Petsmart 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Petsmart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Annual Report

Inspiring happiness

for twenty-five years

25

Table of contents

-

Page 1

25 2012 Annual Report Inspiring happiness for twenty-five years -

Page 2

...-we become PetSmart.® 2011 We open stores in Puerto Rico. 2010 We partner with GNC Pets™ and Martha Stewart Pets™ to launch the first of many exclusive brands. We begin to sell Wellness® pet food as well as flea and tick products. 2007 We open our 1,000th store. 2012 2012 We celebrate... -

Page 3

... and pet care information (http://www.petsmart.com). PetSmart provides a broad range of competitively priced pet food and pet products; and offers dog training, pet grooming, pet boarding, PetSmart Doggie Day CampSM day care services and pet adoption services. Through its in-store pet... -

Page 4

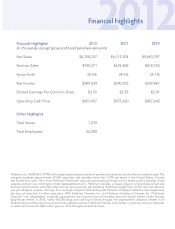

... in operating cash flow, and spent $138 million in capital expenditures, adding 46 net new stores and 4 PetsHotels. We ended the year with 1,278 stores and 196 PetsHotels in the United States, Canada and Puerto Rico. We bought back $457 million of PetSmart stock and received... -

Page 5

... returns. By focusing on our strategic and operational priorities, we will continue to do all the right things to drive future sustainable growth and long-term shareholder value. Sincerely, Robert F. Moran Chairman and Chief Executive Officer David K. Lenhardt President and Chief Operating... -

Page 6

"Since childhood, I've always loved this breed," George Little said. "It was something about their color and eyes that just got me. I am so excited to have Dodge as the newest member of our family. Today is a great day for my family, Dodge and me. I'm so happy!" -

Page 7

... Phoenix, Arizona (Address of principal executive offices) 85027 (Zip Code) Registrant's telephone number, including area code: (623) 580-6100 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $.0001 par value... -

Page 8

... Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations Quantitative and Qualitative Disclosures About Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on... -

Page 9

... care, pet services (such as grooming and boarding) and live animal purchases. The APPA estimates that food and treats for dogs and cats are the largest volume categories of pet-related products and in calendar year 2012, accounted for an estimated $20.5 billion in sales, or 38.7% of the market... -

Page 10

... pet specialty channel exclusive products and our proprietary brand offerings, to drive innovative solutions and value to our customers. Based on net services sales, we are North America's leading specialty provider of pet services, which includes professional grooming, training, day camp for dogs... -

Page 11

... operate and allows associates to be more engaged and productive. We believe these strategic initiatives will continue to generate comparable store sales and overall sales growth, allow us to focus on managing capital and leveraging costs and drive product margins to produce profitability and return... -

Page 12

...cats, which includes 24-hour supervision by caregivers who are PetSmart trained to provide personalized pet care, temperature controlled rooms and suites, daily specialty treats and play time, as well as day camp for dogs. During 2012, our PetsHotels call center was implemented for all of our hotels... -

Page 13

... agreements and have not experienced work stoppages. We consider our relationship with our associates to be a positive one. Financial Information by Business Segment and Geographic Data We have identified two operating segments, Merchandise and Services. These operating segments have similar long... -

Page 14

... February 2010, Vice President of Strategic Planning and Business Development. Prior to joining PetSmart, he worked in Brand Management for Procter & Gamble Europe and in Financial Planning and Analysis for IBM. Donald E. Beaver joined PetSmart as Senior Vice President and Chief Information Officer... -

Page 15

...the Store Support Group and Distribution Centers. Prior to joining PetSmart, he served for 8 years at Distribution Architects International, Inc. in various leadership roles, the last being Director of Human Resources. He previously held human resource leadership positions with Management Technology... -

Page 16

...effective management of our business and associates, which could in turn adversely affect our financial performance. Opening new stores in a market will attract some customers away from other stores already operated by us in that market and diminish their sales. An increase in construction costs and... -

Page 17

... due to seasonal changes associated with the pet products and services retail industry and the timing of expenses, new store openings and store closures. Our business is subject to seasonal fluctuation. We typically realize a higher portion of our net sales and operating profit during the fourth... -

