Northrop Grumman 2011 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2011 Northrop Grumman annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORTHROP GRUMMAN 2011 ANNUAL REPORT

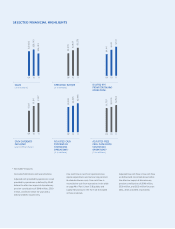

SELECTED FINANCIAL HIGHLIGHTS

* Non-GAAP measures

Non-GAAP definitions and reconciliations:

Adjusted cash provided by operations is cash

provided by operations as defined by GAAP

before the after-tax impact of discretionary

pension contributions of $648 million, $539

million, and $333 million for years 2011,

2010 and 2009, respectively.

Free cash flow is cash from operations less

capital expenditures and outsourcing contract

& related software costs. Free cash flow is

reconciled to cash from operations in the table

on page 49 of Part II, Item 7, “Liquidity and

Capital Resources,” in the Form 10-K included

in these materials.

Adjusted free cash flow is free cash flow

as defined and reconciled above before

the after-tax impact of discretionary

pension contributions of $648 million,

$539 million, and $333 million for years

2011, 2010 and 2009, respectively.

$26, 412$1.97

11

11

10

10

09

09

$28,14 3

$1.84

$2 7, 6 5 0$1.69

SALES

CASH DIVIDENDS

DECLARED

($ in millions )

$7.41

$2,503

11

11

10

10

09

09

$6.32

$2,010

$4.44$1,787

ADJUSTED FREE

CASH FLOW FROM

CONTINUING

OPERATIONS*

DILUTED EPS

FROM CONTINUING

OPERATIONS

($ in millions ) ( $ in millions )

$3,276

$2,995

11

11

10

10

09

09

$2,827

$2,595

$2,274

$2,328

ADJUSTED CASH

PROVIDED BY

CONTINUING

OPERATIONS*

OPERATING INCOME

(per common share )

($ in millions )