North Face 2008 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2008 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To Our Shareholders:

VF is known for a performance-driven culture and excellence

in execution. Over the years, we’ve built and honed highly

disciplined financial and operational processes to help us manage

risk through both good times and bad.

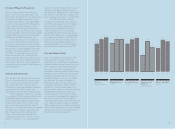

During 2008, these disciplines served us well again, as we

achieved our sixth consecutive year of record revenues and

strong earnings amid unprecedented global economic turmoil.

Revenues in 2008 rose 6% to $7.6 billion while earnings per

share reached $5.42. Earnings included a $.30 per share impact

from a $41 million charge taken in the fourth quarter to realign

our cost structure and protect our future profitability.

Our financial position is solid. We ended 2008 with $382

million in cash, and we have $1.3 billion of borrowing capacity

available under domestic and international lines of credit. Our

debt-to-capital ratio was 25% at year-end, and no significant

long-term debt payments are due until October 2010. Strong cash

flow was a hallmark, with cash flow from operations of $679 million.

In short, the strength of VF’s business model was proven

again in 2008. While we do not expect economic conditions

to improve in 2009, we are well positioned to manage the

challenge—and to emerge from this period stronger than ever.

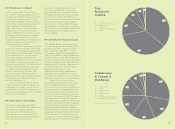

Protecting Profitability; Investing for Growth

When retail conditions worsened in the fourth quarter of 2008,

we moved quickly to reduce costs across the board. The actions

we’ve taken will result in annual cost savings of $100 million,

starting in 2009. At the same time, we are confident that we

have the right brands and strategies for long-term success, and

we remain committed to investing prudently for future growth,

including investments in our strong brands and in our direct-

to-consumer and international businesses.