Page 18

...or any new regulatory requirements. In addition, we purchase a substantial amount of pet supplies from vendors outside of the United States. Effective global sourcing of many of the products we sell is an important factor in our financial performance. We can make no assurances that our international... -

Page 19

... management and services personnel could require us to pay higher wages or other compensation to attract a sufficient number of employees. Turnover, which has historically been high among entry-level or part-time associates at our stores and distribution centers, increases the risk that associates... -

Page 20

...raise additional capital due to market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans. Our credit facility and letter of credit facility are secured by substantially all our personal property assets, our subsidiaries... -

Page 21

...; the distribution, import/export and sale of products; providing services to our customers; contracted services with various thirdparty providers; environmental regulation; credit and debit card processing; the handling, security, protection and use of customer and associate information; and... -

Page 22

... of products to our stores could harm our reputation and decrease our sales. Fluctuations in the stock market, as well as general economic and market conditions, may impact our operations, sales, financial results and market price of our common stock. Over the last several years, the market price of... -

Page 23

Item 1B. Unresolved Staff Comments None. 15 -

Page 24

...as of February 3, 2013: Number of Stores Alabama ...Alaska...Arizona...Arkansas...California ...Colorado...Connecticut ...Delaware ...Florida ...Georgia...Idaho...Illinois ...Indiana...Iowa...Kansas ...Kentucky ...Louisiana ...Maine ...Maryland ...Massachusetts...Michigan ...Minnesota...Mississippi... -

Page 25

... as of February 3, 2013, were as follows: Location Square Footage (In thousands) Date Opened Distribution Type Lease Expiration Ennis, Texas...Phoenix, Arizona ...Columbus, Ohio ...Gahanna, Ohio...Hagerstown, Maryland ...Ottawa, Illinois ...Newnan, Georgia...Reno, Nevada ...Total... 230 620 613 276... -

Page 26

... former managers filed a lawsuit against us captioned Miller, et al. v. PetSmart, Inc. in the United States District Court for the Eastern District of California. The plaintiffs seek to assert claims on behalf of hourly and exempt store management personnel from December 14, 2008 to the present for... -

Page 27

...11, 2011 February 10, 2012 On March 26, 2013, the Board of Directors declared a quarterly cash dividend of $0.165 per share payable on May 17, 2013, to stockholders of record on May 3, 2013. Holders. On March 14, 2013, there were 2,791 holders of record of our common stock. Equity Compensation Plan... -

Page 28

... stock for each period in the fourteen weeks ended February 3, 2013: Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Period Total Number of Shares Purchased Average Price Paid per Share Value That May Yet be Purchased Under the Plans or Programs October 29, 2012... -

Page 29

.... The comparison of the total cumulative return on investment includes reinvestment of dividends. Indices are calculated on a month-end basis. 2/3/2008 2/1/2009 1/31/2010 1/30/2011 1/29/2012 2/3/2013 PetSmart, Inc...$ 100.0 S & P 500...$ 100.0 S & P Specialty Stores...$ 100.0 $ 78.73 $ 61... -

Page 30

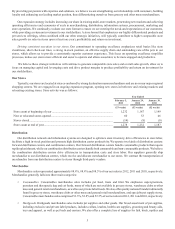

...,528 Net sales per square foot(3) ...$ 242 $ 224 $ 214 $ 205 $ 208 Net sales growth...10.5% 7.4% 6.7% 5.4% 8.4% Increase in comparable store sales(4) ...6.3% 5.4% 4.8% 1.6% 3.8% Selected Balance Sheet Data: Merchandise inventories ...Average inventory per store(5) ...Working capital...Total assets... -

Page 31

... and cats, which includes 24-hour supervision by caregivers who are PetSmart trained to provide personalized pet care, temperature controlled rooms and suites, daily specialty treats and play time, as well as day camp for dogs. As of February 3, 2013, we operated 196 PetsHotels. We make full-service... -

Page 32

.... We added 46 net new stores during 2012, and operated 1,278 stores at the end of the year. • • • • • • Critical Accounting Policies and Estimates The discussion and analysis of our financial condition and results of operations are based on our consolidated financial statements... -

Page 33

...stores would be material to our consolidated financial statements. Insurance Liabilities and Reserves We maintain workers' compensation, general liability, product liability and property and casualty insurance. We utilize high deductible plans for each of these areas as well as a self-insured health... -

