Polaris 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 6 2006 POLARIS INDUSTRIES INC. ANNUAL REPORT

The international sales opportunity remains

significant for Polaris. We can improve our

distribution in several existing markets, and see

growth in emerging markets, as well. Combined,

we should see approximately $50 million of

sales growth outside of North America.

The remaining sales growth will come from

entering two adjacent markets. These are

markets that we currently do not serve, but are

opportunities where we can apply our brand and

technology to create customer value. The first

opportunity is the military market. For the past

few years, we have been working with military

customers on a small scale—learning the market

niches and developing products to deliver the

mission. Based on this early success, we

believe there is a credible, sizable opportunity

for our vehicles in a number of different

military and government applications. We look

to generate $50 million to $75 million in

annual sales in the military market by 2009.

The other adjacent market opportunity is

under development and will be announced in

the future.

LAUNCHING THE NEXT

RANGER

SUCCESS

Sales of our

RANGER

utility vehicles have been so

successful that we extended our family of side-by-side

(SxS) performance vehicles to include a big bore sport

model — the new

RANGER RZR

. It competes in the

rapidly growing recreational segment of the SxS utility

market, and pairs our legendary razor-sharp

RANGER

performance with a Sportsman®800 EFI engine for

faster acceleration than the category market leader.

SEGMENT: Big Bore/Sport Utility

TARGET AUDIENCE: Hunters, Big Bore ATV and

Sport SxS riders

COMPETITORS: Yamaha, Arctic Cat, other Big Bore ATVs

POLARIS DIFFERENTIATORS: 30 percent more horse-

power, 25 percent more suspension travel with

dual anti-sway bars for better handling, and a trim

50 inches wide (the only trail-capable SxS)

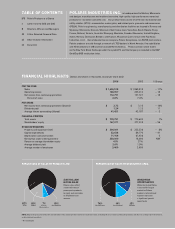

WORLDWIDE SIDE-BY-SIDE UTILITY VEHICLE MARKET

65% Utility (20% growth in 2006*)

20% Commercial/Industrial (flat growth in 2006*)

15% Recreational (45% growth in 2006*)

Utility segment of the total SxS market is the largest segment today. But the fastest-growing

segment is recreational— where the

RANGER RZR

is expected to aggressively compete.

* Estimated