Petsmart 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Petsmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

By providing pet parents with expertise and solutions, we believe we are strengthening our relationships with customers, building

loyalty and enhancing our leading market position, thus differentiating ourselves from grocery and other mass merchandisers.

Our expansion strategy includes increasing our share in existing multi-store markets, penetrating new markets and achieving

operating efficiencies and economies of scale in merchandising, distribution, information systems, procurement, marketing and

store operations. We continually evaluate our store format to ensure we are meeting the needs and expectations of our customers,

while providing a return on investment to our stockholders. A store format that emphasizes our highly differentiated products and

pet services offerings, when combined with our other strategic initiatives, will typically contribute to higher comparable store

sales growth (or sales in stores open at least one year), profitability and return on investment.

Driving consistent execution in our stores. Our commitment to operating excellence emphasizes retail basics like store

cleanliness, short check-out lines, a strong in-stock position, an effective supply chain and outstanding care of the pets in our

stores, which allows us to provide a consistently superior customer experience. This focus on operating excellence simplifies

processes, makes our stores more efficient and easier to operate and allows associates to be more engaged and productive.

We believe these strategic initiatives will continue to generate comparable store sales and overall sales growth, allow us to

focus on managing capital and leveraging costs and drive product margins to produce profitability and return on investment for

our stockholders.

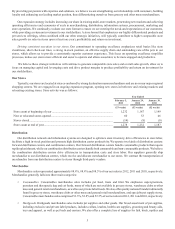

Our Stores

Typically, our stores are located at sites co-anchored by strong destination mass merchandisers and are in or near major regional

shopping centers. We are engaged in an ongoing expansion program, opening new stores in both new and existing markets and

relocating existing stores. Store activity was as follows:

Year Ended

February 3,

2013 January 29,

2012 January 30,

2011

(53 weeks) (52 weeks) (52 weeks)

Store count at beginning of year .................................................................................. 1,232 1,187 1,149

New or relocated stores opened ................................................................................... 60 53 46

Stores closed................................................................................................................. (14)(8)(8)

Store count at end of year............................................................................................. 1,278 1,232 1,187

Distribution

Our distribution network and information systems are designed to optimize store inventory, drive efficiencies in store labor,

facilitate a high in-stock position and promote high distribution center productivity. We operate two kinds of distribution centers:

forward distribution centers and combination centers. Our forward distribution centers handle consumable products that require

rapid replenishment, while our combination distribution centers handle both consumable and non-consumable products. We believe

the combination distribution centers drive efficiencies in transportation costs and store labor. Our suppliers generally ship

merchandise to our distribution centers, which receive and allocate merchandise to our stores. We contract the transportation of

merchandise from our distribution centers to stores through third-party vendors.

Merchandise

Merchandise sales represented approximately 88.4%, 88.4% and 88.5% of our net sales in 2012, 2011 and 2010, respectively.

Merchandise generally falls into three main categories:

• Consumables. Consumables merchandise sales includes pet food, treats and litter. We emphasize super-premium,

premium and therapeutic dog and cat foods, many of which are not available in grocery stores, warehouse clubs or other

mass and general retail merchandisers, as well as our private label foods. We also offer quality national brands traditionally

found in grocery stores, warehouse clubs or other mass and general retail merchandisers, and specialty pet supply stores.

Consumables merchandise sales comprised 53.3%, 52.8% and 52.5% of our net sales in 2012, 2011 and 2010, respectively.

• Hardgoods. Hardgoods merchandise sales includes pet supplies and other goods. Our broad assortment of pet supplies,

including exclusive and private label products, includes collars, leashes, health care supplies, grooming and beauty aids,

toys and apparel, as well as pet beds and carriers. We also offer a complete line of supplies for fish, birds, reptiles and