Page 34

...our offerings of exclusive and proprietary brands. Finally, we have made more than twenty website enhancements this year and during the thirteen weeks ended October 28, 2012, we launched our Canada site on PetSmart.com. Services sales, which include grooming, training, day camp for dogs and boarding... -

Page 35

... transactions and average sales per comparable transaction due to the impact of merchandising strategies, pricing strategies and new product offerings. Comparable transactions were 2.5% for 2011 and 2.1% for 2010. Services sales, which include grooming, training, day camp for dogs and boarding... -

Page 36

...vendor terms of $29.6 million, a reduction in growth of merchandise inventories of $21.8 million and the $16.0 million dividend received from Banfield in 2011, as no dividends were received in 2010. Net cash used in investing activities consisted primarily of expenditures associated with opening new... -

Page 37

... treasury stock, payments of cash dividends, payments on capital lease obligations, and a decrease in our bank overdraft, offset by net proceeds from common stock issued under equity incentive plans and excess tax benefits from stock-based compensation. The primary difference between 2012 and 2011... -

Page 38

... the payment of dividends would not result in default. During 2012, 2011 and 2010, we paid aggregate dividends of $0.775 per share, $0.53 per share, and $0.45 per share, respectively. Operating Capital and Capital Expenditure Requirements Substantially all our stores are leased facilities. We opened... -

Page 39

... scheduled above, we have executed operating and capital lease agreements with total minimum lease payments of $167.1 million, which includes $66.9 million related to the new distribution center in Bethel, Pennsylvania. The lease term for the new distribution center in Bethel, Pennsylvania is... -

Page 40

... for the sharing of profits on the sale of therapeutic pet foods sold in all stores with an operating Banfield hospital. The net sales and gross profit on the sale of therapeutic pet food are not material to our consolidated financial statements. Credit Facilities On March 23, 2012, we entered... -

Page 41

... of foreign currency exchange rate fluctuations related to certain balance sheet accounts. We do not designate these Foreign Exchange Contracts as hedges and, accordingly, they are recorded at fair value using quoted prices for similar assets or liabilities in active markets. The changes in the fair... -

Page 42

... reported within the time periods specified in the SEC's rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer, or "CEO," and Chief Financial Officer, or "CFO," as appropriate, to allow timely decisions regarding required... -

Page 43

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of PetSmart, Inc. Phoenix, Arizona We have audited the internal control over financial reporting of PetSmart, Inc. and subsidiaries (the "Company") as of February 3, 2013, based on criteria established in Internal Control... -

Page 44

... Website located at www.petm.com. Item 11. Executive Compensation The information required by this item is incorporated by reference from the information under the captions "Compensation Discussion and Analysis," "Executive Compensation," "Stock Award Grants, Exercises and Plans," "Employment... -

Page 45

...: The financial statement schedule required under the related instructions is included within Appendix F of this Annual Report. See Index to Consolidated Financial Statements and Financial Statement Schedule on page F-1. 3. Exhibits: The exhibits which are filed with this Annual Report or which... -

Page 46

... and Chief Executive Officer (Principal Executive Officer) Executive Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) Director Director Director Director Director Director Director Director Director Director Date March 28, 2013 March 28... -

Page 47

APPENDIX F PetSmart, Inc. and Subsidiaries Index to the Consolidated Financial Statements and Financial Statement Schedule Page Number Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of February 3, 2013, and January 29, 2012 Consolidated Statements of Income ... -

Page 48

... sheets of PetSmart, Inc. and subsidiaries (the "Company") as of February 3, 2013 and January 29, 2012, and the related consolidated statements of income and comprehensive income, stockholders' equity, and cash flows for each of the three years in the period ended February 3, 2013. These financial... -

Page 49

... Balance Sheets (In thousands, except par value) February 3, 2013 January 29, 2012 ASSETS Cash and cash equivalents ...$ Short-term investments...Restricted cash ...Receivables, net ...Merchandise inventories...Deferred income taxes ...Prepaid expenses and other current assets ...Total current... -

