and paid in early February

2008. Based on similar parameters and the

1.18 factor of 2006, if the dividend policy had

been in effect for the year, the dividend would

have been about $.39 per share. We will con-

tinue to publish the year-to-date Gainshare

factor and full details of underwriting per-

formance rather than provide any guidance

on dividend expectations.

INVESTMENT AND CAPITAL MANAGEMENT