Pitney Bowes 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Summary of Selected Financial Data

Dollars in thousands, except per share amounts

We also continued our emphasis on risk management and financial controls. In addition

to our continued compliance with the internal control requirements, we have implemented

a robust enterprise risk management program that focuses upon 15 key risk categories.

We have developed mitigation programs for each of these risks and have established an

explicit governance model that includes regular reviews by the company’s Board of Directors.

As we view 2007, we continue to have confidence in the guidance that we gave this past

September of earnings per share in a range of $2.90 to $2.98. This confidence reflects

our diversified portfolio of mailstream solutions and services and our high percentage

of recurring revenue. We also expect to benefit from our initiatives to achieve continual

improvements in our selling, general, and administrative expense.

We are proud of our performance this past year and believe that the company is very well-

positioned to deliver predictable and steadily improving results for the foreseeable future.

Bruce P. Nolop

Executive Vice President and

Chief Financial Officer

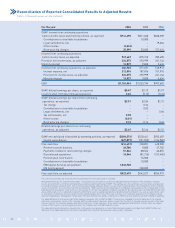

For the year 2006 2005 2004

As reported

Revenue $5,730,018 $5,366,936 $4,832,304

Income from continuing operations $565,659 $473,243 $405,439

Diluted earnings per share from continuing operations $2.51 $2.04 $1.73

Cash (used in) provided by operating activities $(286,574) $530,441 $935,487

Depreciation and amortization $363,258 $331,963 $306,750

Capital expenditures $327,877 $291,550 $316,982

Cash dividends per share of common stock $1.28 $1.24 $1.22

Average common and potential shares outstanding 225,443,060 232,089,178 234,229,987

Total assets $8,480,420 $10,621,382 $10,211,626

Total debt $4,338,157 $4,707,365 $4,375,163

Stockholders’ equity $699,189 $1,364,249 $1,349,152

Total employees 34,454 34,165 35,183

As adjusted

EBIT $1,160,063 $1,063,194 $943,683

Income from continuing operations $606,765 $571,491 $518,912

Diluted earnings per share from continuing operations $2.69 $2.46 $2.22

Free cash flow $523,439 $542,527 $554,937

EBIT to interest 5.5 5.7 6.0