Page 50

PetSmart, Inc. and Subsidiaries Consolidated Statements of Income and Comprehensive Income (In thousands, except per share data) Year Ended February 3, 2013 (53 weeks) January 29, 2012 (52 weeks) January 30, 2011 (52 weeks) Merchandise sales ...$ Services sales ...Other revenue ...Net sales...Cost ... -

Page 51

... Statements of Stockholders' Equity (In thousands, except per share data) Shares Common Stock BALANCE AT JANUARY 31, 2010 ...Net Income...Issuance of common stock under stock incentive plans ...Stock-based compensation expense...Excess tax benefits from stock-based compensation ...Dividends... -

Page 52

... from Banfield ...13,860 Excess tax benefits from stock-based compensation ...(43,196) Non-cash interest expense ...962 Changes in assets and liabilities: Merchandise inventories ...(34,015) Other assets ...(46,932) Accounts payable ...40,653 Accrued payroll, bonus and employee benefits ...18... -

Page 53

..., training, day camp for dogs and boarding. We also offer pet products through our website, PetSmart.com. As of February 3, 2013, we operated 1,278 retail stores and had full-service veterinary hospitals in 816 of our stores. MMI Holdings, Inc., through a wholly owned subsidiary, Medical Management... -

Page 54

... factors that may render inventories unmarketable at their historical cost. If assumptions about future demand change or actual market conditions are less favorable than those projected by management, we may require additional reserves. As of February 3, 2013, and January 29, 2012, our inventory... -

Page 55

... the cost for future occupancy payments, net of expected sublease income, associated with closed stores using the net present value method at a credit-adjusted risk-free interest rate over the remaining life of the lease. Judgment is used to estimate the underlying real estate market related to... -

Page 56

...2012, 2011 and 2010. Revenue is recognized net of applicable sales tax in the Consolidated Statements of Income and Comprehensive Income. We record the sales tax liability in other current liabilities in the Consolidated Balance Sheets. In accordance with our master operating agreement with Banfield... -

Page 57

... for all awards except management equity units which are evaluated quarterly based upon the current market value of our common stock. We use option pricing methods that require the input of highly subjective assumptions, including the expected stock price volatility. Compensation cost is recognized... -

Page 58

... tax rate is as follows (dollars in thousands): Year Ended February 3, 2013 (53 weeks) January 29, 2012 (52 weeks) January 30, 2011 (52 weeks) Provision at federal statutory tax rate...$ 208,911 State income taxes, net of federal income tax benefit ...15,724 Tax on equity income from Banfield... -

Page 59

... Consolidated Financial Statements - (Continued) The components of the net deferred income tax assets (liabilities) included in the Consolidated Balance Sheets are as follows (in thousands): February 3, 2013 January 29, 2012 Deferred income tax assets: Capital lease obligations...$ Employee benefit... -

Page 60

... preferred stock that may be converted into voting common stock at any time at our option; and 1.8 million shares of voting common stock. Banfield's financial data is summarized as follows (in thousands): February 3, 2013 January 29, 2012 Current assets...$ Noncurrent assets...Current liabilities... -

Page 61

... 3, 2013, and January 29, 2012, respectively, and were included in receivables, net in the Consolidated Balance Sheets. Our master operating agreement with Banfield also includes a provision for the sharing of profits on the sale of therapeutic pet foods sold in all stores with an operating Banfield... -

Page 62

... Statements - (Continued) The activity related to the reserve for closed stores was as follows (in thousands): Year Ended February 3, 2013 (53 weeks) January 29, 2012 (52 weeks) January 30, 2011 (52 weeks) Opening balance...$ Provision for new store closures ...Lease terminations ...Changes... -

Page 63

... all of our stock option plans is as follows (in thousands, except per share data): Year Ended February 3, 2013 (53 weeks) WeightedAverage Exercise Price WeightedAverage Remaining Contractual Term Shares Aggregate Intrinsic Value Outstanding at beginning of year...Granted ...Exercised...Forfeited... -

Page 64

... restricted stock awards and restricted stock units plan is as follows (in thousands, except per share data): February 3, 2013 (53 weeks) Weighted-Average Grant Date Fair Value Year Ended January 29, 2012 (52 weeks) Weighted-Average Grant Date Fair Value January 30, 2011 (52 weeks) Weighted-Average... -

