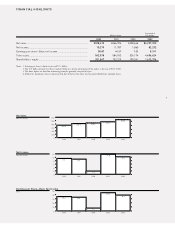

Olympus 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

plan calls for 1 million cameras to be produced in China. At the same time, we

are moving forward with the integration of domestic production and are invest-

ing ¥6 billion over the next three years in this reorganization. By having Japan

concentrate on the creative aspects that lead to a high degree of added value,

such as development, and China focus on high-quality, low-cost production, we

will be able to drastically lower production costs. In addition, by opening up

production in China, Olympus will be able to strengthen its internal supply

structure and increase its internal production ratio. We are projecting an inter-

nal production ratio of 50% by the second half of fiscal 2003.

Q: What are your thoughts on a profit structure that is dependent on the

Medical Systems Group?

The majority of Olympus’s profit is generated by the Medical Systems

Group. Why does Olympus not specialize in the Medical Systems Group

is a question I have heard often from shareholders over the past year.

However, at this time we are neither thinking of spinning off nor withdrawing

from the Imaging Systems Group or the Industrial Systems Group. One cannot

assess the degree of contribution from each of the businesses solely on short-

term profitability. The cross-fertilization and exchange of technologies from

different fields has given rise to new core technologies. Synergies created in this

process have been the foundation of Olympus’s growth. That represents a

strong corporate asset that makes Olympus different from other companies.

For example, consider Olympus’s medical endoscopes, which have been

received with an unparalleled confidence, holding approximately an 70% share

of the world market. What underpins that competitiveness is the accumulation

of optical and high-precision processing technologies acquired by a global

camera manufacturer.

The keyword in this process is “OPTO-Digital Technology.” OPTO-

Digital Technology, a fusion of optical and digital technologies, is the base on

which our core businesses of endoscopes and cameras have been built. At the

same time, this base gives rise to strategic new business fields. Olympus is

seeking to expand these new fields based on OPTO-Digital Technology, which

already made up 35% of sales during fiscal 2002.Our goal is to increase this

percentage to about 52% by the end of fiscal 2004 by focusing investment in

promising businesses that we expect to be the core business areas of the future,

including digital cameras, endoscopes-related products, optical communications

and related businesses, and the genome medical business.

Above all, in the genome medical business, where we see a tremendous

opportunity, Olympus’s ability to utilize its technical assets gives it an advan-

tage. In the field of genomic analysis, in addition to our accumulated optical

technology, we have been acquiring technology regarding genomes since the

Synergies created in the process of

exchanging technologies represent a

strong corporate asset that makes

Olympus different from other companies.

4