North Face 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

5-YEAR FINANCIAL SUMMARY

1 Operating results for 2014 include a noncash charge for impairment of goodwill and

intangible assets — $396.4 million (pretax) in operating income and $306.8 million

(after tax) in net income attributable to VF Corporation, $0.71 basic earnings per

share and $0.70 diluted earnings per share. Operating results for 2010 include a

noncash charge for impairment of goodwill and intangible assets — $201.7 million

(pretax) in operating income and $141.8 million (after tax) in net income attributable

to VF Corporation, $0.33 basic earnings per share and $0.32 diluted earnings

per share.

2 Dividend payment ratio is defined as dividends per share divided by earnings per

diluted share. Dividend payout ratios for 2014 and 2010, excluding the noncash charge

for impairment of goodwill and intangible assets, are 36.0% and 37.6%, respectively.

3 Total capital is defined as stockholders’ equity plus short-term and long-term debt.

4 Operating margin for 2014 and 2010, excluding the noncash charge for impairment

of goodwill and intangible assets, is 14.9% and 13.3%, respectively.

5 Return is defined as net income attributable to VF Corporation plus total interest

income/expense, net of taxes.

6 Invested capital is defined as average stockholders’ equity plus average short-term

and long-term debt. Return on invested capital for 2014 and 2010, excluding

the noncash charge for impairment of goodwill and intangible assets, is 18.6% and

15.6%, respectively.

7 Return on average stockholders’ equity for 2014 and 2010, excluding the

noncash charge for impairment of goodwill and intangible assets, is 24.5%

and 20.1%, respectively.

8 Return on average total assets for 2014 and 2010, excluding the noncash charge for

impairment of goodwill and intangible assets, is 13.6% and 11.8%, respectively.

9 The Timberland Company was purchased on September 13, 2011 and its results

have been included since the date of acquisition.

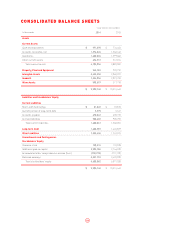

YEAR ENDED DECEMBER

In thousands, except per share amounts 2014

(9) 2013(9) 2012

(9) 2011(9) 2010

Summary of Operations1

Total revenues $ 12,282,161 $ 11,419,648 $ 10,879,855 $ 9,459,232 $ 7,702,589

Operating income 1,437,724 1,647,147 1,465,267 1,244,791 820,860

Net income attributable to VF Corporation 1,047,505 1,210,119 1,085,999 888,089 571,362

Earnings (loss) per common share attributable to

VF Corporation common stockholders — basic

$ 2.42 $ 2.76 $ 2.47 $ 2.03 $ 1.31

Earnings (loss) per common share attributable to

VF Corporation common stockholders — diluted

2.38 2.71 2.43 2.00 1.29

Dividends per share 1.1075 0.9150 0.7575 0.6525 0.6075

Dividend payout ratio246.5% 33.8% 31.2% 32.7% 46.9%

Financial Position

Working capital $ 2,565,613 $ 2,314,981 $ 1,717,371 $ 1,521,912 $ 1,716,585

Current ratio 2.6 2.5 2.0 1.9 2.5

Total assets $ 9,980,140 $ 10,315,443 $ 9,633,021 $ 9,313,126 $ 6,457,556

Long-term debt 1,423,581 1,426,829 1,429,166 1,831,781 935,882

Stockholders’ equity 5,630,882 6,077,038 5,125,625 4,525,175 3,861,319

Debt to total capital ratio3 20.5% 19.3% 26.5% 31.9% 20.2%

Weighted average common shares outstanding 432,611 438,657 439,292 437,148 435,056

Book value per common share $ 13.01 $ 13.80 $ 11.63 $ 10.23 $ 8.94

Other Statistics

Operating margin411.7% 14.4% 13.5% 13.2% 10.7%

Return on invested capital5,6 14.6% 17.6% 16.2% 15.8% 12.8%

Return on average stockholders’ equity5,7 19.2% 23.7% 24.7% 22.0% 16.5%

Return on average total assets5,8 10.7% 12.8% 11.9% 11.9% 9.6%

Cash provided by operations $ 1,697,629 $ 1,506,041 $ 1,275,000 $ 1,081,371 $ 1,001,282

Cash dividends paid 478,933 402,136 333,229 285,722 264,281

Basis of presentation: VF operates and reports using a 52/53-week fiscal year ending on the Saturday closest to December 31 of each year. For presentation purposes herein, all

references to “2014” relate to the 53-week fiscal period ended January 3, 2015, and all references to “2013,” “2012,” "2011" and "2010" relate to the 52-week fiscal periods ended

December 28, 2013, December 29, 2012, December 31, 2011, and January 1, 2011, respectively.