Page 65

... target awards. Activity for PSUs in 2012, 2011 and 2010 is as follows (in thousands, except per share data): Year Ended February 3, 2013 (53 weeks) Weighted-Average Grant Date Fair Value January 29, 2012 (52 weeks) Weighted-Average Grant Date Fair Value January 30, 2011 (52 weeks) Weighted-Average... -

Page 66

...2013 (53 weeks) January 29, 2012 (52 weeks) January 30, 2011 (52 weeks) Stock options expense ...$ Restricted stock expense ...Performance share unit expense...Stock-based compensation expense - equity awards ...Management equity unit expense...Total stock-based compensation expense...$ Tax benefit... -

Page 67

PetSmart, Inc. and Subsidiaries Notes to the Consolidated Financial Statements - (Continued) The following assumptions were used to value stock option grants: Year Ended February 3, 2013 January 29, 2012 January 30, 2011 Dividend yield ...1.20% Expected volatility ...28.8% Risk-free interest rate... -

Page 68

... and Stand-alone Letter of Credit Facility are secured by substantially all our financial assets. Operating and Capital Leases We lease substantially all our stores, distribution centers and corporate offices under noncancelable leases. The terms of the store leases generally range from 10 to... -

Page 69

..., et al. v. PetSmart, Inc., et. al., a lawsuit originally filed in California Superior Court for the County of Alameda. PetSmart removed the case to the United States District Court for the Northern District of California. The complaint brings both individual and class action claims, first alleging... -

Page 70

... former managers filed a lawsuit against us captioned Miller, et al. v. PetSmart, Inc. in the United States District Court for the Eastern District of California. The plaintiffs seek to assert claims on behalf of hourly and exempt store management personnel from December 14, 2008 to the present for... -

Page 71

... financial information for 2012 and 2011 is as follows: Year Ended February 3, 2013 First Quarter (13 weeks) Second Quarter (13 weeks) Third Quarter (13 weeks) Fourth Quarter (1) (14 weeks) (In thousands, except per share data) Merchandise sales ...Services sales...Other revenue ...Net sales... -

Page 72

(This page intentionally left blank.) -

Page 73

.... Phoenix, Arizona We have audited the consolidated financial statements of PetSmart, Inc. and subsidiaries (the "Company") as of February 3, 2013 and January 29, 2012, and for each of the three years in the period ended February 3, 2013, and the Company's internal control over financial reporting... -

Page 74

... of Period Charged to Expense Balance at End of Period Description Deductions(1) (In thousands) Valuation reserves deducted in the Consolidated Balance Sheets from the asset to which it applies: Merchandise inventories: Lower of cost or market 2010 ...2011 ...2012 ...Shrink 2010 ...2011 ...2012... -

Page 75

... of Stock Certificate Form of Indemnity Agreement between PetSmart and its Directors and Officers 2003 Equity Incentive Plan 1996 Non-Employee Directors' Equity Plan, as amended 1997 Equity Incentive Plan, as amended 2012 Employee Stock Purchase Plan Non-Qualified 2005 Deferred Compensation Plan, as... -

Page 76

...Wells Fargo Capital Finance, LLC, as Sole Lead Arranger and Sole Bookrunner. Letter of Credit Agreement, dated as of March 23, 2012, among the Company and Wells Fargo Bank, N.A., as L/C Issuer. 2011 Performance Share Unit Program 2011 Equity Incentive Plan Form of Nonstatutory Stock Option Agreement... -

Page 77

... By Reference Exhibit Number Exhibit Description Form File No. Exhibit Filing Date Filed Herewith 31.2 Certification of Chief Financial Officer as required by Rule 13a-14(a) of the Securities Exchange Act of 1934, as amended Certification of Chief Executive Officer as required by Rule 13a... -

Page 78

(This page intentionally left blank.) -

Page 79

... P. Molloy Executive Vice President, Chief Financial Officer Joseph D. O'Leary Executive Vice President, Merchandising, Marketing, Supply Chain and Strategic Planning John W. Alpaugh Senior Vice President, Chief Marketing Officer Donald E. Beaver Senior Vice President, Chief Information Officer Gene... -

Page 80

19601 North 27th Avenue Phoenix, AZ 85027 (623) 580-6100 petsmart.com ©2013 PetSmart Store Support Group, Inc. All rights reserved.